Direct indexing, the process of replicating a broad market index through the direct purchase of individual securities, rather than purchasing the index itself, has recently experienced rapid growth—but in fact, it isn’t a new phenomenon.

Until recently, direct indexing was only feasible for high-net-worth investors, due to the extensive manual resources required to manage a multitude of individual accounts. Investors had the potential to own 500 or 5,000 individual securities, making direct indexing a cumbersome, complicated process.

But as it is wont to do, technology is changing the game, automating much of the direct indexing workload and making it feasible for advisors to create customized, separately managed accounts for all their clients—regardless of account size.

Benefits of Direct Indexing

Direct indexing offers a number of benefits unavailable through traditional index mutual funds:

Leverage security and/or sector restrictions. Not every stock index perfectly matches each client’s risk preferences, so you can exclude those that don’t.

Foster trust with greater portfolio transparency. Using direct indexing, you can provide an additional layer of clarity into the investment holdings to your clients.

Capitalize on tax-loss harvesting opportunities. By holding the underlying securities, you can harvest stock losses on individual positions to offset taxes on capital gains elsewhere.

Defer capital gains. You can avoid selling the top gainers if there aren’t losses to harvest, and/or if you want to defer capital gains for when your tax bracket decreases.

Arguably, the greatest benefit of direct indexing, in terms of delivering tangible benefits to your client, is the ability to infuse tax management into an indexing strategy. Capital gains deferral and tax loss harvesting strategies are great ways to generate alpha in an indexing strategy, something that may more than cover the premium associated with the strategy and provide much-needed differentiation—in the form of value, not cost—from competitors who offer more rudimentary indexing solutions.

Direct Indexing with Orion Portfolio Solutions

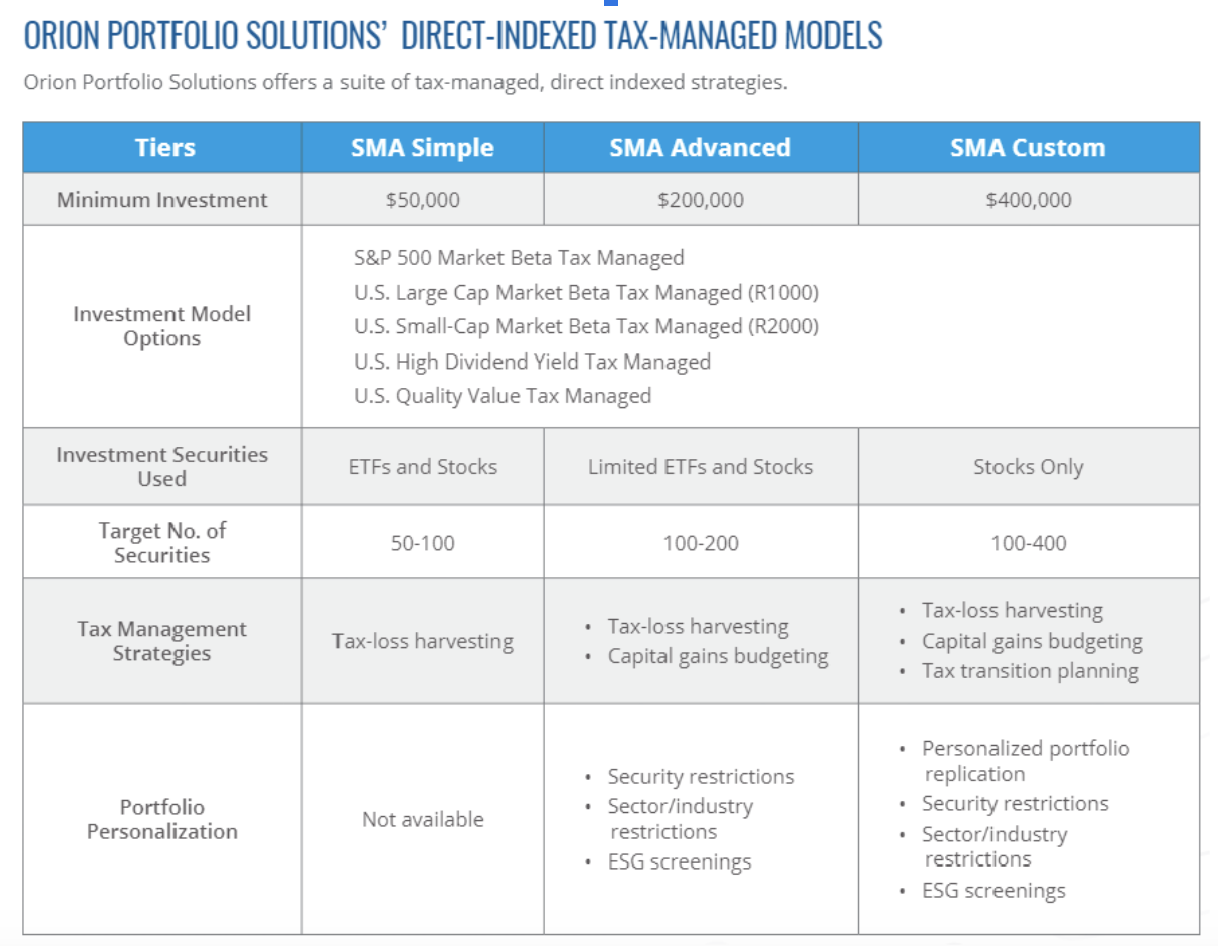

Not only does Orion Portfolio Solutions offer traditional direct indexing associated with such well-known categories like US Domestic Large Cap, but we also offer factor-strategies such as Quality Value and High Dividend.

In addition, we’ve recently added thematic strategies for unique opportunities such as Biotech and Metals/Mining. As new opportunities present themselves, or academic research points to a new factor that has proven to be a value-add, it’s part of our mission to continue to offer these strategies to our advisors.

Below is an independent study conducted by Northfield Analytics in 2018, the engine that drives our risk-based portfolio optimization tool. This technology consistently captures tax advantages by realizing short-term embedded losses and allowing winning companies with embedded gains run.

It accomplishes all of this while maintaining a low relative risk—in the form of tracking error—to any particular index, model, or investment strategy you wish to replicate.

Want to learn more about the Orion Portfolio Solutions suite of direct indexing portfolios? Reach out to our team today!

2227-OPS-8/27/2020