My family and I recently went crabbing on Galveston Island, a beautiful spot between West Bay and the Gulf of Mexico, with a friend as our guide. Since we were first-timers, he tried to describe what crabbing is like on our drive over.

“It’s simple,” he said. “Put your bait on the hook, cast it into the bay, and wait for the crab to bite–or pinch in this case.” That sounded easy and a lot like fishing, which I am more experienced with. I was ready to catch a lot of crabs!

That day, I was reminded that reality rarely lives up to expectations. The crabs outsmarted me with their vigilance, and I was surprised by how quickly they could move.

It also reminded me of investing. As Warren Buffett once said, “Investing is simple, but not easy.” During the pandemic, many people, including gamblers, have turned to the stock market for entertainment (having no sports to bet on).

Online brokerages, such as Fidelity, TD Ameritrade, Robinhood, and others, have reported an uptick in account growth. Fidelity added 1.17 million new retail accounts in the second quarter, while TD Ameritrade added 661,000 accounts. Robinhood, a popular trading app, with a median customer age of 31, added 3 million accounts during the first four months of this year.

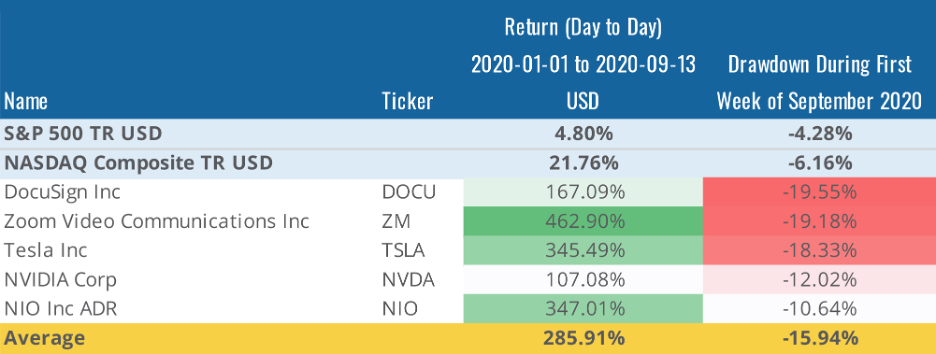

We have always encouraged people to invest, and we will continue to do so. However, there is a fine line between gambling and investing, and many learned that lesson the hard way earlier this month. Some of the most popular names among Robinhood traders saw double-digit drawdowns last week. DocuSign, Zoom Video, and Tesla all fell nearly 20%, while Nvidia and Apple slid more than 10% compared to the S&P 500’s loss of 4% for the same period. Despite the drawdown, all five stocks have experienced triple-digit gains so far this year with an average return of 286%, beating the S&P 500 by almost 60x and the tech-heavy NASDAQ index by 13x!

Source: Morningstar Direct

Unfortunately, these gains will probably not be realized by most Robinhood traders. Many are inexperienced and might have jumped on the wagon too late. To make things worse, Robinhood reported that $111 million of its $180 million order-flow revenue in the second quarter came from options. While options are great tools if used correctly, investors with less knowledge could take on a lot more risk than they realize.

Inexperienced investors may not be familiar with the concept of risk tolerance, much less their own appetite for risk. As an advisor, that’s an opportunity for you to showcase your value. Use this unprecedented time to communicate with your clients and prospects about the importance of aligning portfolio design and implementation with a proper risk score to create an investment experience that’s both comfortable and productive.

Our goal at Orion Portfolio Solutions is to strengthen the connections between client, advisor, and portfolio. Read more about how we strive to accomplish this through our new risk scoring methodology here.

2386-OPS-9/16/2020

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.