There are countless ways of gaining exposure to the US Stock market. The S&P 500 may be the most well-known index; it is often quoted and has multiple ETFs to track the 500 companies that make up the index.

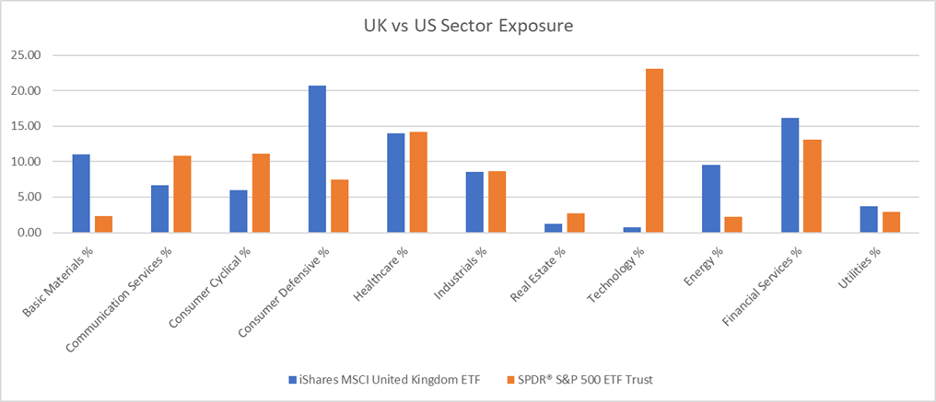

Beyond the S&P 500, there are value and growth indices, large and small-cap indices, sector indices, and even more ways to access the US market. But this isn’t the case for many international countries. Often, there is only one ETF to gain exposure to an international country’s market, usually a market-cap-weighted index of large companies. An investor may expect a similar makeup to the S&P 500, given the same general idea, but this is not the case. The chart below shows sector exposure for the S&P 500 (SPY) and MSCI United Kingdom (EWU).

Source: Morningstar Direct, as of 08/30/2020

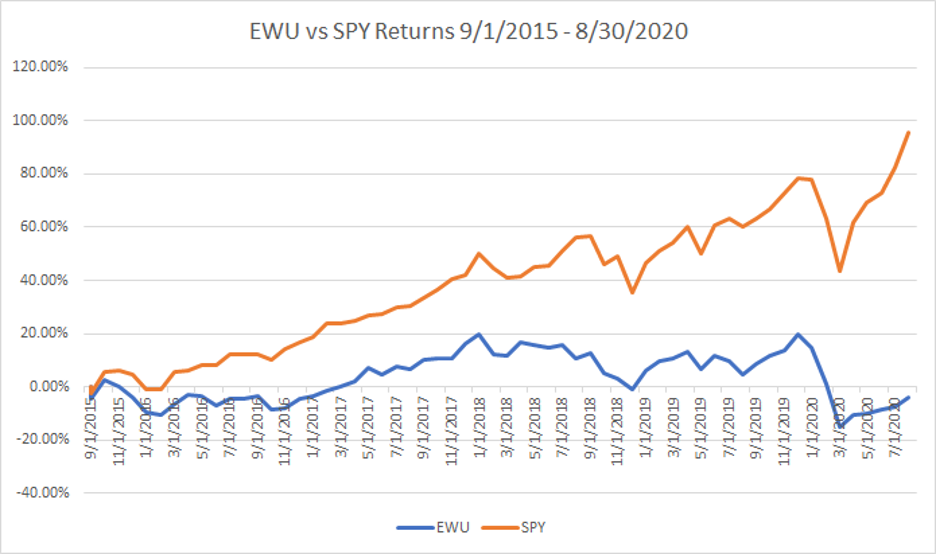

It’s clear that there are some major differences, the largest being technology making up 23% of SPY and less than 1% of EWU! Other sectors have wide discrepancies as well. International markets are traditionally thought of as cheaper than the US, but the makeup of the index certainly plays a role in this, as the US market has a higher exposure to technology, communication services, and consumer cyclical: all higher valuation areas of the market. Does this prove the argument for attractive international markets invalid? Judging by the past five years, it may seem the thesis is one of little merit. The performance chart below shows SPY has outperformed EWU by nearly 15% annually over the past 5 years.

Source: Morningstar Direct, as of 08/30/2020

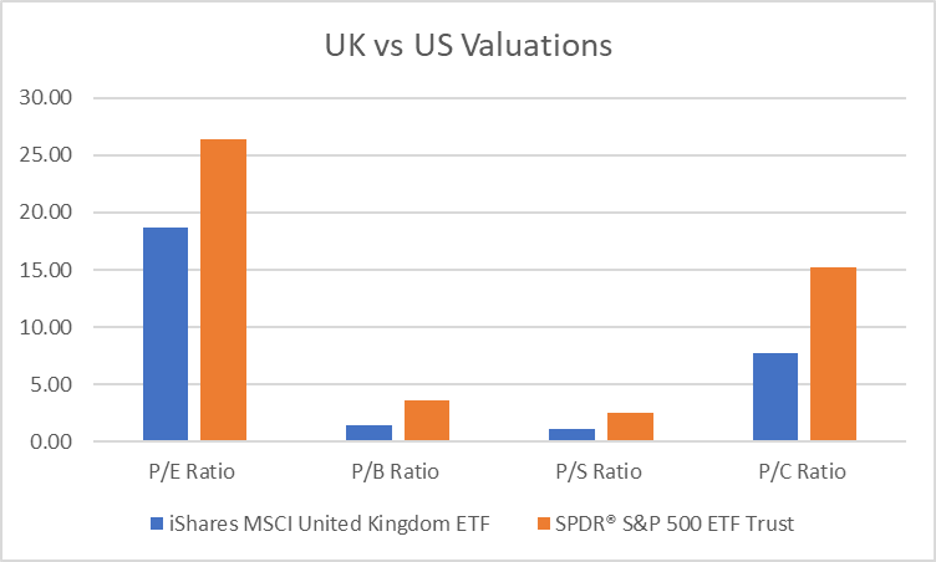

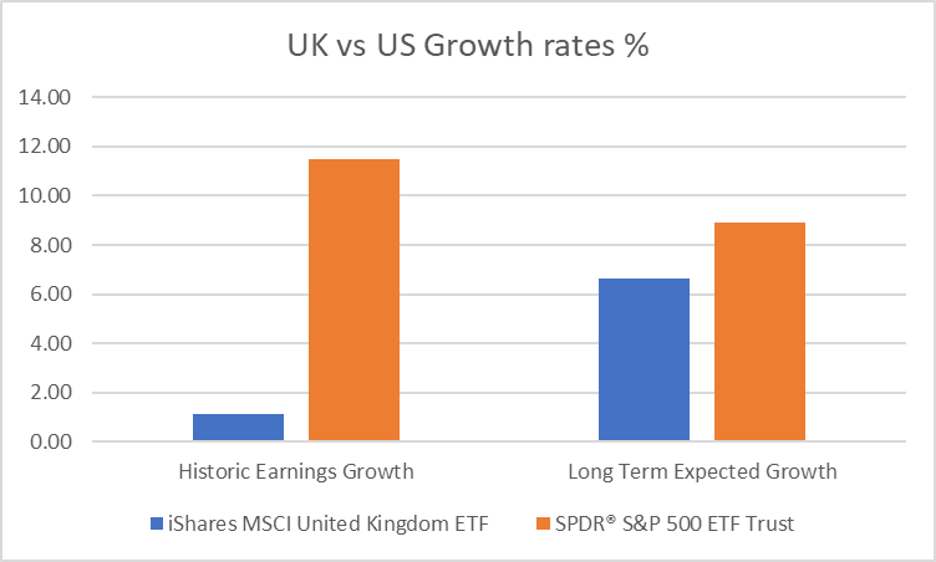

The following two charts show a comparison of valuations and growth rates. In the first, we see that EWU does, in fact, trade at a substantial discount to SPY. But some explanation of the underperformance and hope for the future comes from the next chart, comparing historical growth rates between the two in the past five years. The US has seen a huge advantage in earnings growth, potentially leading to the outperformance. However, looking at the second column offers hope for the future. The forward growth rate differential has narrowed, while the gap in valuations continues to grow in favor of the UK.

Source: Morningstar Direct, as of 08/30/2020

The combination of similar growth at cheaper valuations amongst a host of other factors, including a depressed British Pound and the potential for a Brexit resolution, all lead to a bright outlook for UK markets. The comparison of underlying indices also serves as an important reminder to know what you own and understand the constituents of any index and/or ETF before investing.

Want to stay on top of market volatility, trends, and developments? Check out our Market Volatility Command Center, featuring regularly updated market commentary and thought leadership from our strategist partners and Investment Team. Click here to view and subscribe.

2425-OPS-09/21/2020

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

CLS Investments, LLC and Orion Portfolio Solutions, LLC are affiliated companies through their parent company Orion Advisor Solutions, LLC.