- Happy Monday. I hope everyone on the east coast survived Kenan. And, for the Cincinnati crowd, Who Dey!

- Thanks to a great close on Friday last week, with the S&P 500 gaining over 2%, the index snapped its 3-week losing streak.

- Nonetheless, the overall US stock market is off to a tough start this year with a YTD loss of nearly 8%.

- The NASDAQ is roughly 15% off its November record close and is now looking at its worst month since October 2008 and worst January of all time.

- The S&P is down over 7% this month and the Dow 4%. Both are looking at their worst months since March of 2020.

- The Russell 2000 (small caps) is down 12% so far this year.

- There are some bright spots: high-dividend stocks have a small gain on the year, commodities are up 8%, and energy stocks are up nearly 19%!

- One-year trailing returns are fascinating:

- Overall the US market is up 14% and the S&P 500 is up about 19%.

- Value has outperformed Growth 19% to 9%.

- Small caps are down 6% (incredible given the earnings growth and inflation numbers last year), but it should be noted that Small Value is up 11% while Small Growth is down 20%.

- The top sector is Energy (+71%), with Consumer Discretionary (+5%) the laggard.

- With the bond market down 3% over the last 12 months, it’s good to see other diversifiers performing well, including absolute return (+3%) and real assets like commodities (+34%).

- Last week the Ten Year Treasury Yields rose 3 basis points to 1.78%. The high yield last week was 1.86%. Ten-year yields are still knocking on the door of the highest yields since 2019. The high yield in 2020 again was 1.90%.

- This is a big week for earnings reports. More than 100 companies in the S&P 500 are set to report fourth-quarter results through this Friday, including Amazon, (AMZN), Facebook now Meta Platforms (FB), and Alphabet (GOOG, GOOGL), three of the five corporate heavyweights that account for about one-quarter of the benchmark’s total market capitalization.

- Speaking of earnings, here’s the Weekly Factset Earnings Scorecard as of last Friday:

- For Q4 2021 (with 33% of S&P 500 companies reporting actual results), 77% of S&P 500 companies reported a positive Earnings Per Share surprise and 75% of S&P 500 companies reported a positive revenue surprise.

- Earnings Growth: For Q4 2021, the blended earnings growth rate for the S&P 500 is 24%. If this is the actual growth rate for the quarter, it will mark the fourth straight quarter of earnings growth above 20%.

- Last week Real GDP for 4Q21 grew at a 6.9% annual rate in Q4, beating the consensus expected 5.5% (and higher than the GDPNow estimate of 6.5%).

- Despite the expectation beat, analysis shows that +4.9% points of the growth were due to inventory rebuilding.

- This was the fastest calendar-year growth for Real GDP since 1984.

- Adding back in inflation, it was 11.7% nominal GDP growth in 2021. That’s a big number.

- Here’s something that will likely surprise you: the first estimate for 1Q22 GDP growth according to GDPNow is 0.1%.

- Also last week, the latest inflation data showed another multi-decade high rate of price increases, as the Personal Consumption Expenditures (PCE) index posted a 5.8% year-over-year rise in December or the biggest jump since 1982. Core PCE, which excludes more volatile food and energy prices, rose at a 4.9% annual rate, representing the largest leap since 1983.

- Housing had a great year last year. The December Zillow Home Value Index report showed a 1.4% nominal monthly increase from November and the nominal year-over-year figure is up 19.6%. The inflation-adjusted number was up 15.2% since this time last year.

- For the week ahead, there is fresh economic data each day next week on the economic schedule, but the week’s big number is Friday’s Employment Report for January. The consensus is for 155,000 jobs added, and for the unemployment rate to be unchanged at 3.9%. There were 199,000 jobs added in December, and the unemployment rate was at 3.9%.

- RenMac’s Jeff deGraaf shared some technical analysis nuggets last week:

- Bull/Bear ratios in Investors Intelligence have fallen to their lowest levels since the COVID-19 low, while the AAII % of bears have jumped to a similar reading, both useful contrarian indications. These readings coincide with the weakest 10-day breadth figures we’ve seen since the Spring of 2020, suggesting a good internal oversold condition has developed.

- During this latest weakness, value has dominated performance, reading the 99th percentile in our rolling 65-day measure that dates back to the early 2000s.

- The market has taken the Fed at their word and moved from an environment of perpetual easy liquidity to one of overly aggressive tightening that threatens (from the market’s perspective) economic viability

- On this last point, I read an analysis regarding what the Fed will likely do with interest rate moves this year. The consensus is something like 4 or 5 rate hikes this year, but one analysis noted the real (i.e, inflation-adjusted) Fed Funds rate is now -7.0%. It’s never been that low. The view was the Fed will need to be much more aggressive than suggested. I also read another seasoned Wall Street veteran’s perspective that the Fed has only once risen rates when the stock market was down so much (in this case he cited small caps being in a bear market). He concluded that the current rate hike cycle may be over before it even begins! These are the views that make markets – and why we diversify portfolios!

- Come to Omaha this year!

- The Berkshire Hathaway Shareholder Meeting is on April 30, 2022. If you’ve never seen “The Woodstock for Capitalists” live, you might not have many more chances given that Warren Buffett is 90 and Charlie Munger is 97.

- The College World Series will be June 16th-27th.

- Either you love or hate him, but Professor Scott Galloway in my opinion had another great philosophical read, which included some classic investing wisdom in his Algebra of Wealth commentary last week, which included this nugget that speaks to why long-term investing in professionally-managed, globally diversified portfolios makes sense for many investors: “One study found that over a 12-year period, only 5% of active retail traders made any profit at all.”

- Speaking of reading, if you want 132 pages of cool stuff on disruptive technology, ARK Invest came out with its annual Big Ideas book for 2022 last week.

- Crypto Corner – Grant Engelbart, CFA, CAIA, Sr. Portfolio Manager, Brinker Capital Investments

- Finally, positive returns to report (at least at the time of writing). Bitcoin and Ethereum prices both rebounded 7% last week. Other large coins were flat to slightly negative. Avalanche rose 13% on the week, with Luna suffering the largest decline, down 25%.

- Facebook/Meta ended the company’s project to launch a stable coin, what started known as Libra, and then changed to Diem. Bank of America released a report projecting a central bank digital currency in the U.S. between 2025 and 2030.

- Fidelity was the latest firm to receive a spot Bitcoin ETF rejection from the SEC. Blackrock filed to launch an ETF that will invest in companies involved with blockchain and cryptocurrency technologies, similar to several of the ETFs that are held in the Brinker Digital Asset portfolio.

- Thanks to everyone who watched the latest portfolio recipes webinar! Keep the questions coming.

- The next two weeks on Orion's The Weighing Machine podcast (TWM) should be killer with the one-two punch of Orion’s leadership talking about Orion and their outlook for our industry in 2022 and beyond. Eric Clarke is on TWM this week, and Noreen Beaman is on next week.

- “Returns drive flows; it’s not flows driving returns.” Jeff deGraaf RenMac's Weekly Podcast 01/28/22

- Want to live longer? Only takes 10 minutes a day. Walk 10 minutes a day!

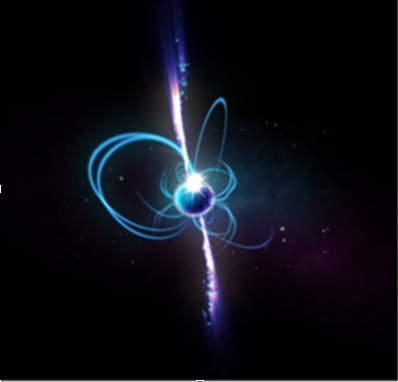

- This week’s awesome picture is an "ultra-long period magnetar”, something astronomers recently said was ‘unlike anything seen before’ – it's sending signals our way.

- Thanks for reading and have a great week! For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com.

- Have a great week!

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.