Hope everyone had a great weekend. How about those games yesterday!? I know we have lots of Eagles and Chiefs fans here at Orion; should be a great Super Bowl.

As for performance highlights:

- It was an overall positive week in the markets. The US market gained nearly 3%, driven by growth stocks (Morningstar, Jan. 2023).

- Other notable growth for the week came from China, real estate, and small caps (Morningstar, Jan. 2023). Commodities and the US dollar slid slightly (Morningstar, Jan. 2023).

- Year-to-date, US growth and international stocks have led the charge in market gains (Morningstar, Jan. 2023).

- “January has been a complete reversal of the action we saw in 2022. The Nasdaq, Consumer Discretionary, Communication Services, and Technology have been 2023’s biggest winners, and these were last year’s biggest losers…” (Bespoke Investment Group, Jan. 2023)

- ”…international markets are currently experiencing three conditions that have historically led to strong outperformance: a weakening U.S. Dollar, low valuations, and strong forward growth estimates.” (Main Management, Jan. 2023)

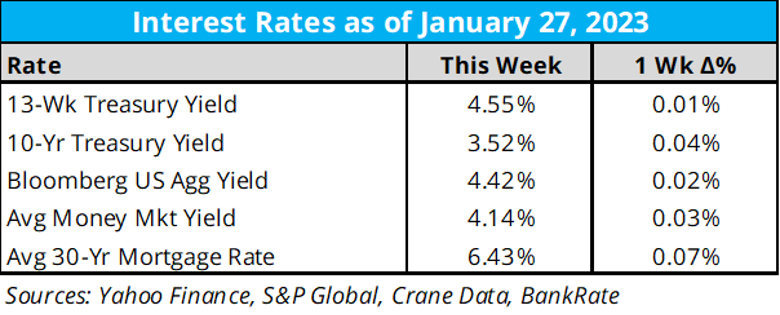

Here’s where key rates landed last week:

Deeper Dive

The next Federal Open Market Committee (FOMC) meeting is on February 1 (Wednesday) and the market overwhelmingly expects a 25 basis point increase to the fed funds rate (FOMC, Jan. 2023). The FedWatch Tool from CME Group is forecasting a 98.4% chance of a 25 basis point increase, a 1.6% chance that rates are not raised at all, and therefore a 0% forecasted chance that rates are raised by 50 or 75 basis points (CME Group, Jan. 2023). Heightened volatility should be expected this week if the rate increase is anything other than 25 basis points (CME Group, Jan. 2023).

Here’s a great quote on the expected rate hike slowdown:

- “It’s just like if you’re on a road trip, and all of a sudden, it starts to rain, and it’s very foggy. You’re going to slow down. It doesn’t change the destination you’re going to — it changes the pace at which you’re approaching it.” ~ Greg McBride, CFA, Bankrate chief financial analyst (Bankrate, Jan. 2023).

- Earnings Scorecard: For Q4 2022 (with 29% of S&P 500 companies reporting actual results), 69% of S&P 500 companies have reported a positive EPS surprise and 60% of S&P 500 companies have reported a positive revenue surprise (Factset, Jan. 2023).

- Earnings Growth: For Q4 2022, the blended earnings decline for the S&P 500 is -5.0% (Factset, Jan. 2023). If -5.0% is the actual decline for the quarter, it will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%) (Factset, Jan. 2023).

- Earnings Revisions: On December 31, the estimated earnings decline for Q4 2022 was -3.2% (Factset, Jan. 2023). Seven sectors are reporting lower earnings today (compared to December 31) due to downward revisions to EPS estimates and negative EPS surprises (Factset, Jan. 2023).

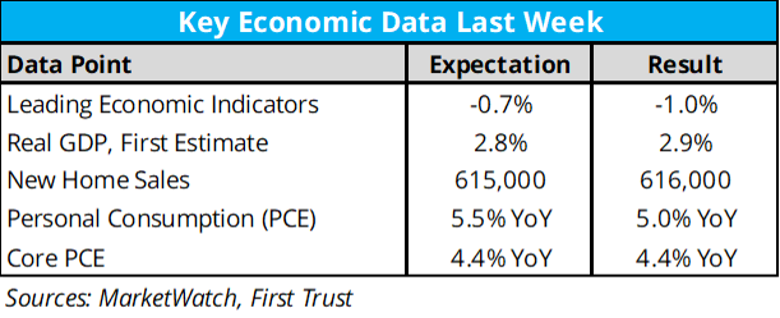

As for economic data last week:

More on last week’s PCE (personal consumption expenditures) data: Real rates are now positive again (PCE v Fed Funds Rate) (Bloomberg, Jan. 2023). Coming out of a period of 40-year high inflation paired with near-zero yields, this is a great sign for investors, especially conservative and income-taking investors (Bloomberg, Jan. 2023).

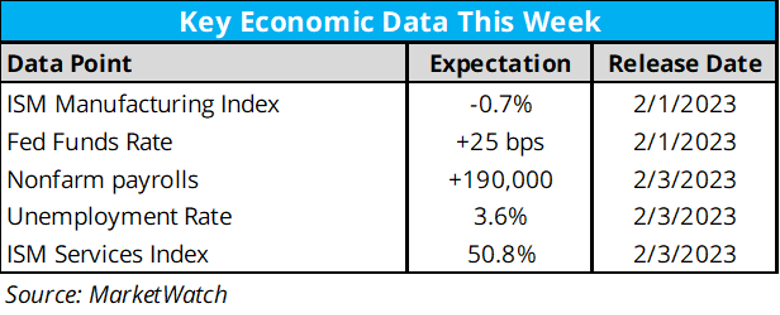

Here’s what to expect for economic data this week, beginning Monday, January 30:

Coming off stronger than expected GDP growth for the fourth quarter, Atlanta Fed's GDPNow is projecting just 0.7% growth for the first quarter of 2023 (GDPNow, Jan. 2023).

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Crypto prices continued to climb last week, with Bitcoin rising 4.4% to near $24,000 and Ethereum slightly higher to hover around the $1,650 level (Decrypt, Jan. 2023). Bitcoin is higher by 43% YTD; Polygon and Avalanche popped 17% each last week (CoinMarketCap, Jan. 2023).

- Genesis is optimistic they can emerge from Ch. 11 bankruptcy by May (Arcane Research, Jan. 2023). Gemini announced its third round of layoffs related to losses due to the Genesis bankruptcy (Arcane Research, Jan. 2023). Credit ratings agency Moody’s is working on a stablecoin scoring system (Arcane Research, Jan. 2023). Amazon is reportedly starting a NFT initiative this spring (Blockworks, Jan. 2023).

- ARK and 21Shares had their second proposal for a spot Bitcoin ETF rejected by the SEC last week (Arcane Research, Jan. 2023). March 7 is the date for arguments regarding Grayscales SEC suit (Arcane Research, Jan. 2023).

“Don’t just sit there. Do something. The answers will follow.” ~ Mark Manson (GoodReads, Jan. 2023).

On this week’s Orion's The Weighing Machine podcast we talk to Stan Sattler from Belle Haven. In short, this is a fantastic interview regarding the fixed income markets, especially the municipal bond market. I believe this was one podcast on fixed income that was loaded with talking points that could be used in investor conversations.

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at orionportfoliosolutions.com/blog.

0268-OPS-1/30/2023

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.