Contribution from Ryan Dressel, Senior Investment Strategist, Orion

For financial advisors guiding clients through these uncertain times, re-visiting the 2020 U.S. election offers a good reminder of how politics and investing intersect. Despite the heightened volatility and uncertainty that often accompany elections, the market’s strong post-election rebound provided a clear reminder of the importance of maintaining a long-term investment perspective. In this context, maintaining a diversified portfolio and resisting the urge to react emotionally to short-term market swings can be critical strategies for long-term success.

COVID-19 Bear Market:

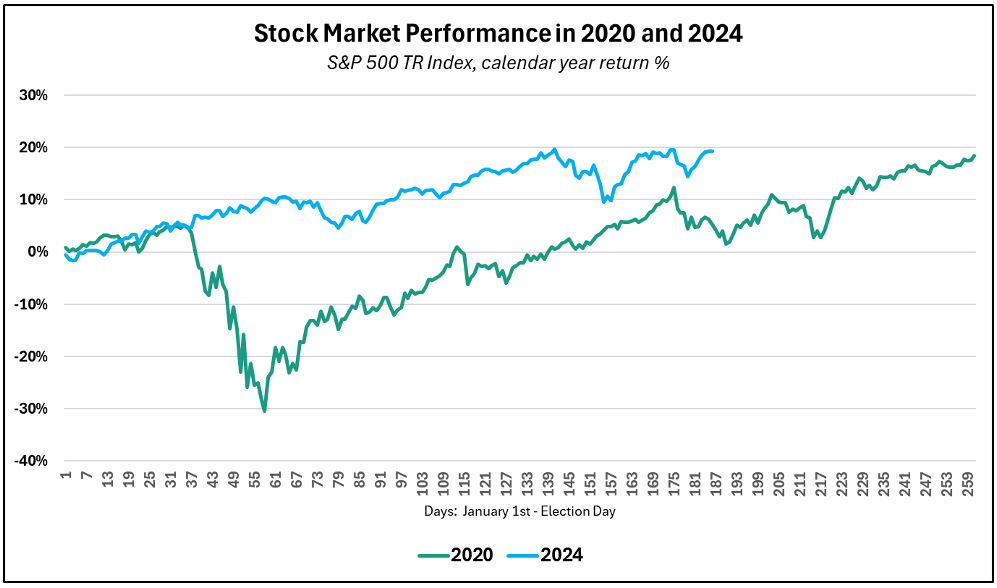

Markets were caught off guard in the first half of 2020, as the COVID-19 outbreak spread into a global pandemic. Stocks quickly entered bear market territory as investors awaited clarity around fiscal and monetary policy, alongside scary health care scenarios.

Summer Rally:

- Stocks ripped higher beginning in the spring and through the summer, as stimulus measures emerged, alongside optimism that a treatment breakthrough would emerge.

The S&P 500 hit its near-term low on March 23, 2020, closing at 2,237. A remarkable recovery ensued, as the index gained +56% through the end of August, notching a new all-time high in the process.

Mail-in Ballots:

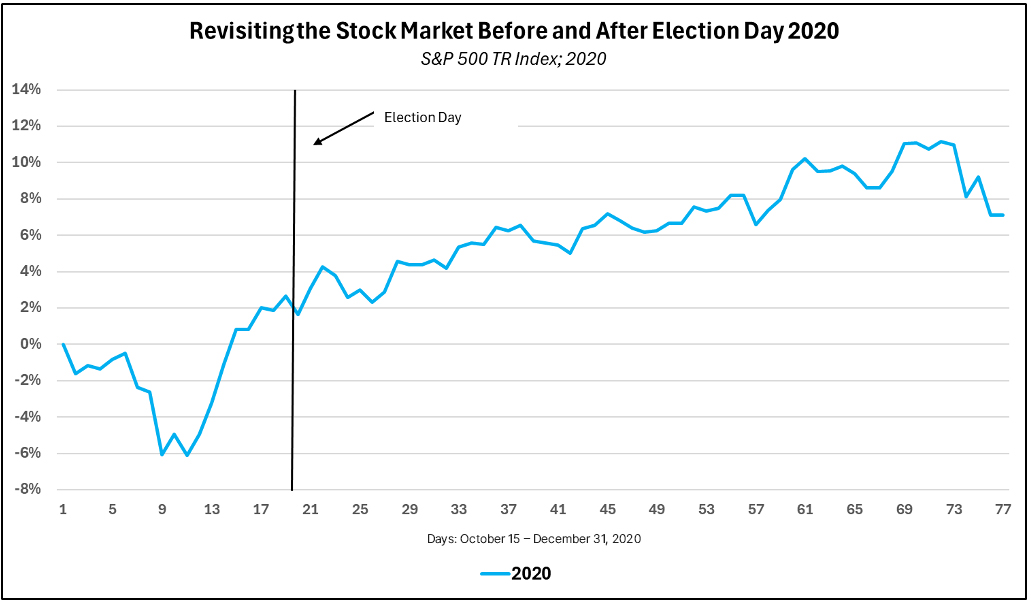

- Markets sold off in September and into October that year, as investors took profits from the summer rally, re-considered COVID-19 related impacts, and priced-in uncertainty around the vote. In the final week of October, the S&P 500 fell about -5.6%, its worst performance since March earlier in the year.

- The stock market performed strongly in the days immediately following Election Day, even though it took several days to declare a winner due to the unprecedented number of mail-in ballots.

- On November 9th, while votes were still being counted, Pfizer announced promising results for its COVID-19 vaccine, triggering a massive market rally. The S&P 500 rose by about 7% in the week after Election Day. Eventually, Joe Biden was declared the winner.

- Sector winners: clean energy, information technology, financials*

- Sector losers: energy, utilities, consumer staples, health care*

Stocks are ahead of the pace set in 2020, with the S&P 500 approaching a year-to-date gain of 20%, but we should all be mindful of some key lessons as the race heats up into November:

- Expect volatility but don’t panic

- Markets move on policy expectations – not politics

- Vote in the ballot box – not with your portfolio

- Tune out the noise and keep the focus on your financial goals

- The US economy and stock market have a strong track record with both political parties

And perhaps most importantly, we are all in this together!