Contribution from Ryan Dressel, Senior Investment Strategist, Orion

Indicators that Favor a Harris Victory

Several economic and financial indicators traditionally aligned with a preference for stability and growth under Democratic leadership are currently showing positive trends. Below, we highlight key indicators—namely, the Misery Index, S&P 500 performance leading up to the vote, and Wall Street’s informal “fear gauge” —that could be interpreted as signals in favor of a Harris win.

1. Misery Index: The Misery Index, calculated by adding the unemployment and inflation rates, serves as a gauge of the nation’s economic well-being. Currently, the Misery Index has shown relative stability, particularly as inflation pressures have eased and employment numbers remain strong. A low Misery Index is often favorable for incumbents or their party successors, as it reflects an economy where consumers feel more confident. The tipping point for Harris is an index reading below 7.4, which currently sits at 6.5, an encouraging signal for the Vice President.

Source: FactSet

This stability could be seen as a sign of support for the current administration’s economic policies, and thus, for Harris as she seeks to continue them. The Misery Index has accurately predicted 15 of the past 16 elections.

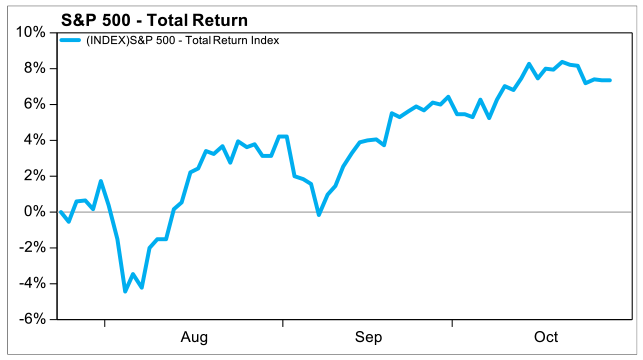

2. S&P 500 Performance over the Past 90 Days: The S&P 500 index, a bellwether measure of U.S. equities, has seen substantial gains in the past 90 days. Historically, rising stock prices ahead of an election often favor the incumbent party. Negative returns during this period tends to favor the challenging party, as Wall Street re-calibrates policy uncertainty. This dynamic has held true in predicting 83% of elections dating back to 1928.

Source: FactSet

This pattern can reflect investor confidence in the continuity of economic policies and general market optimism. With the S&P 500 up recently, Wall Street might be indicating its approval of the current economic trajectory, aligning more with a Harris victory. It is important to also note, that the gauge was incorrect in 2020.

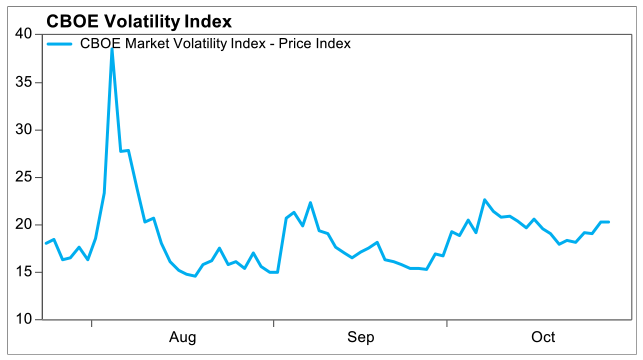

3. CBOE VIX (Volatility Index): Known as the “fear gauge,” the VIX tracks market expectations of volatility and tends to spike during periods of political or economic uncertainty. Currently, the VIX remains at relatively moderate levels, signaling a market outlook that doesn’t foresee imminent upheaval. A low VIX suggests a certain level of calm among investors, which may imply confidence in the current administration’s policies. This stability might be indicative of Wall Street’s expectation of a Harris win, as she represents policy continuity.

Source: FactSet

These indicators suggest that the market may see a Harris victory as a continuation of the current economic landscape, offering predictable and steady economic policy. However, other signs point in Trump’s direction.

Indicators that Favor a Trump Victory

On the other hand, certain politically sensitive stocks and market segments appear to be moving in ways that signal a potential Trump victory. These include securities influenced by his policies, as well as real dollars wagered in betting markets, and also in critical battleground state polling data.

Let’s take a look at some select securities of late:

1. iShares MSCI Mexico ETF (EWW): The iShares Mexico ETF has been known to react to political developments involving U.S.-Mexico relations. Under Trump’s presidency, policies such as tariffs and a strong stance on immigration affected the Mexican economy and, in turn, the performance of this ETF. Recent declines in this ETF suggest investor speculation about a potential shift in policies that could affect trade relations with Mexico—something that would likely be more pronounced under a Trump administration. Continued weakness could reflect Wall Street’s preparation for a Trump victory and his trademark “America First” policies.

Source: FactSet

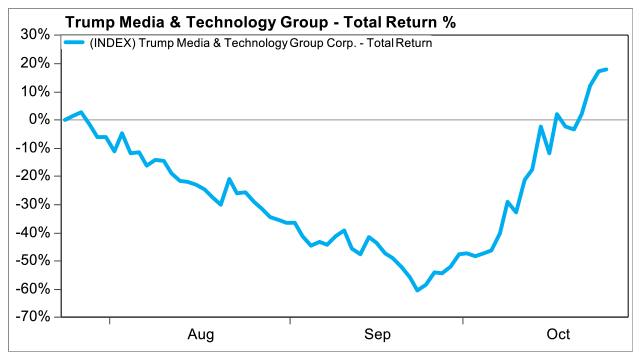

2. Trump Media & Technology Group: Trump Media, the parent company of Truth Social, has seen fluctuations in its stock prices in recent months. Positive movement in Trump-affiliated companies could signal investor optimism about Trump’s return to power and the likelihood of favorable conditions for companies directly tied to him. Investors seeing upward trends in Trump-linked assets might anticipate a stronger alignment with Trump’s policies if he wins the election, a scenario that would benefit his corporate affiliations.

Source: FactSet

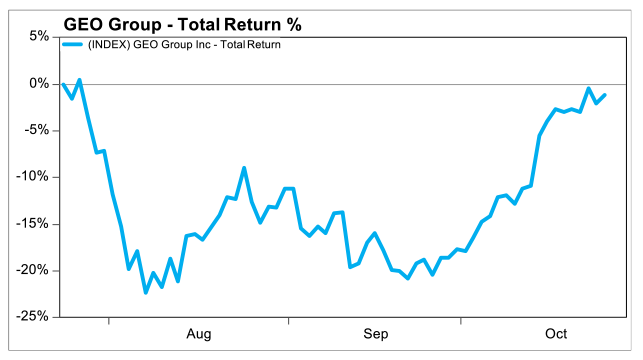

3. GEO Group: GEO Group, a private prison company, has historically benefited from Trump’s policies on immigration and criminal justice. The company saw declines under the Biden administration as government contracts decreased. Recent gains in GEO Group shares could indicate that Wall Street is betting on a resurgence in these policies under Trump, pointing to an expectation of more favorable conditions for private prison operators in a Trump-led administration.

Source: FactSet

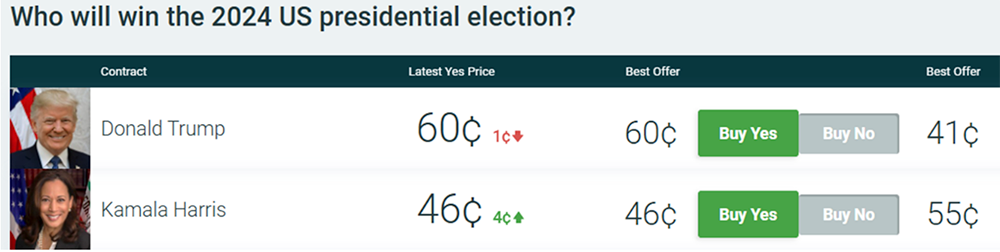

4. Betting Markets: Betting markets have become an increasingly popular gauge for predicting election outcomes, and currently, they show strong odds in favor of Trump. Historically, these markets can sway based on day-to-day political news, but when they lean one way consistently, it’s often reflective of the broader public sentiment. Betting markets reflecting higher odds for Trump could be indicative of an expectation for change, and Wall Street often mirrors this sentiment.

Source: PredictIt

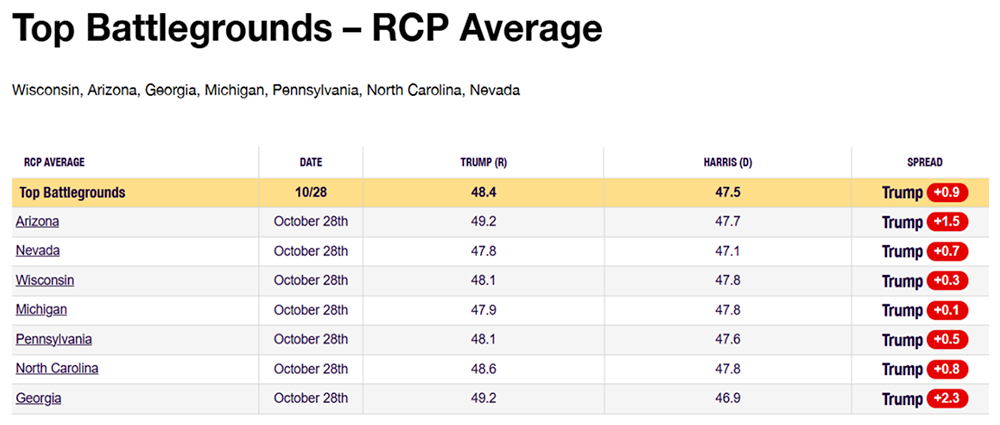

5. Polling in Battleground States: Polling in key battleground states remains tight, but recent gains for Trump in several of these states suggest growing momentum in his favor. Since these states ultimately decide the Electoral College outcome, favorable polling for Trump in states like Pennsylvania, Arizona, and Georgia can be a sign that his campaign is resonating with voters in crucial areas. Wall Street, especially in sectors sensitive to political change, watches these polls closely as they can hint at market-moving shifts tied to policy changes post-election.

Source: RealClearPolitics

These indicators collectively highlight that while some economic measures favor Harris, specific stock movements, betting market trends, and battleground state polls indicate a growing anticipation of a Trump victory.

In conclusion, Wall Street appears to be at odds with itself, reflecting both confidence in the current administration’s economic policy and hedging for a potential shift back to Trump-era policies.

As Election Day approaches, this tension underscores the uncertain and dynamic relationship between politics and markets, where financial indicators offer insights into both investor sentiment and broader economic forecasts. In essence, the race is as close to a coin flip as we can glean from live market data.