In a series of notes, we’ve explored the genesis of artificial intelligence (AI), the infrastructure required to support this revolutionary technology, and the functions in which it can be deployed to spur productivity in businesses and convenience in households.

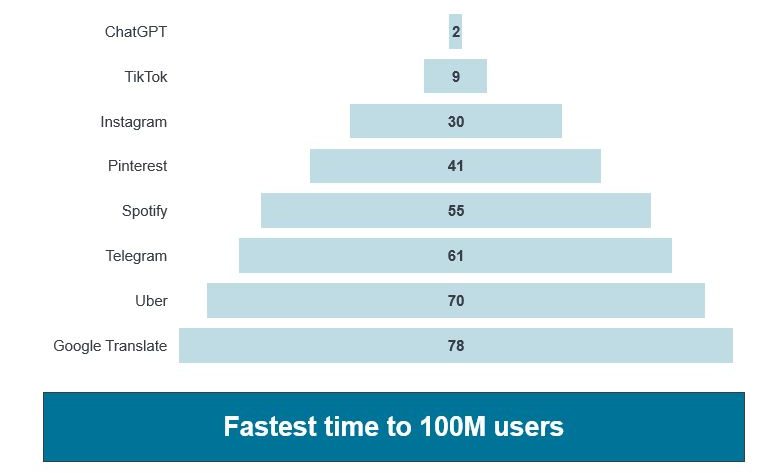

One of the questions we addressed was whether AI’s potential would live up to the hype that began with OpenAI’s release of ChatGPT. While the mid-year sell-off in technology stocks may have suggested otherwise, we remain confident that AI has the potential to be a force multiplier for economic productivity and corporate earnings growth.

The short-lived correction of tech-focused indices – including names closely associated with AI – served as a reminder that equity markets are volatile, can be susceptible to a high degree of enthusiasm, and are vulnerable to macro and technical forces – in this case, the unwinding of a popular “growth trade” funded by the Japanese yen.

What the correction did not do was invalidate the powerful secular thesis underpinning AI. In fact, despite the ease with which earnings multiples compressed, we had not considered AI-related valuations particularly high prior to the sell-off. That’s because, unlike the late-1990s internet bubble, today’s investors can gain exposure to business models already capable of compounding earnings growth and generating cash – not merely the hope of eras past.

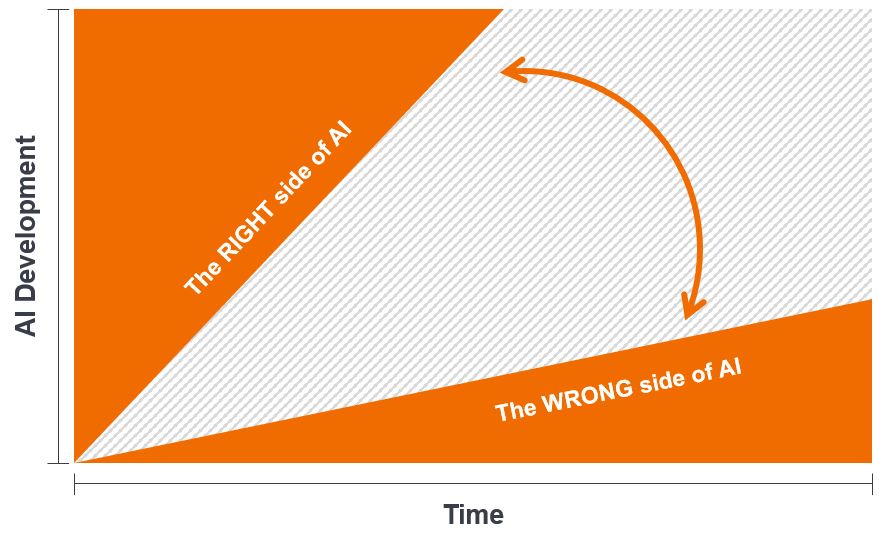

Furthermore, in our view, inevitable market pullbacks represent buying opportunities. Guiding this enthusiasm is the tech-sector maxim: The earnings potential of technological breakthroughs is typically overestimated in the near term while considerably underestimated over longer horizons. History illustrates that once the marketplace gains access to a new innovation, it can better determine how to best deploy it to increase efficiencies and grow revenues. For step-function technologies, growth has historically exceeded initial estimates.

Nevertheless, recent volatility provides us with the opportunity to close our AI series with an exploration of the risks involved in investing in this still-novel theme. By their nature, long-duration themes carry a degree of risk as investors attempt to assess market dynamics years in the future. Additionally, the AI theme carries a unique set of risks given its disruptive potential and concerns over negative outcomes associated with the notion of handing the keys to much of our everyday lives over to a machine.

Source: Janus Henderson Investors.

Source: Janus Henderson Investors.