Notable Performance Points in 2024 | What Stock Prices Follow Over Time | Our Important Twist on Many Advisors’ Favorite Slide

Portfolio Advice, Talking Points, and Useful Resources

- A Year in Review: 2024 was an exceptional year for investors and included impressive earnings growth and price returns from the Magnificent Seven.

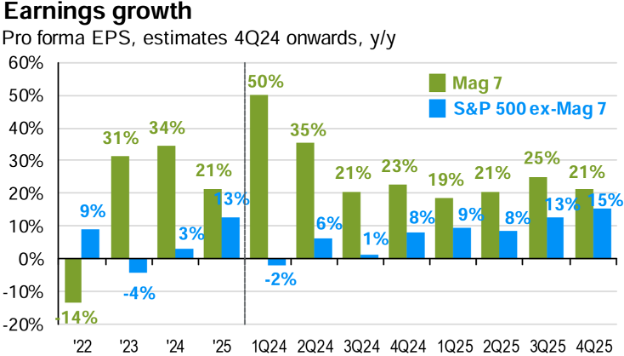

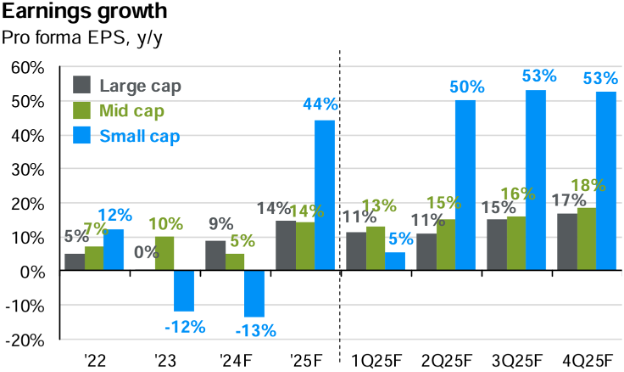

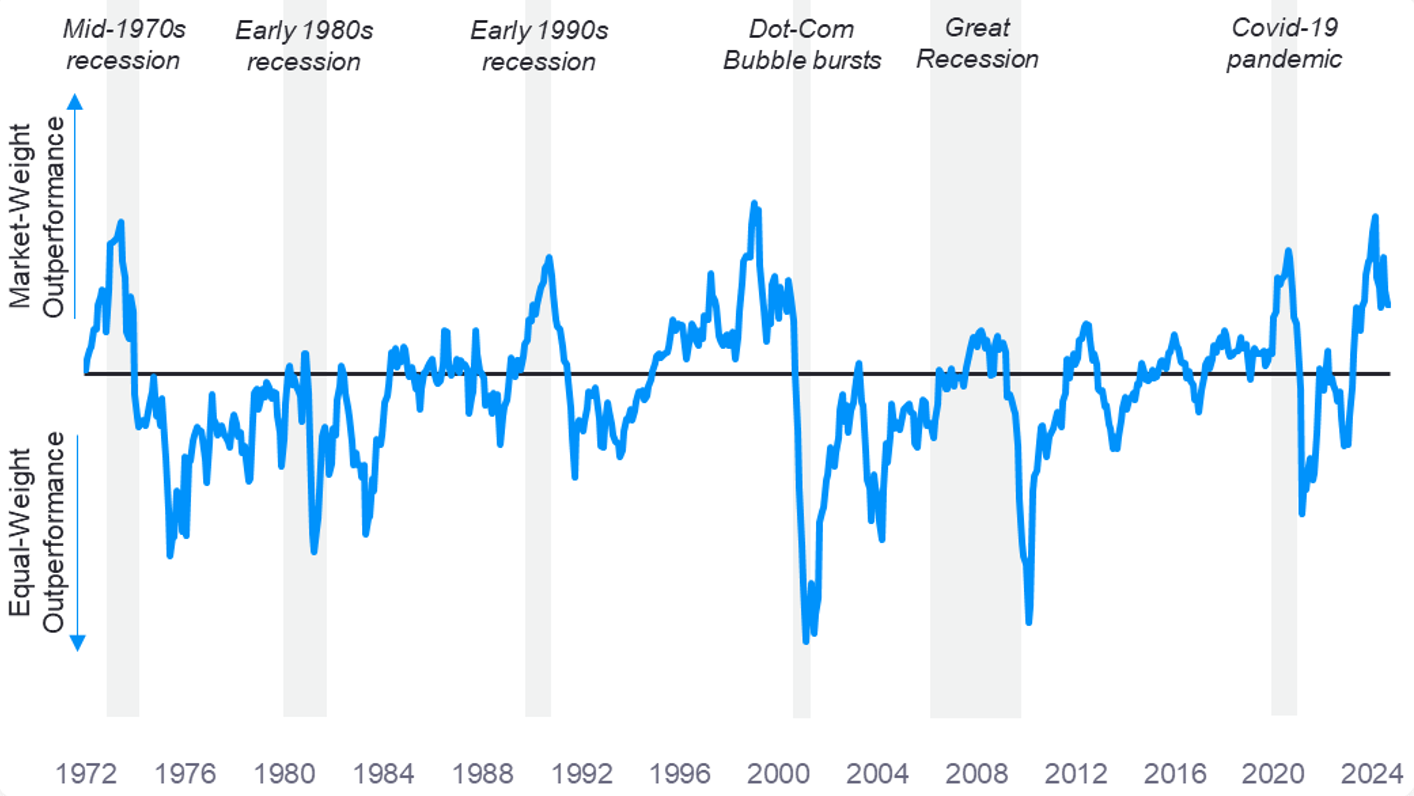

- Earnings Growth: Stocks follow earnings, and earnings growth could provide clues for future market leadership.

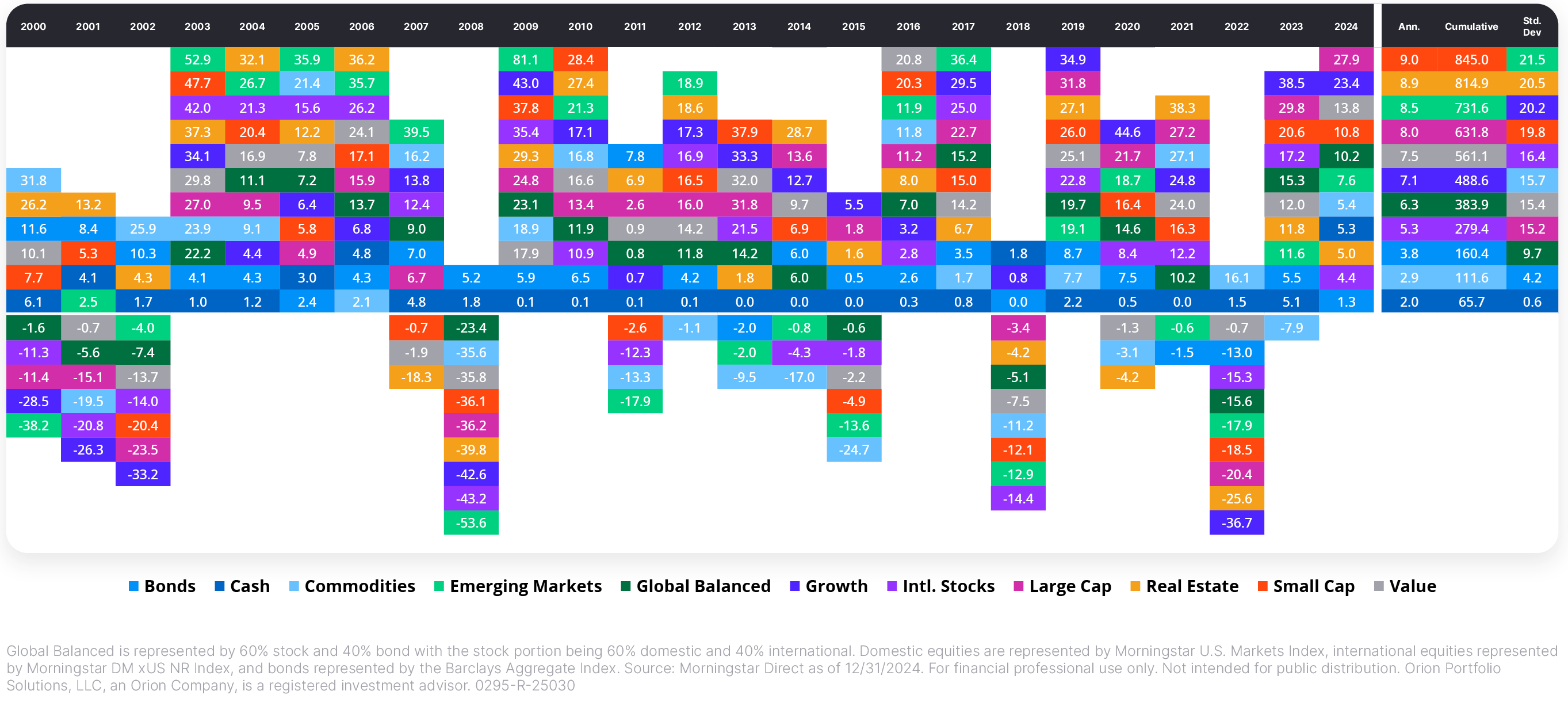

- Our Twist on a Powerful Slide: The asset class quilt chart is a winner for explaining markets, but it also shows the markets’ powerful positive expectation. Stay invested. Stay diversified.

Looking Back On 2024

By Rusty Vanneman, CFA, CMT, BFA, Chief Investment Strategist

Five Notable Performance Points in 2024:

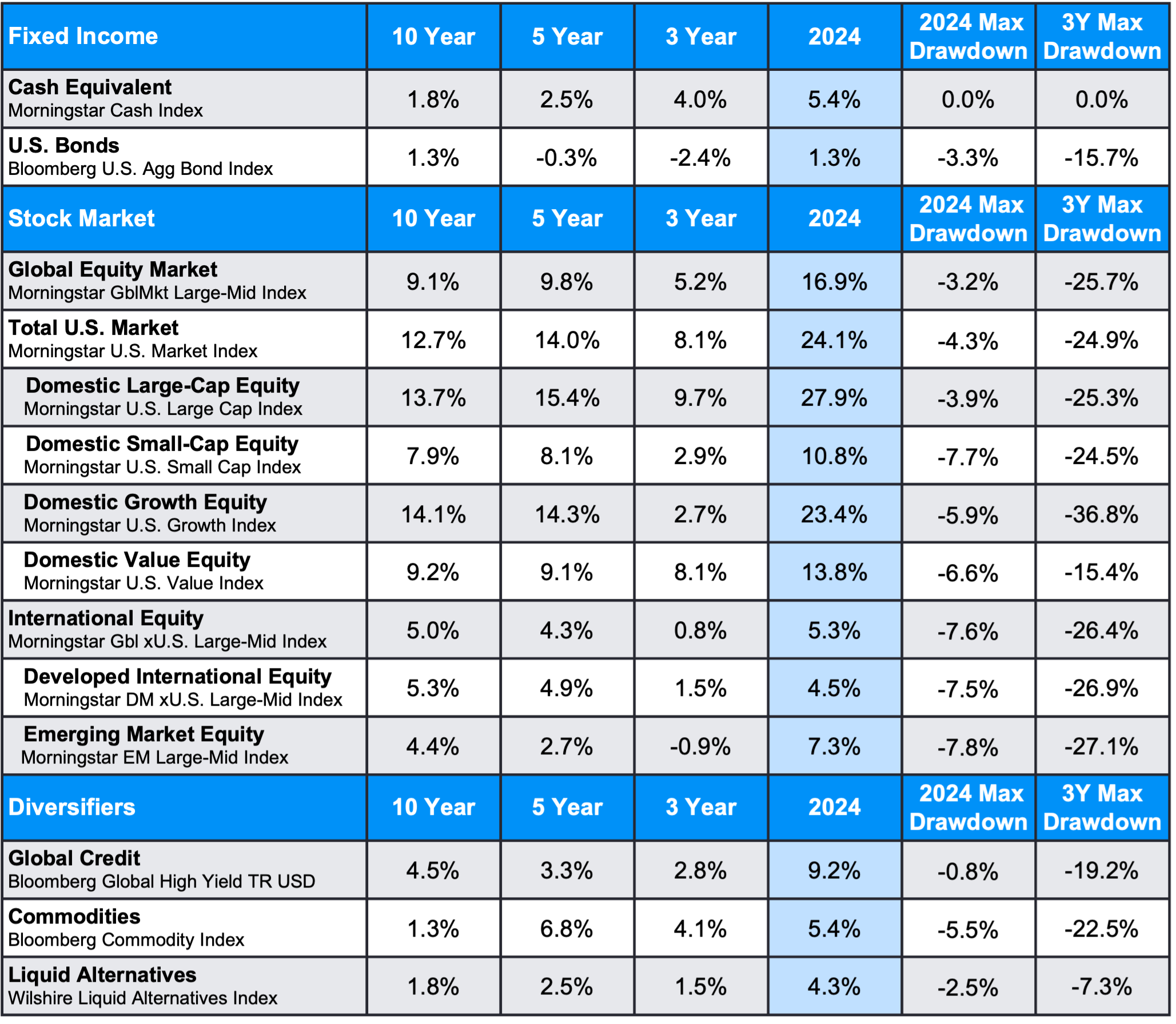

2024 was a strong year for investors in balanced portfolios. U.S. large-cap growth stocks took the spotlight, with the Magnificent Seven delivering price gains of nearly 50%. Reviewing the table of annualized returns below, five key themes emerge from last year’s exceptional performance:

- A Good Year by Any Standard

With historical stock market returns typically in the 8-10% range, 2024’s double-digit gains firmly classify it as a strong year. Large-cap stocks posted a stellar 28%, well above long-term averages. - Large-Caps Outpaced Small-Caps

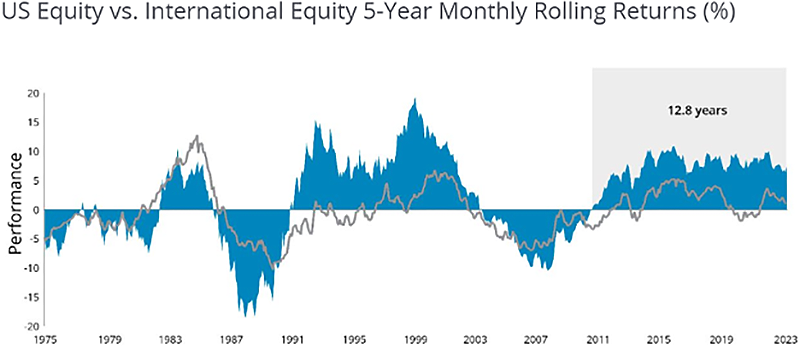

Large-cap stocks significantly outperformed small-caps, with returns of 28% versus 11%. This divergence underscores the outsized influence of a handful of dominant growth stocks. - U.S. Stocks Outperformed Global Markets

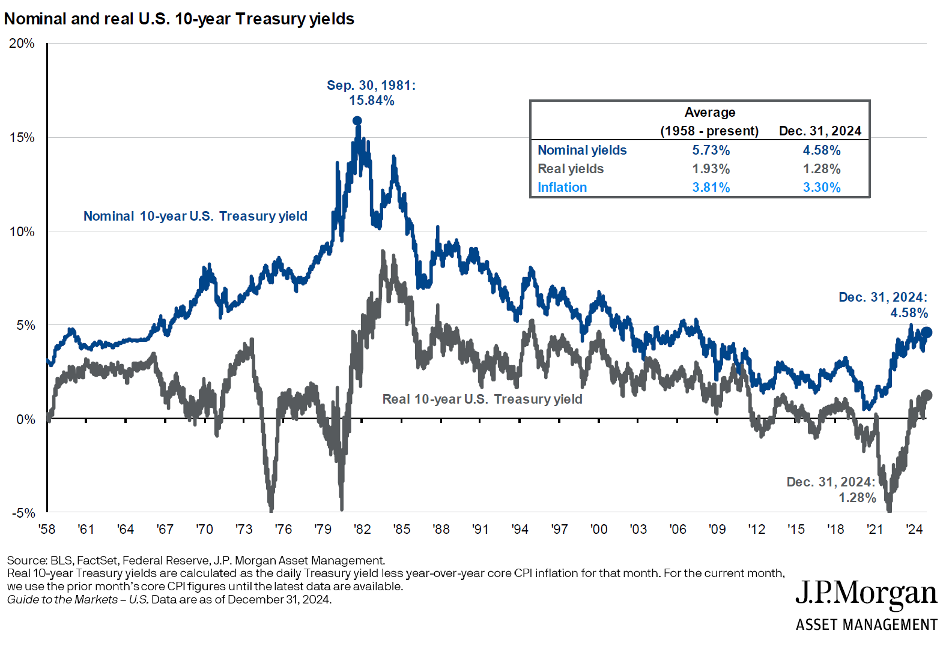

Fueled by a strong fourth quarter, U.S. equities surged 24%, while non-U.S. stocks lagged at just 5%. In the final quarter alone, the S&P 500 gained 10%, buoyed by an 8% rise in the U.S. dollar and a sharp increase in long-term interest rates. - Fixed Income Found Positive Ground

Bonds, as measured by the Bloomberg Aggregate Index, eked out a positive return in 2024. Yet, their three- and five-year annualized returns remain negative — a rarity in the historical record. - Diversifiers Shined

Diversifying asset classes, such as global credit, real assets, and alternatives, outperformed core fixed income. Over the past three, five, and 10 years, these assets have consistently added value, reinforcing their role as a complement to traditional fixed income for managing equity risk.

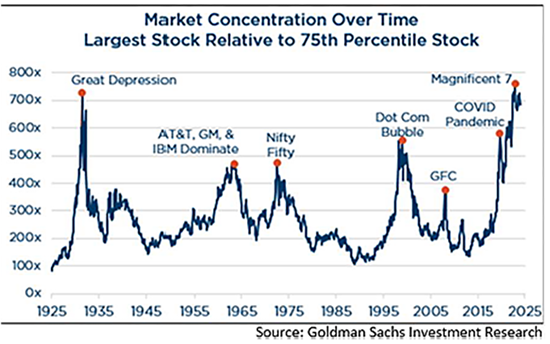

The Magnificent Seven Was Indeed Magnificent

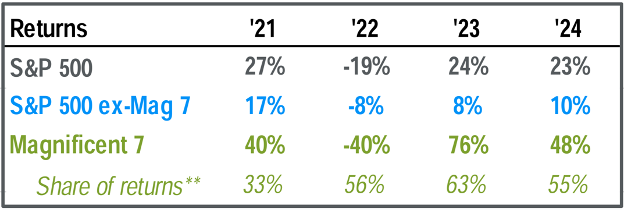

Large-cap stocks’ extraordinary performance in 2024 was driven by the Magnificent Seven (M7): Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. Their returns were nothing short of remarkable.

In 2024, the S&P 500 gained 23% in price terms, while the Magnificent Seven delivered a staggering 48% price return. Strikingly, if you exclude these seven stocks, the S&P’s price return drops to 10%. Though still solid, it pales in comparison to the M7’s contribution. This pattern has continued for several years, with the M7 outperforming the broader market in three of the last four years.

Source: J.P. Morgan Guide to the Markets, page 12. As of 12/31/2024.

**Share of returns represent how much each group contributed to the overall return. Numbers are always positive despite negative performance in 2022.