Video Transcript

Hello, everyone. My name is Nolan Mauk, and I'm an investment research analyst here at Orion. I wanted to jump on today and discuss international equities, an asset class that has been relatively out of favor compared to the United States for over a decade, but it started to stand out in the first quarter of 2025 amid U.S. volatility.

As of this recording, international equities are outperforming the S&P 500 by over 10% year to date, causing many investors to take another look at their strategic international equity allocations.

Let's take a quick look at some potential benefits of holding international equities within diversified long-term portfolios.

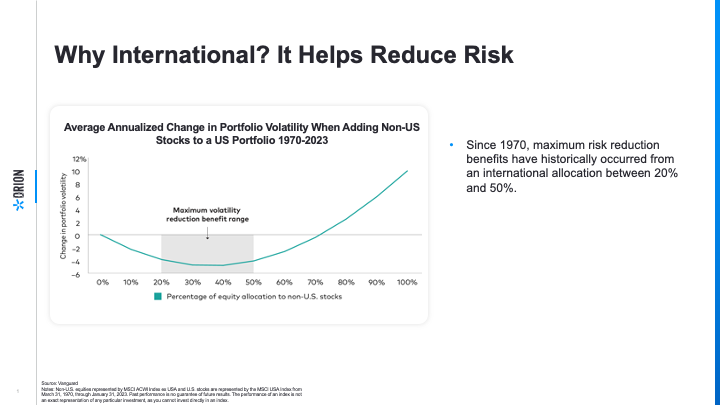

First, holding international stocks can do more than just provide a differentiated source of returns in market conditions like these. It also has the potential to dampen volatility over the long term. This study done by Vanguard found that allocating between 20% and 50% of the equity portion of portfolios to international stocks can provide meaningful volatility reduction benefits over time, historically speaking.

Additionally, the current deglobalization trends we're seeing, including market-friendly policy changes in important international markets that may improve growth prospects going forward, could further decrease correlations between economies and markets, which may further increase the diversification benefits of an allocation to international equities.

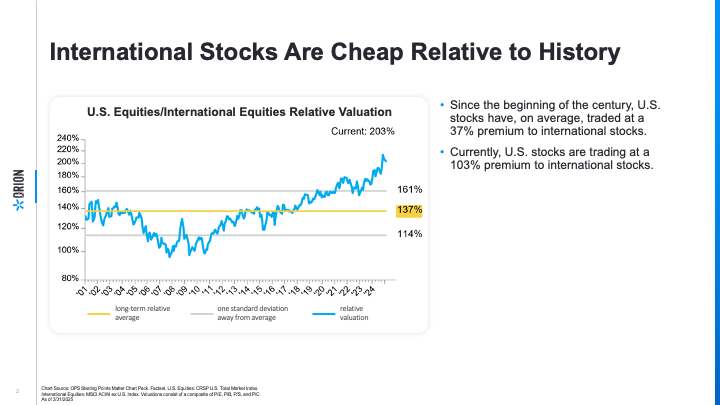

Now despite the recent rally in ex-U.S. markets, the valuation landscape remains attractive for foreign stocks if history is any guide, as international stocks have traded at their largest discount to U.S. stocks of the 21st century in recent months.

With the backdrop of a volatile U.S. market year to date, the valuation disparity between the U.S. and ex-U.S. markets, along with catalysts like European economic stimulus and strong GDP growth in Asia, there is a potential opportunity to strategically diversify with international equities.

Thanks for checking in. And as always, if you have any questions, please let us know. Thanks.