Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- My investment career is more rooted in equities than bonds…before joining Brinker Capital and Orion in investment strategist and investment officer roles I spent 17 years working on long / short and long only US equity funds. And while I still find the equity markets fascinating, I also have a deep appreciation and deep respect for the importance and scale of the fixed income markets, both domestically and globally and corporate and government (and as any professional fixed income investor will tell you, everyone knows that bond investors are a lot smarter than equity investors). So it is with deep humility that I take pen to paper this week.

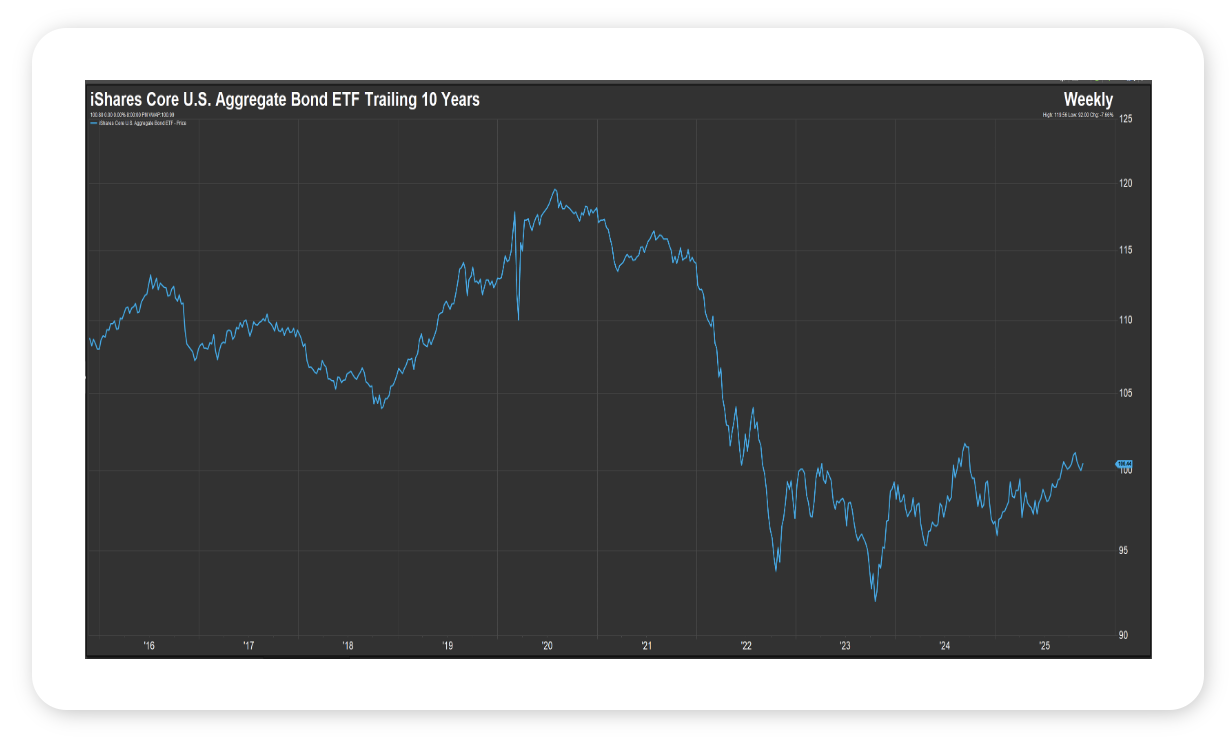

- It seems, knock on wood, that bonds are back. According to Morningstar, as of Thanksgiving the iShares Core U.S. Aggregate Bond ETF has returned 7.64% year to date on a total return basis; if that rate of return holds through year-end, it will be the ETF’s best showing since 2019, when it gained 8.46% and a far cry from the negative 1.77% and negative 13.02% returns it posted in 2021 and 2022, as bonds were hit hard by surging inflation and a Federal Reserve that was taking the Fed Funds Rate from 0% to 5%+ (see chart). Also, importantly, high quality fixed income was flat in November, helping to offset that month’s stock market volatility.

- As to why bonds have caught such a bid this year, we think inflation moving sideways to down, two interest rate cuts from the Fed and a likely third cut at the Fed’s December meeting, solid but not too hot economic growth and the US dollar finding its footing are all likely catalysts. And as to where fixed income heads from here, much will depend on investor demand, and the path forward for inflation, interest rates and the economy. But for now, we will gladly take a moment to appreciate the asset class that accounts for the all important 40% of a classic 60/40 portfolio of US stocks and bonds; a portfolio which has returned a very impressive 12.6% in 2025.*

Source: FactSet, November 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets rebounded sharply during the short holiday week, reversing earlier November weakness and pushing the S&P 500 positive for the month. That marked seven straight months of gains. Momentum improved as odds of a December rate cut climbed.

Equities rallied across the board. The NASDAQ led with nearly a 5% gain, and small caps rose more than 4.5%. The S&P 500’s November strength pushed its year-to-date gain to roughly 18%, while international equities are up nearly 30%. Rising expectations for rate cuts pulled interest rates lower, giving fixed income a boost, though mortgage rates ticked slightly higher.

Key data last week showed steady producer prices, softer retail sales, and solid durable goods orders. PPI matched expectations with a 0.3 percent rise. Retail sales missed consensus but still grew at the fastest quarterly pace since 2023. Durable goods orders beat expectations and showed healthy year-over-year growth.

Earnings season has mostly wrapped up. For Q3 2025, S&P 500 earnings rose 13.4%, marking a fourth straight quarter of double-digit growth. Most companies reported positive earnings and revenue surprises. Retail and tech companies continued to report into the end of the season.

This Week

With the government having cancelled October’s nonfarm payrolls report due to the shutdown, markets will look to the ADP Employment report for direction on labor. Investors will also watch PMI data for signs of slowing.

The Federal Reserve’s preferred inflation measure, PCE, will be released Friday and will be a key input ahead of the next FOMC meeting. Consumer sentiment also gets a preliminary release on Friday and remains a closely watched gauge in a choppy year.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.