The benefits of offering your clients formal financial planning services are numerous. From providing a better client experience to increasing your advisor alpha, connecting your clients’ financial goals with investment performance data will help you differentiate yourself and your firm in a crowded wealth management industry.

In fact, according to Cerullli, nearly 50 percent of financial advisors call themselves “financial planners,” meaning they offer a full range of planning services, such as savings goals (retirement, college), budgeting, tax planning, and insurance. Yet, in reality only 24 percent of them actually provide those planning services.

That’s why at Orion we’ve made financial planning easy for advisors like you to add to your services by creating a single sign-on for Orion’s financial planning software.

So, in the spirit of Valentine’s Day, this week’s Tech Tip will walk you through how to use this lovable single sign-on feature and create a data feed that allows your clients’ financial plans to automatically mingle sync with their existing account information in Orion.

Accessing Financial Planning from Orion

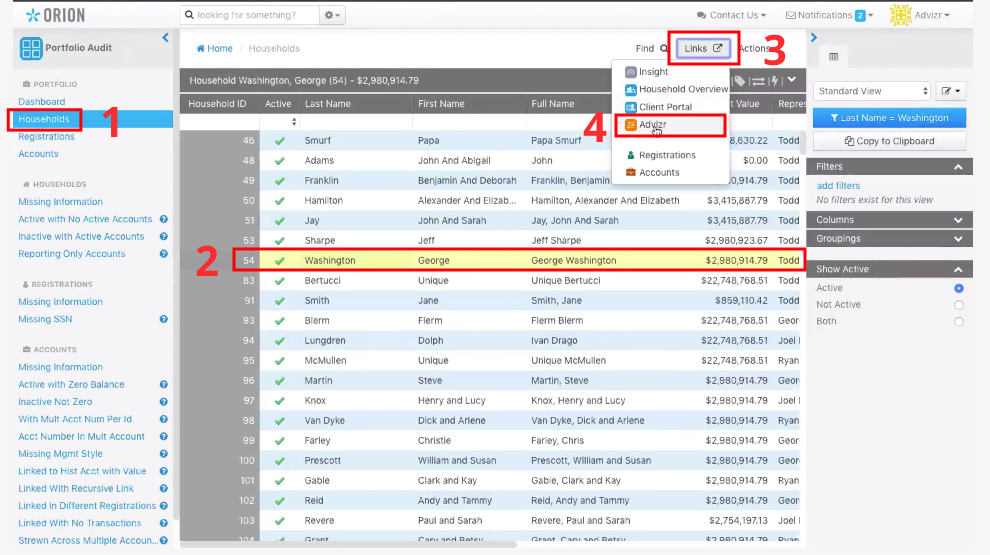

To get started using the single sign-on for Orion’s financial planning software, sign into your Orion Connect portal and navigate to the Portfolio Audit App.Next, complete the following steps:

- Click on “Households” in the left column.

- Select the household you want to send over to Advizr, Orion’s financial planning software.

- Click “Links” in the top right corner.

- Select “Advizr” from the drop-down menu.

Starting a New Financial Plan

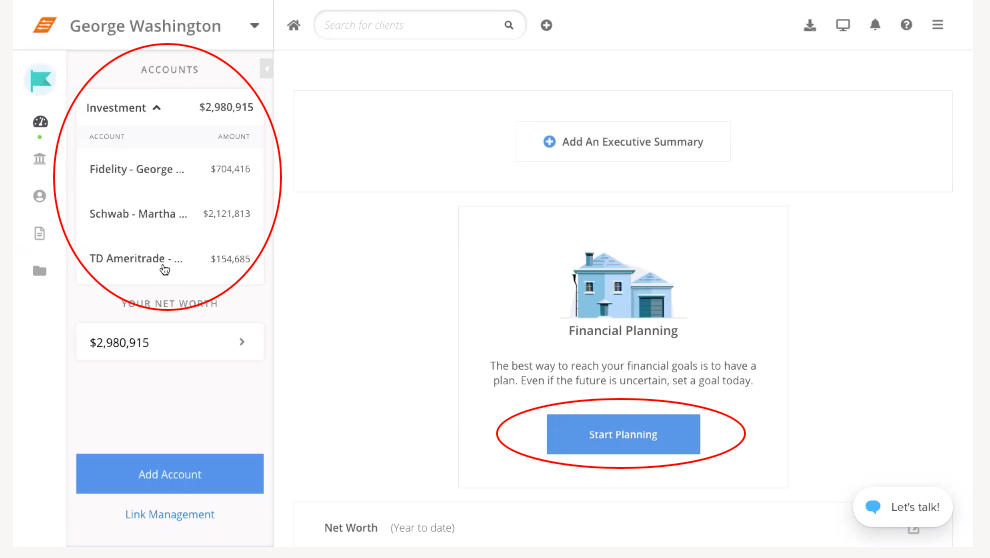

Once you have completed the single sign-on within Orion, you are ready to start creating a financial plan for your client.If this is your first client, the first Advizr screen (shown above) that pops up will ask you to map Orion asset classes to the Advizr asset classes. You do not have to complete this step right away. To skip this process, hit “Confirm” to be taken to the client’s homepage.

In addition to the client’s name, the client homepage will display in the left column the client’s investment accounts that were set up in the Orion platform.

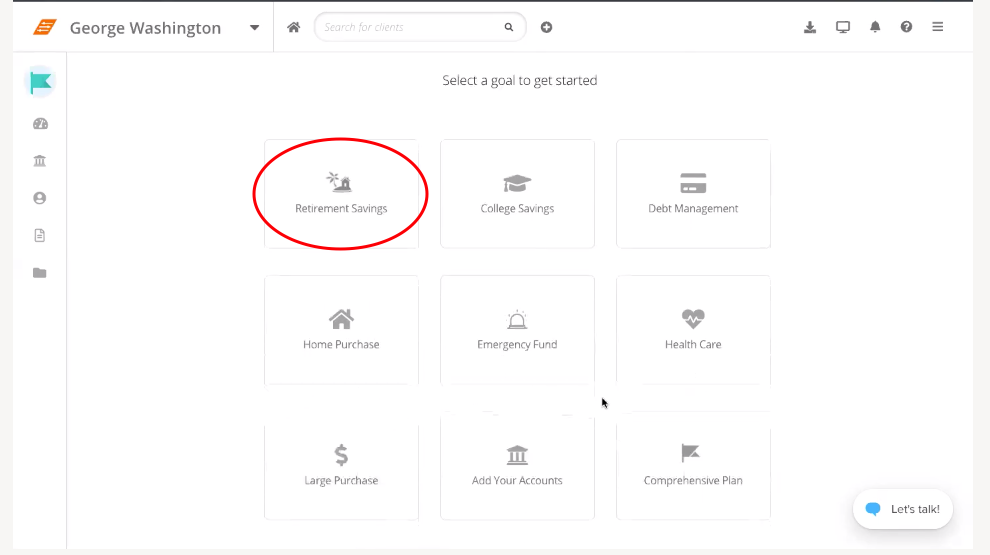

To get started with a financial plan, select the “Start Planning” blue button in the middle of the screen. You will then choose a goal from the list:

- Retirement Savings

- College Savings

- Debt Management

- Home Purchase

- Emergency Fund

- Health Care

- Large Purchase

We will do a walkthrough of the Retirement Savings section as an example, but these same steps can be used as a guide for the other options as well:

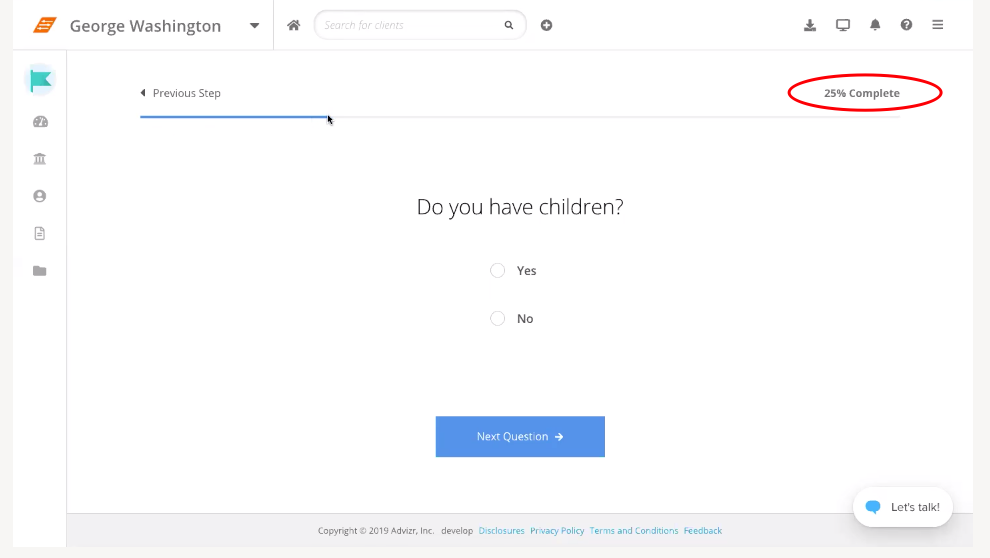

- Notice that information that was already in Orion — such as age, name, and marital status — will pre-populate and will count toward the total progress toward the goal (as shown above).

- Next, answer a series of questions.

- Review the information.

- Then click “Take Me to My Plan,” where you can then create what-if scenarios and the advice you’re going to give to the client.

Checking the Flow of Information Between Orion and Advizr

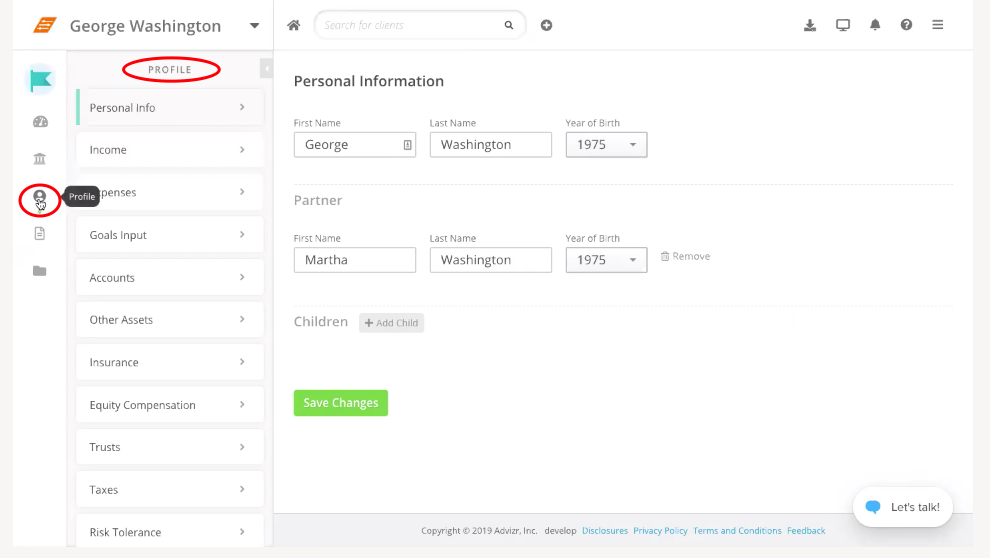

You can view all of the information from Orion and any extra information you or your client enter into Advizr in the Profile section located on the left side. That information can include:

- Personal Information

- Income

- Expenses

- Goals Input

- Accounts

- Insurance

- Equity

- Trusts

- Taxes

- Risk Tolerance

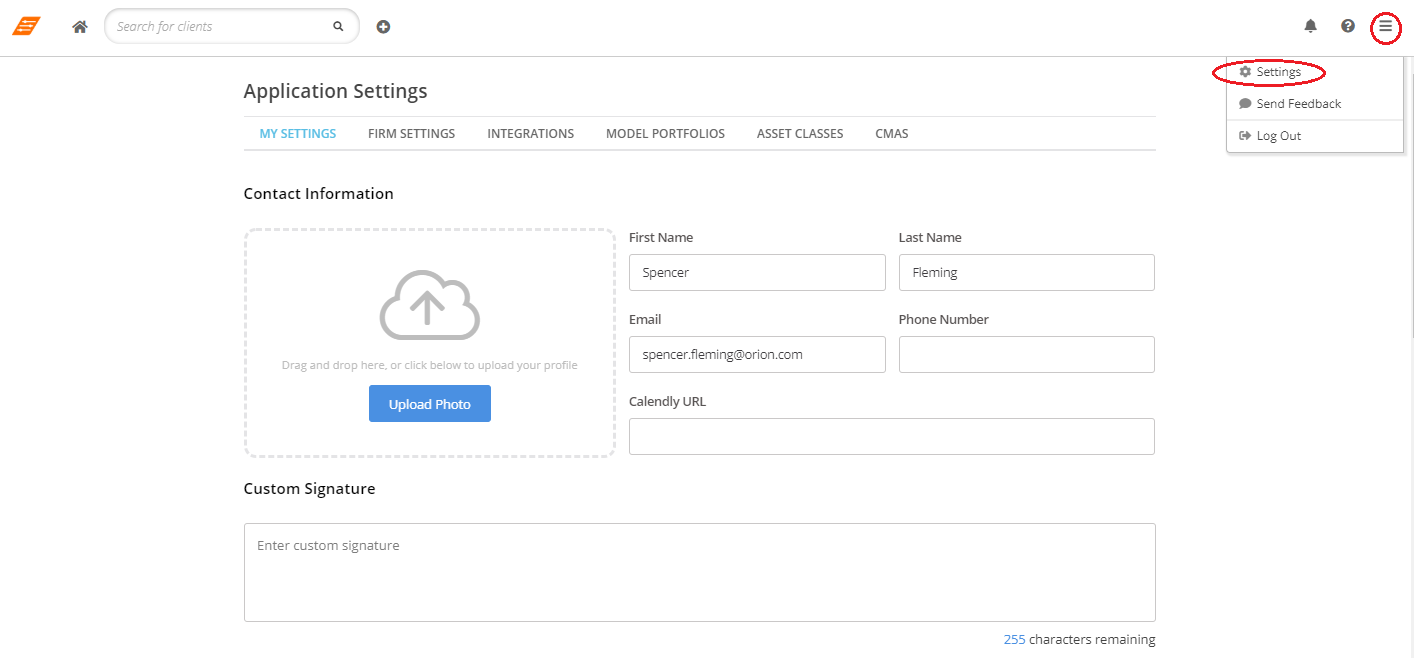

To customize Advizr, select “Settings in the top right.” From there you can white label your service by adding a logo, custom signature, and disclosures.

In addition to asset class mapping, you can also change assumptions to set global settings or settings per client, and check out model portfolios.

To watch a video on how to complete any of these processes, check out this walkthrough. For more tips on how to harness Orion’s financial planning software, contact our Financial Planning Team.

0312-OAS-2/10/2020