-

Advisor Tech

-

-

Recommended

-

-

Wealth Management

-

-

Recommended

-

-

Who We Serve

-

Who We Serve

-

Individuals

- Financial Advisors

- Business Owners

- Chief Compliance Officers

- Chief Operations Officers

- Chief Technology Officers

FirmsRecommended

- Resources

-

Resources

-

LearnOur Technology

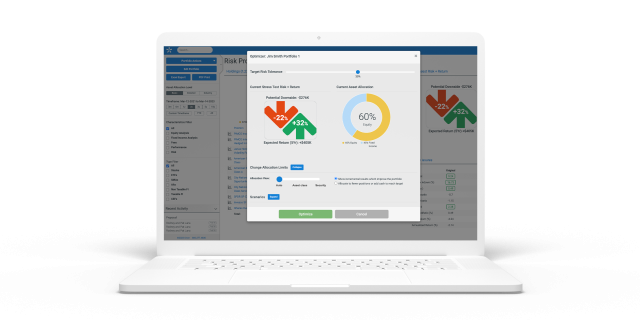

Ditch the Old-School Approach To Risk

Start risk conversations off right with next-level business intelligence, risk analytics, and economic research to help you guide each client toward investment strategies that work for them — regardless of what’s happening in the world.

Customize for Every Client

Learn MoreCustomize your approach with every client and prospect with our BeFi-driven 3D Risk Profile, personalized proposal generator, and custom asset builder tool.

Run Stress Testing & Risk Analytics

Learn MoreStrategize based on goals and market realities, and show upside and downside risk. Compare your model with prospect holdings in the context of economic events.

Leverage Robust Modeling and Portfolio Construction

Learn MoreTest dozens of asset classes and investment vehicles in minutes to easily develop the right investment approach.

Supercharge Your Strategy

Learn MoreBuild a stronger business for current and future clients with tools to level up your IPS creation, model management, and investment committee.

Prevent Panic Selling

Learn MoreEase fears and help your clients stay invested by showing your hedging strategies in real-life macro scenarios.

Boost Growth

Learn MoreBuild trust, win business, and grow better with strategies that account for your client’s life changes, goals, and deliver customization at scale.

TESTIMONIALS

TESTIMONIALSWhat Our Clients Are Saying

"Reports produced are professional and enhance the client's understanding of their portfolios."

— Michelle H, G2 review

"I have closed several sales with this program and the custom portfolio outputs it helps you with."

— Thomas B, G2 review

"The ability to integrate and link accounts makes it very easy to prospect and build proposed portfolios. Stress testing and scenario analysis is amazing."

— Cory P, G2 reviewIs Your Business Risk-Ready?Turn the Risk Lens on Your Firm

Understand how macro events affect firm performance with a dashboard that provides meaningful insights into the health of your firm.

Access 100+ Real-World Scenarios

Calm investor fears with our regularly-updated library of 100+ stress testing scenarios, built upon robust regression modeling and fueled by Morningstar data.

Sample ScenarioCryptomania

How will the developing cryptocurrency market impact the economy and other asset classes?

Sample ScenarioFed Shock Therapy

Will the Fed rate hikes curb inflation and stimulate the economy, or will they induce a recession?

Sample ScenarioHousing Whiplash

How will the Fed’s tightening cycle influence the US housing market, and will that be enough to prevent a housing market bust?

Sample ScenarioCold War 2.0

What’s the market impact of a Cold War between the US and China/Russia?

Sample ScenarioBoomers Retire

How will the aging of the Baby Boomer generation affect stock markets in the United States?

Free Resource: Whitepaper

Free Resource: WhitepaperHow Risk Intelligence Positions You for Success

Advisors have traditionally relied on a cursory review of client risk tolerance. But today’s world is volatile, and that approach no longer works.

Enter Orion Risk Intelligence, which enables advisors to go beyond the simple RTQ to build deeper client relationships and more informed financial plans. This whitepaper explores risk technology and how one firm is putting it to use with remarkable results. In this whitepaper, we’ll show you:

- Lessons from top advisors on how they are leveraging risk intelligence tools

- How you use risk intelligence tools to enhance client relationships

- The benefits of using risk intelligence to quantify and manage risks for your clients and business

Pricing

Orion Risk Intelligence is offered as a standalone solution or as a part of the Orion Advantage Stack. If you are affiliated with a broker dealer, Risk Intelligence is pending broker dealer approval.

$275a month

Pricing is per user, per month. Receive a 10% discount by option for annual billing. This price includes full access to Orion Risk Intelligence, including:- 100+ Stress Tests

- Robust Regression Modeling

- Portfolio Construction

- 3D Risk Profile

- Asset Drift Monitor

- Custom Asset Builder

- Personalized Proposal Builder

- Fueled by Morningstar Data

- Proposal and IPS Solution

Includedin the Advantage Stack

Leverage Risk Intelligence and its integrations to their fullest capacity with the Orion Advantage Stack. In addition to the full Risk Intelligence suite listed in the standalone offering, you also get:- Access to the Orion Compare Tool

- Pre-Trade Compliance

- Enhanced Proposal and Integrated Proposal Workflow

Introducing Orion Advantage

Introducing Orion AdvantageOne Integrated UX. One Agreement. All the Power of Orion.

57% of advisors cite a lack of integration between their core applications as their biggest technology pain point.1 The Orion Advantage Stack is the newest way for you to seamlessly connect all the tools you need to grow your firm.

With the Advantage Stack, you can stress test a client’s existing portfolio, suggest changes based on goals and market realities, and easily develop the right investment approach.

Start Your Free Trial

Access the power of next-generation risk analytics and stress testing.

Dig DeeperRelated Content

1Source: https://digitaledition.investmentnews.com/articles/the-trouble-with-tech-integration

Access to the services presented is provided solely as a service to financial advisors. Orion Risk Intelligence does not make recommendations or determine the suitability of any security or strategy. Past performance of a security or strategy does not guarantee future results. Orion Risk Intelligence research and tools are provided for informational purposes only. While the information is deemed reliable, Orion Risk Intelligence does not guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with respect to the results to be obtained from its use.

1861-OAS-7/29/2024

-

-

-