- A new bull market (gain of 20% or more off price lows) arrived last week. Although it took nearly 8 months from the lows to get to a 20% gain (in fact, that’s the slowest since 1957 to get from low to bull market status), it also one of the shortest and least painful bear markets of the past 50 years according to the Independent Vanguard Adviser newsletter, which referred to the vanquished bear market as a “Teddy Bear” market. Clever.

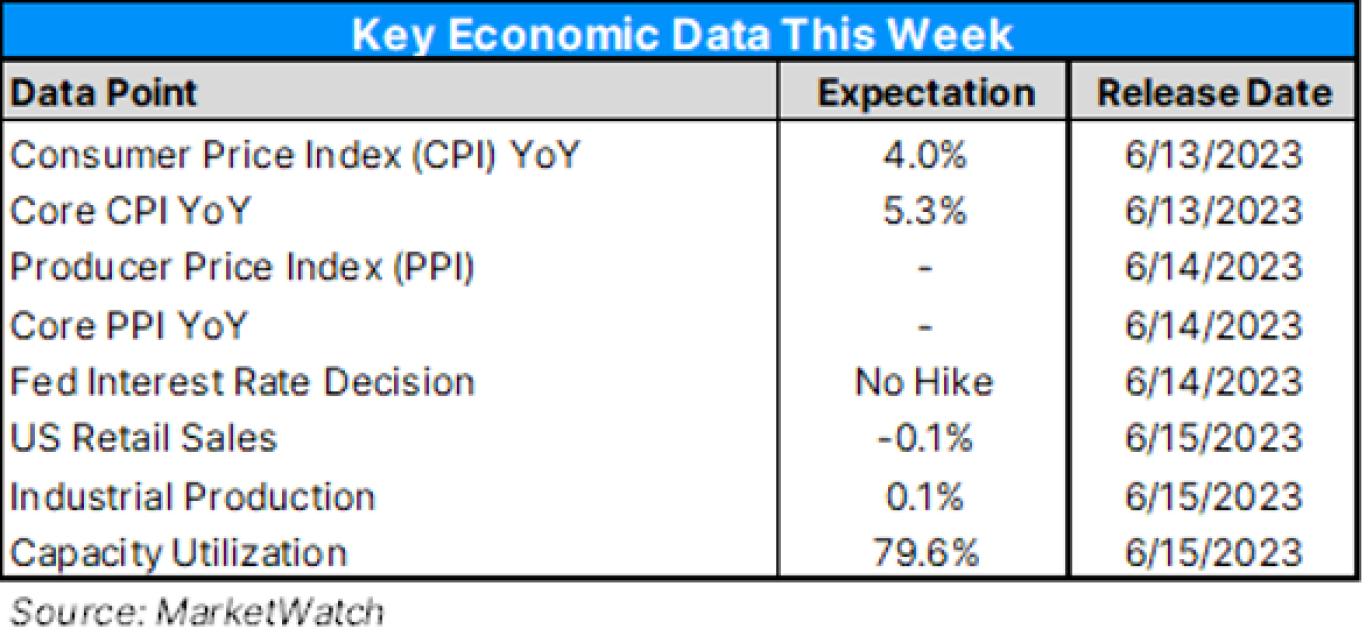

- This week has a lot of stuff going on, including key inflation data both Monday and Tuesday, as well as the Federal Reserve decision on Wednesday. As for the expectations on both coming into the week, it is expected that inflation will continue to drop (albeit still at higher levels than desired) and that the Fed will “pause” raising rates, or at least a “skip” where they pause now and raise rates later.

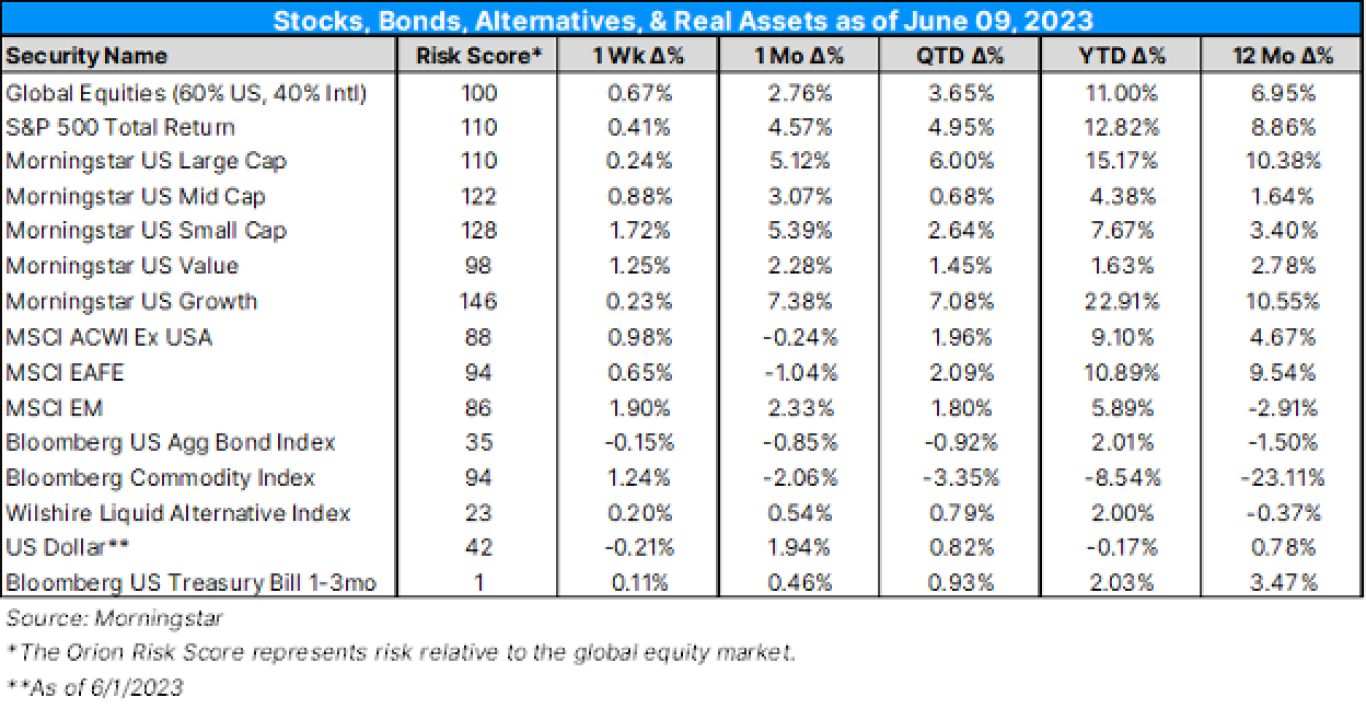

- As for performance last week1:

- Equity markets were broadly positive last week, with gains led by small caps and value stocks.

- YTD, growth stocks are still leading the charge, now up 23%!

- 12-month gains are still recovering from 2022 losses, but broadly, equities are positive.

- Bonds are still struggling early this year and holding onto a loss over the last 12 months.

- Here’s a crazy stat regarding the top US companies: The seven largest companies now have a market cap greater than the Energy, Materials, Industrials, and Financials sectors combined.

- According to Bespoke Investments,

- “[Last week], the S&P Regional Banking ETF (KRE) closed above its 50-day moving average for the day in a row which hasn’t happened since late February/early March, before the onset of the regional banking crisis. Who knows if the worst is over, but if it is, it would have been one hell of a quick ‘crisis’.”

- As we hoped/expected last week, the long bearish streak in weekly investor sentiment (the 4th longest bearish stretch going back to 1987) was snapped. According to BeSpoke Investments, “the latest sentiment readings from the American Association of Individual Investors saw an absolute surge in optimism. Whereas the past year and a half has only averaged roughly a quarter of respondents reporting as bullish, this week, 44.5% reported as bullish. That is the highest bullish sentiment reading since the week of November 11, 2021. Equally impressive is that bullish sentiment had its biggest one-week jump since November 2020, rising 15.4 percentage points from 29.1% last week.”

- While we’re on the subject of investor sentiment, have you heard of the magazine cover curse? In other words, once a major publication has a major bullish (or bearish) story, the market often goes lower (higher). Here was the recent Barron’s cover.

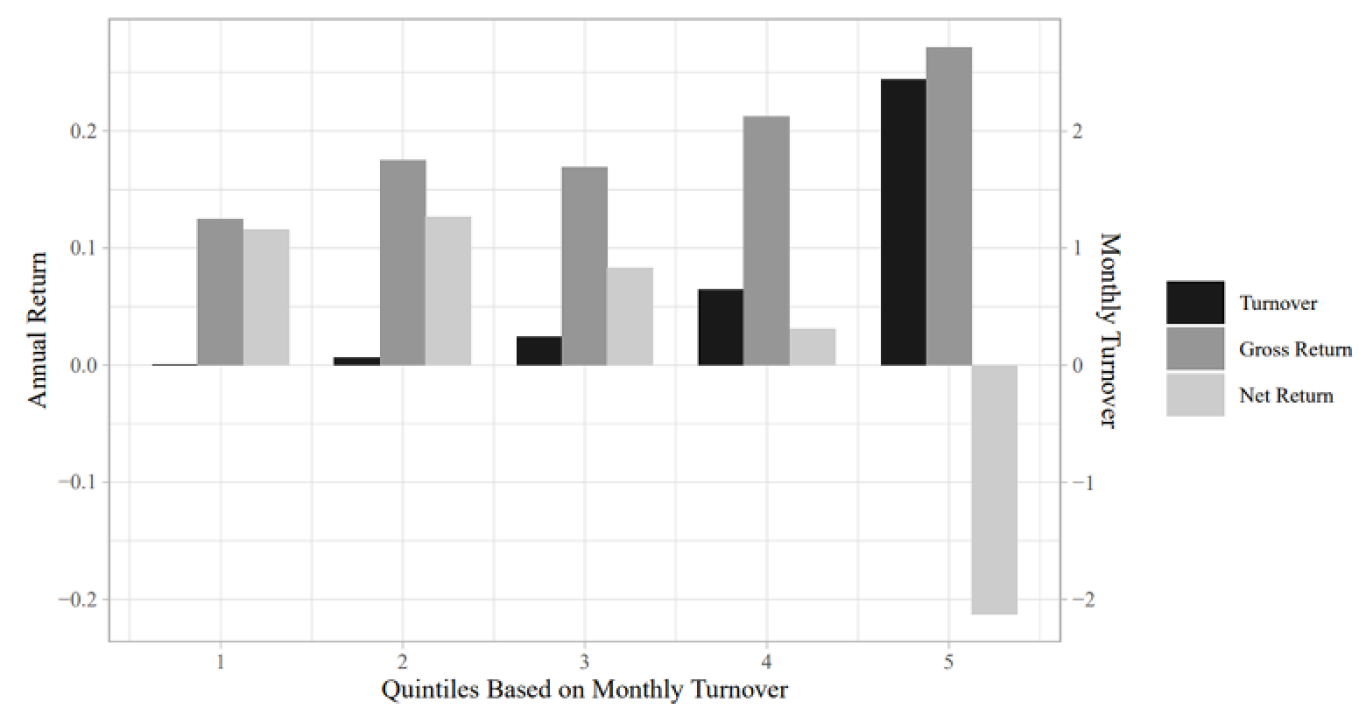

- What happens when you remove investment costs? As you would expect, investor returns see a meaningful increase, even with no change to investor behavior. However, according to this study, if we look at accounts with high turnover (lots of trading), even in today’s low transaction cost environment, we see something interesting happen. While average gross returns are higher, the net returns are negative. In other words, the most attractive traders still tend to lose money on average, despite no commissions. 2

Source: Even-Tov, Omri and George, Kimberlyn and Kogan, Shimon and So, Eric C., Fee the People: Retail Investor Behavior and Trading Commission Fees (October 1, 2022).

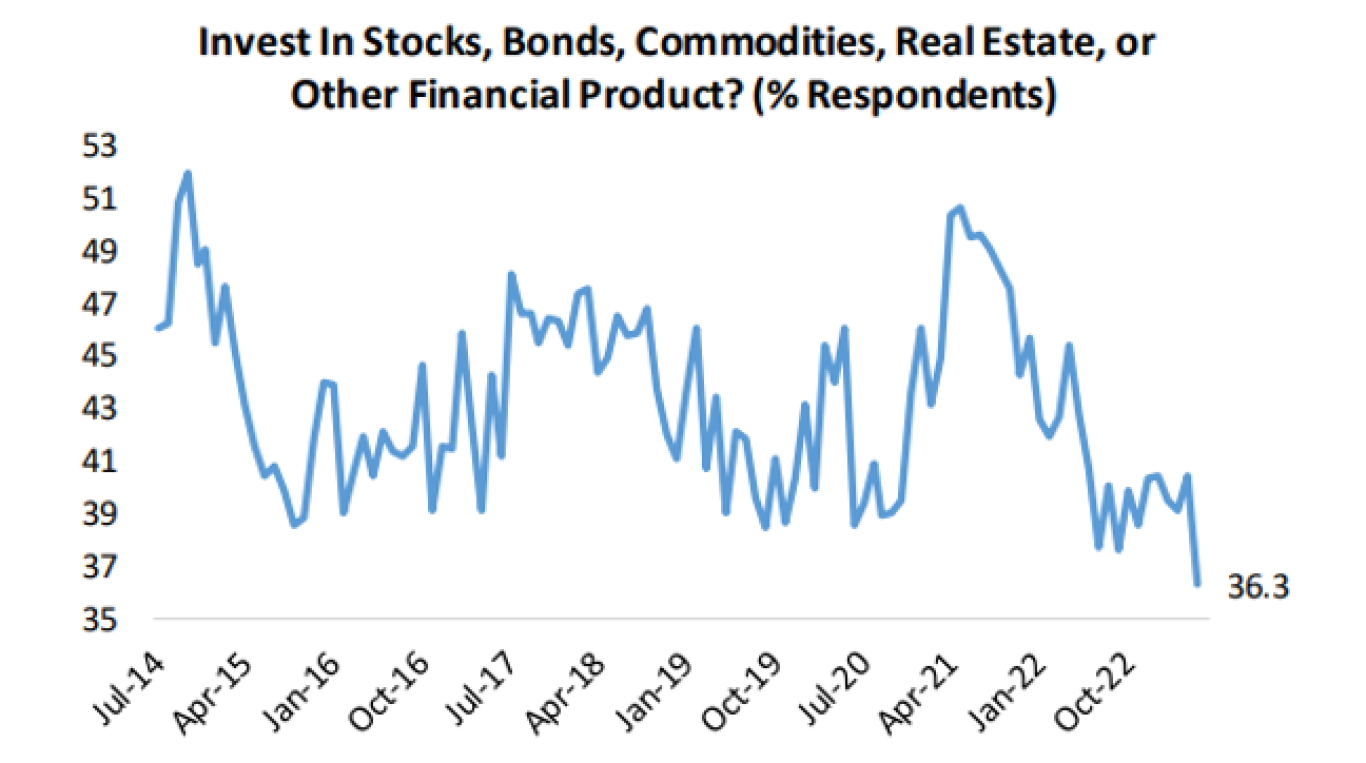

- Investors aren’t really trading much lately. Heck, they’re not buying either. Here’s a stat from Bespoke Investments last week: “Consumers have also been pulling back on risk when it comes to investing. Just this month, the percentage of respondents who said they invest in any asset class dropped to a record low of 36.3% (chart below).”

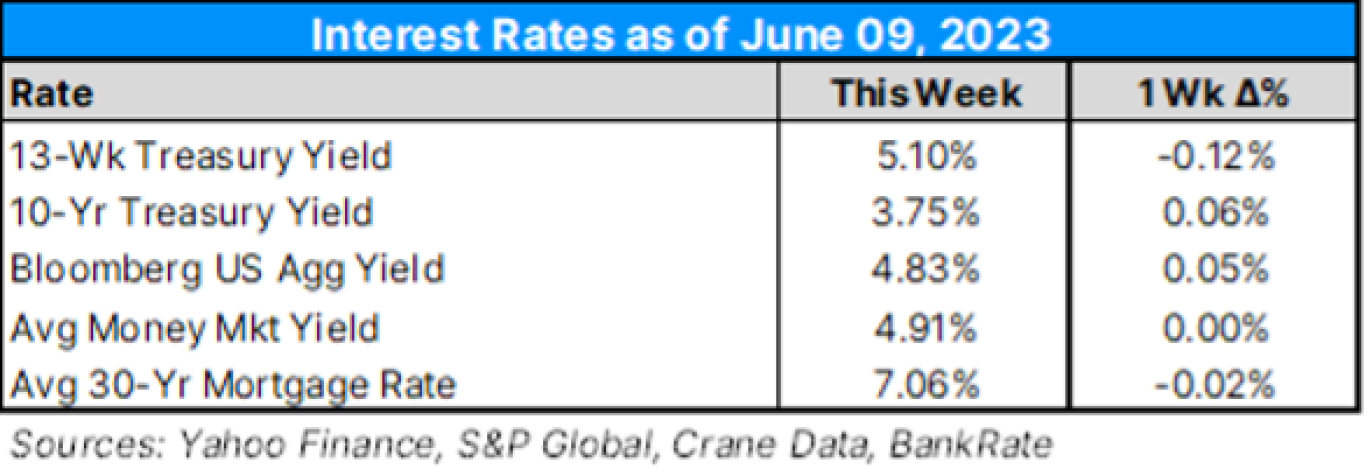

- As for key interest rates last week:

- The Atlanta Fed GDPNow Forecast Tool is setting estimated Q2 2023 GDP at 2.2% (up 0.2% from last week), as of 6/8/2023.

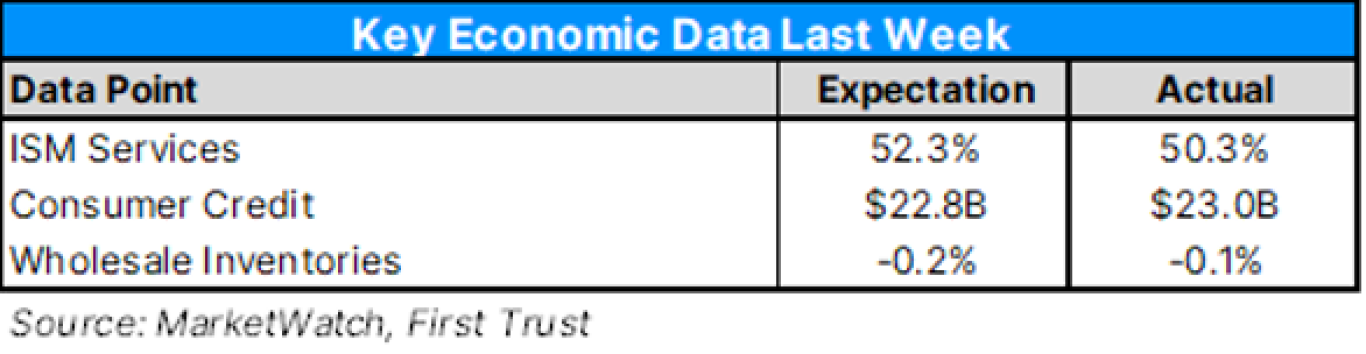

- The economic data calendar last week:

- Here is the economic data calendar for this week:

- The Fed’s interest rate decision comes on Wednesday of this week, and as of now, according to the CME FedWatch Tool:

- At a current target benchmark rate of 5.00-5.25%, the market is pricing a 70% chance of a pause in interest rate changes after ten consecutive increases since last March.

- As we wrap up earnings season, here’s this week’s Earnings Insight from Factset, as of 6/9/23

- “While analysts expect earnings for the S&P 500 to decline in Q2 2023, they also project earnings growth to return in the second half of 2023. For Q3 2023, the estimated earnings growth rate is 0.8%. For Q4 2023, the estimated earnings growth rate is 8.2%. If 8.2% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q1 2022 (9.4%).”

- Direct indexing remains hot and here’s a panel discussion that helps shows how DI struts its tax management magic.

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Crypto prices fell last week, with most of the decline coming during late Friday night (when liquidity was likely least). Bitcoin fell 4% to near $26,000. Ethereum dropped 7.5% to near $1,750. Smaller ‘altcoins’ came under more pressure as Robinhood and other exchanges remove some deemed as securities from their offerings. Cardano, Solana, and Polygon all fell nearly 30%.3

- The SEC sued Binance and Coinbase last week, alleging both operate as unregistered securities exchanges. A new crypto market structure bill discussion draft was released last week, seeking to provide clarity for regulation in the gap between the CFTC and SEC’s oversight. Tuesday of this week will be highly watched, a number of regulatory hearings and responses are due on Coinbase, Binance, Ripple, and more. In other news, Louis Vuitton is releasing $39,000 ‘Treasure Trunk’ NFTs.

- Also on Tuesday, Volatility Shares launches their 2x Bitcoin Strategy ETF (BITX) – assuming it is allowed to start trading.

- “A lot of people think that the way you make a lot of money is to come up with the best single, or few, bets. That’s wrong. That approach to the game will knock you out. How do you diversify well to have a good return relative to your risk? That’s the most important principle.” Ray Dalio

- On this week’s Orion's The Weighing Machine podcast Robyn and I talk to Kostya Etus, the Chief Investment Officer at Dynamic Advisor Solutions. In years past, Kostya has been on the podcast a few times, often ranking as one of the most popular guests, not only because he knows the markets and has great stories, but also because he knows summer movies! With specialized experience in asset allocation and security selection of various ETF and mutual fund portfolios, Kostya talks about what goes into building successful investment models, how to choose the best model provider, and what sets investment firms apart. A self-proclaimed movie buff, Kostya also shares a list of recommended summer movies worth watching.