-

Advisor Tech

-

-

Recommended

-

-

Wealth Management

-

-

Recommended

-

-

Who We Serve

-

Who We Serve

-

Individuals

- Financial Advisors

- Business Owners

- Chief Compliance Officers

- Chief Operations Officers

- Chief Technology Officers

FirmsRecommended

- Resources

-

Resources

-

Learn

Wealth Management

Maximize your profitability and lifestyle with the technology and investment options you need to fuel your firm’s success.

Broaden Your Offering. Increase Efficiency.

Spur Growth.Create positive investor experiences, streamline wealth management, and grow your business with seamlessly integrated technology, flexible investment options and hands-on support. Growth has never looked so good.

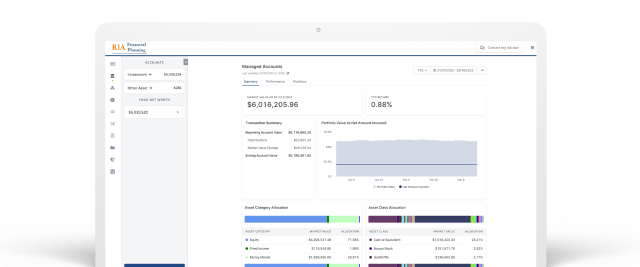

Powerful Investment Management Technology

Learn MoreHarness the power of Advisor Portal to generate personalized proposals, streamline BeFi-driven financial planning, and create an engaging client experience.

Robust Investment Options

Learn MoreAccess a diverse selection of third-party asset managers and proprietary investments, an in-house due diligence team, and well-diversified UMA portfolios.

Proprietary Investments

Learn MoreHelp your clients achieve their goals with proprietary investments designed to deliver better outcomes from Brinker Capital Investments.

Proposal Generation

Learn MoreWow clients and prospects with dynamic, compelling, and easy-to-understand investment proposals.

Orion OCIO

Learn MoreTake back time in your day and get the horsepower and team to win more — and bigger — business, faster.

Strategists

Learn MoreAccess leading strategists and get full flexibility to create well-diversified investment portfolios and make more personalized investment decisions for your clients.

Destinations Funds

Learn MoreOffer clients a complete investment solution designed to help them stay invested, implemented through asset allocation, manager selection, portfolio considerations, and construction and monitoring.

Ranked #1 TAMP forBest Technology

by America's Best TAMPs 2023.¹#1

Orion is ranked #1 for Best TAMP Technology by America’s Best TAMPs 2023.¹

#1 in BeFi

We’re the only firm with behavioral finance embedded across our full suite of technology and investment solutions, helping you deepen relationships so you can guide investors to stay the course.³

#1 CRM

We’re the only TAMP that’s fully integrated with the industry’s #1 CRM for market share.²

6.18%

Our Not in Good Order (NIGO) rate — well below industry averages.4

62.1%

The average rate of firm growth our OCIO clients have seen since partnering with us.5

46

Hours saved per high-net-worth account, per year, with Orion Custom Indexing.³

Our Investment PhilosophyEmpowering Financial Advisors and Investors

We empower financial advisors with customizable investment solutions that help investors pursue and achieve their long-term goals. Our core investment principles guide what we do every day.

Keep Investors Invested

To build wealth, capital must be invested — and stay that way.

Institutional Due Diligence

Deep, curated due diligence helps build confident portfolios.

Multi-Asset Class Approach

Build portfolios by risk-managing a blend of assets to enhance performance.

Safeguard for Tomorrow

Align investors’ needs with their goals with robust due diligence, risk management, and behavioral finance.

Free Webinar: Bolster Your Business with BeFi

Free Webinar: Bolster Your Business with BeFiGrow with Investment Management, Financial Planning,

& Behavioral FinanceWe’re the only firm with behavioral finance embedded across our full suite of technology and investment solutions, helping you deepen relationships so you can guide investors to stay the course. Watch our free webinar and meet our behavioral finance tools — the 3D Risk Profile, Protect, Live, Dream, and BeFi20 — all designed to help increase your client engagement.

Join Dr. Daniel Crosby, Chief Behavioral Officer, and Cade DeNazario Akers, CFP, Product Manager, Financial Planning, as they show you how to use these tools that are now built into the Orion technology you’re already using every day.

Downloadable ResourceYour Go-To Guide for Building Smarter Portfolios

The 2025 Orion Portfolio Solutions Cookbook is your starting point for navigating investment strategies and building well-diversified portfolios. The Cookbook features pre-designed portfolio recipes tailored to a range of client goals, such as inflation armor, all-weather, and sustainable edge, giving you a strong starting point to meet your client’s goals.

Hands-On and Here for You

Hands-On and Here for YouRobust Support at Every Step

There’s a reason we lead the industry with a 95% client retention rate and a NIGO rate of less than 2%.³ Partner with a team of investment professionals to help design, implement, and manage customized solutions for each investor.

Our support is designed to help make growing your advisory business easier — including providing a seamless onboarding experience, guidance to help you find the right investment options, the technology to streamline your tedious administrative tasks, and a dedicated, experienced team to solve your daily challenges. Grow better with the support you need to succeed.

Check This Out: Custom Indexing

Check This Out: Custom IndexingCustomize at Scale. Add Revenue. Click Once.

Manage tax-efficient, personalized portfolios at scale with the only tech-enabled solution that brings together proposal generation, trading, and reporting all in one place.

Focus On Clients.

We’ll Handle the Rest.Contact us to see how you can start spending more time with clients, streamline investment management, and gain operational efficiency.

1Source: 2023 America’s Best TAMPs – Best Technology and Best Model Market Marketplace, WealthAdvisor, 2023.

2Source: T3/Inside Information Advisor Software Survey, 2025. Orion holds the #1 market share for CRM, Portfolio Management/Reporting Tools, and Portfolio Design Solutions. Orion also ranks in the Top 3 for All-In-One Software, Trading and Rebalancing, TAMP, and Risk Intelligence.

3Source: Proprietary Orion data, as of 7/28/2023. The Net Promoter Score (NPS) is a widely-used metric for understanding customer satisfaction and loyalty. It's based on the simple question: "On a scale of 0-10, how likely are you to recommend our [product/service] to a friend or colleague?" Transactional NPS scores above 50 are generally considered excellent.

4Source: Proprietary Orion data, as of 4/1/2025. The Not In Good Order (NIGO) rate indicates the percentage of submitted client paperwork that contain errors, omissions, or other issues that prevent them from being processed efficiently or correctly.

5Source: Firm weighted average growth, Q2 2018 to Q1 2025. Data as of March 2025.Orion Portfolio Solutions (“OPS”) was selected as a winner for America’s Best TAMPs 2023 in the categories of Best Technology and Best Model Marketplace. Each TAMP (“Provider”) included in America’s Best TAMPs 2023 is based on the results presented of an independent survey of all Wealth Advisor subscribers. The methodology used for this independent survey of The Wealth Advisor’s registered subscribers was deployed on December 26th and closed on December 29, 2022. The survey uncovered advisor familiarity and overall satisfaction covering three categories set forth for the 27 of the TAMP solution providers nominated. The winners and full survey results were published in the 2023 edition of America’s Best TAMPs and released on January 3, 2023. Each TAMP provider paid the same sponsorship fee to be listed in America’s Best TAMP’s. Sponsorship fee has no tie-in or connection to survey results. The fee entitles providers to also receive marketing services from The Wealth Advisor. Providers have no affiliation with The Wealth Advisor.

Orion Portfolio Solutions, LLC, an Orion Company, is a registered investment advisor.

OCIO services offered through TownSquare Capital, LLC, an Orion Company, a Registered Investment Advisor. TownSquare Capital, LLC, is an affiliated company of Orion Portfolio Solutions, LLC.

Custom Indexing offered through Orion Portfolio Solutions, LLC a registered investment advisor.

This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation, and the particular needs of any specific person. This material does not constitute any representation as to the suitability or appropriateness of any security, financial product or instrument. There is no guarantee that investment in any program or strategy discussed herein will be profitable or will not incur loss. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended and should understand that statements regarding future prospects may not be realized. Investors should note that security values may fluctuate and that each security's price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not a guide to future performance. Individual client accounts may vary.

An investment in the Funds are subject to risks, and investors could lose money on their investment. Outcomes depend on the skill of the sub-advisers and adviser and the allocation of assets amongst them, as well as market fluctuations and industry/ economic trends, etc. There can be no assurance that the Funds will achieve their investment objectives. Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus with this and other information about the Funds, please call 877-771-7979. Read the prospectus carefully before investing.

The Destinations Funds are distributed by Foreside Fund Services, LLC.

2030-R-25210

-

-

-