They say religion, politics, and bitcoin are generally off limits in conversation, yet here I go. First off – I do NOT want to get political here by any means. Politics are, of course, important and impossible to avoid in our lives, but I would contend that keeping politics from impacting our portfolios would go a long way. Let me explain.

Let’s begin by talking about statistics. Dating back to President Ulysses S. Grant (whose name is near and dear to me), there have been a whopping total of 37 elections. Thirty. Seven. Most statisticians agree that a minimum sample size for anything to be statistically significant is 100! Let’s keep that in mind when analyzing any stats on election results and stocks.

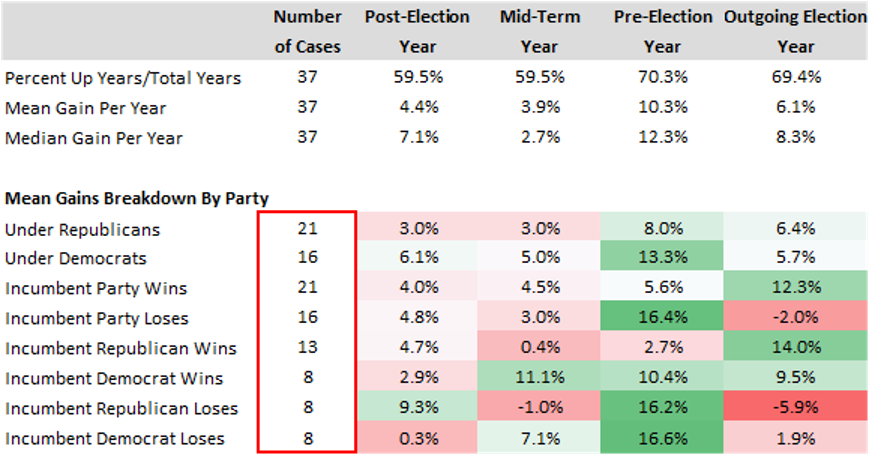

Now let’s glance at the data. First off, the markets go up 60-70% of the time, every time. I could, and maybe should, just stop writing here. There has been some significance in the year leading up to an election being stronger than others, and we saw that in 2019. Interestingly, look at the bottom two rows in the table – in years leading up to the election, markets are strongest when the incumbent party loses, regardless of party. But again, we have a whopping 16 elections worth of statistics there (I highlighted the numbers in red for effect). Even in years where it appears one party has an advantage, there tends to be underperformance during the prior or following year. Similar results are shown here and here.

Source: Ned Davis Research

There are a million and one things that affect markets, but over time, we know what direction they go – up and to the right. Help guide your clients through the noise (especially when it gets REALLY loud) so they stay focused on their long-term investment goals.

Want to learn more about preparing your clients to navigate all markets with confidence? Check out our unique process for creating well-diversified UMA portfolios by clicking here!

2549-OPS-10/5/2020

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.