I hope you had a wonderful weekend and your fantasy football team(s) are off to nice starts!

- The stock market actually had a loss on the week last week. After hitting a record high price on September 2, the S&P 500 lost ground each day last week. The 5-day losing streak is tied for the longest losing streak since February.

- All major equity styles, sectors, and market caps lost ground last week. The only asset classes that had gains were diversifiers such as commodities and bonds. The leading reason cited for weakness were concerns over COVID-19’s impact on the economy. Personally, I don’t discount that, but the market’s gains have been so steadily impressive this year, that a breather for a week (or two or three or even more) qualifies as natural and normal market behavior. Call it a pause to refresh.

- One thing I’ve been talking and writing about is how long it has been we haven’t seen a 5% correction in the market this year. In a typical market year, we see 3-4 corrections a year of 5% or more. According to Bespoke Investments, it has now been 307 days (as of last Friday) since we’ve had one. This is rare, but not unheard of. There was a long streak without a 5%+ pullback as recently as 2018, and the longest streak ever was 593 days back in the late 1950s.

- That said, we have had “rolling corrections” this year. According to Bloomberg, about 90% of Russell 2000 stocks have already fallen into a “correction” (10% loss or more). According to Morgan Stanley, the average stock in the S&P 500 is down 10% from its 52-week high. Looks like we’re already getting that pause to refresh. “You should always be expecting a 10% correction. If you’re investing in equities, you should be prepared for that at any time,” says Morgan Stanley's Chief Investment Officer Mike Wilson.

- The economic calendar wasn’t that heavy last week. Arguably the most notable number was the data on Friday showing that prices paid by producers surged last month. The Producer Price Index (PPI) increased by 0.7% last month and is now up 8.3% through August, the biggest year-on-year advance since November 2010. PPI was 7.8% in July.

- In other economic news, weekly jobless claims results last week hit another pandemic low at 310,000, pointing to continued increases in hiring and strengthening of the economy and labor force. However, job openings rose to 10.9 million as companies look to keep up with continued growth and face the consequences of “The Great Resignation”. Preliminary results of the University of Michigan’s August consumer sentiment survey will be released on Friday.

- For the year, the overall US market is up just less than 19% on the year, and up over 37% over the last 12 months. The average stock, meanwhile, is still holding a slight year-to-date (YTD) lead with a gain of just over 19% YTD, and a gain of over 53% the last 12 months.

- The best performing sector both YTD (just under 31%) and the last 12-months (over 57%) is Energy. This isn’t too much of a surprise given that Commodities are up over 24% this year and up less than 36% the last 12 months. Crude is pushing above $70/barrel this morning.

- As for the lagging sector this year for performance, it’s Consumer Defensives up just over 9%. Consumer Defensives are up over 18% in the last 12 months. These are still nice returns.

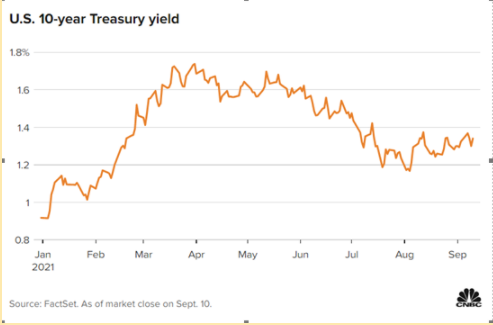

- Despite the rising inflation data last week, Ten Year Treasury Yields only gained 2 bps to 1.34% last week. Yields have been steadily moving higher of late. See the chart below from CNBC and Factset.

- Another asset class that dropped ground last week was Bitcoin. It hit a new multi-month high early in the week, then it dropped shortly thereafter. It’s opening the new week around $45k.

- Big economic numbers this week include the Consumer Price Index (CPI) on Tuesday and Retail Sales on Thursday.

- For the value investing fans, value investor GMO came out with an excellent (albeit slightly longer) piece addressing concerns that value investing has slipped back into underperformance after its epic outperformance over the prior year up until mid-June. Spoiler alert – they still like value investing!

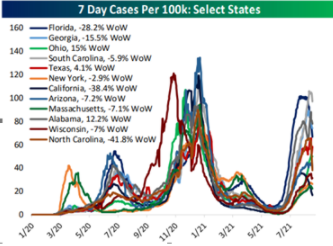

- Value started to underperform in mid-June when COVID cases started to pick up. Now, it appears that COVID cases have crested – at least in the hot spots from this summer (source: BeSpoke Investments)

- This week on Orion’s The Weighing Machine podcast, our guest is Larry Swedroe, who is clearly one of the most prolific writers and thought leaders in our profession. Larry is from Buckingham Strategic Wealth. Larry was so gracious with this interview. We talked for 90 minutes and we could have easily talked longer. It was like being in a graduate level investments course. I hope you enjoy it as much as I did.

- For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or benjamin.vaske@orion.com.

- Thanks for reading and have a great week!

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.