I hope you had an enjoyable and refreshing weekend. It was the last official summer weekend as this Wednesday is the Fall Equinox which of course marks the turning point when darkness begins to win out over daylight.

- The US stock market will open lower this morning, led by losses in Asia. The Hang Seng index, for instance, was down 4%.

- Last week was the second consecutive week in a row for a loss in the S&P 500, though the index entering the week is still only 3% off its all-time highs reached on September 2. That said, we might just have our first 5% correction in the S&P since last October this morning.

- Last week was a busy week for news flow, as there was increased talk of Fed tapering of asset purchases and a lot going on in Washington (bipartisan infrastructure packing, tax talk, Fed Chair reappointment chatter, debt ceiling/potential government shutdown, etc.). SpaceX also successfully completed the mission of launching four civilians into space last week. That’s another exciting milestone flight for private space travel.

- The strongest parts of the stock market were the Energy and Materials sectors, as both gained as did Commodities. Small cap value also posted a gain last week. Energy is now up nearly 35% YTD.

- These gains are a bit surprising, given that each tends to do relatively well in reflationary environments, despite last week the Consumer Price Index (CPI) “only” increased 0.3% in August, slightly below the consensus expected 0.4%. The CPI is up 5.3% from a year ago.

- Last week Ten Year Treasury Yields also continued to drift higher, closing up another 3 bpts to 1.37% last week. Yields bottomed on August 4 at 1.12%. Yields are currently at 1.31%.

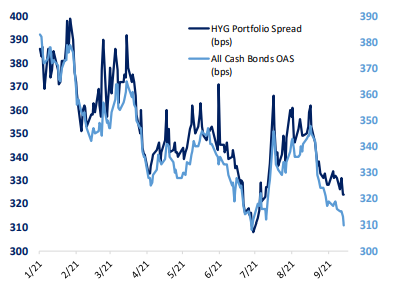

- Speaking of bonds, high-yield bond spreads (i.e, the difference between high-yield bond yields and Treasury bond yields of the same maturity) continue to move lower and are now approaching the year’s lows. I’ll admit, I was a tad concerned several weeks ago about the rise in corporate yield spreads over the last few months, as rising corporate bond spreads tend to be a leading indicator of stock market weakness. These spreads were basically following the growth scare that accompanied the COVID case counts, but once the light at the end of the tunnel for the latest COVID scare started to appear, the spreads started to contract again (chart from Bespoke Investments). Here again is a nice weekly resource on COVID COVID-19 Tracker (ftportfolios.com).

- Here’s another positive for the market. As many of you may know, I’m a big fan of investor sentiment data. Not only do I believe it’s valid input into investment decision-making, but it also may help inform what advisors should be communicating to investors in an effort to keep investors balanced and staying on course. In short, sentiment tends to be a contrarian indicator. When investors are really bullish, for instance, that’s typically an indicator of below-average returns in the following months. And vice versa. When investors are really bearish, that’s typically an indicator of above average returns in the following months. Well, according to the last week’s AAII Weekly Sentiment Survey , bullish sentiment plunged from 39% down to 22% this week (lowest level since June 2020) while bearish sentiment surged from 27% up to 39% (highest level since last October). Bottom line, that tends to be a bullish indicator for potential market gains in the months ahead.

- Speaking of sentiment, here’s a fascinating chart from the latest Bank of America Global Fund Manager Survey. In short, the number of professional money managers who think the economy will get stronger has plummeted. Yet, notice that the percentage of investors who remain overweight stocks remains near 13-year highs. What will give? Will the economy surprise to the upside or will portfolio managers reduce equity exposure? I’d bet on the former, especially with COVID rates rolling over.

- Here’s another chart from the same BOFA Global Fund Manager Survey. Speaking of expectations, professional investors are also thinking that inflation will start to move lower.

- Perhaps a driver of some of the sentiment surveys above is the seasonal factor that risk assets tend to underperform in September. But as the fairly short Weekly RenMac Podcast said late last week, the typically weak September is followed by a fourth quarter that is generally very strong for the stock market, especially more cyclical fare (like small caps or value stocks generally).

- Speaking of seasonals, here’s a fascinating stat on Bitcoin from Eaglebrook Advisors Weekly Commentary: Bitcoin has declined an average of 10.4% in September for the last four years… While not unusual for risk assets to experience profit-taking and rotation in preparation for Q4, this year had catalysts such as El Salvador speedbumps, the failure to hold $50,000, and potential tapering as near-term firepower for bitcoin bears. While September often struggles, the month also provides an opportunity for long-term investors to gain exposure. October, November, and December have averaged 23.7%, 6.0%, 25.2% in the last five years.

- Bitcoin currently has a slight loss on the month, with prices currently at $43k.

- The economic calendar this coming week primarily includes an FOMC conference with Fed Chair Jerome Powell on Wednesday afternoon, we expect some discussion about the Fed Tapering. Also look out for all the SAAR data around building, housing, and household net worth, and nonfinancial debt levels for August.

- Here’s a Big Number for you. Does health-care sticker shock ever fade? The latest cost estimate for a year’s worth of long-term care is nearly $70,000. The same price as a shiny, European sports car. That’s the focus of Horizon Investment's Big Number Report.

- Did you know? According to Congress Asset Management, dealmaking is on pace to potentially break records set in 2015. Mid-caps have historically benefited from this.

- Last week’s Weighing Machine guest Larry Swedroe just published "Suckers at the Investment Table". In short, new research confirms that institutional investors, such as mutual funds, outperform the market before fees, and they do so at the expense of retail investors. The article is loaded with links to various research studies.

- This week on Orion’s The Weighing Machine podcast, our guest is Glenn Dorsey from Clark Capital Management in Philadelphia. Glenn is a senior Client Portfolio Manager at Clark. Client PMs are worth their weight in gold and Glenn’s been a Client PM a long time. If you want to hear what a client PM does, and what Clark Capital is currently thinking about the markets and how their repositioning portfolios, check this podcast out.

- Starting this week, I would like to close out this comment with a picture of “Awesome”. Given that there is so much negative news in the media that we all have to deal with both personally and professionally, it seems a nice reminder that there is so much awesome in the world. In the spirit of space given the exciting space travel news of last week, here’s a picture of Orion Nebula. Awesome, huh?

- For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or benjamin.vaske@orion.com.

- Thanks for reading and have a great week!

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.