Happy Monday! Can you believe after last Monday – which was the worst single-day loss in months, causing the first 5% correction off the S&P’s highs since last October, and the catalyst for many to think a bear market was imminent -- that last week ended up being another positive week for the US stock market?

- There was plenty of bad news last week to push prices lower, including concerns from the China debt crisis around the Evergrande real estate giant to the Federal Reserve’s signal to start turning down its liquidity spigot, to China’s crackdown on cryptocurrencies. Nonetheless, the major TV benchmarks managed to wipe out steep losses earlier in the week and eke out small gains. The Dow Jones Industrials finished the week 0.6% higher, breaking a three-week losing streak, the S&P 500 rose 0.5% on the week and the Nasdaq Composite eked out a 0.02% gain last week.

- Still, it’s September, which is notoriously on average the weakest month of the year for the US stock market. As of last Friday, the S&P 500 is off by 1.5% for the month, which could be its first negative month since January. The index is about 2% off its record high from September 2.

- There is an active economic calendar (but note the employment data that is usually released on the first Friday of each month will be next week on October 8), but I would expect the news flows will more likely follow the progress in Washington D.C. regarding the potential of a government shutdown, a default on U.S. debt, and the fate of President Biden’s economic agenda.

- Last week Ten Year Treasury Yields moved notably higher, closing up another 10 basis points to 1.47% - July 1 was the last time the 10-year yield was this high. Yields bottomed on August 4 at 1.12%. As of this writing, yields are now at 1.49%.

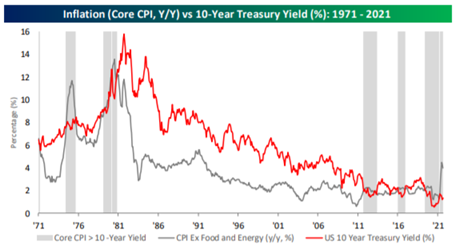

- Could yields go even higher? Perhaps. According to the below chart from Bespoke Investments, it’s rare that 10-year Treasury yields are ever below inflation (as measured by core CPI). And when they are, yields tend to rise.

- As you may know, I’m a fan of the research firm RenMac’s work. They had one interesting blurb last week saying: “Yields breaking out thru 1.40% is the biggest story of the month as it sets into motion plenty of sector/styles and factors”. In short, rising rates suggest that market leadership could shift back toward cyclical stocks, including small caps and sectors such as Energy and Financials. For the more analytical, a good short (usually less than 15 minutes) weekly economic/market podcast that comes out Friday afternoons just in time to load up on the podcast queue before weekend yard work is the RenMac Weekly Podcast.

- Speaking of rising interest rates, there was some interesting research from well-known Wall Street analyst and quant money manager Richard Bernstein last week on extreme valuations for interest-rate sensitive stocks. (Hat tip to The Felder Report for this chart). In short, it is suggesting that growth stocks are expensive and vulnerable to rising inflation/interest rates. This is a good argument to diversify growth-heavy equity portfolios!

- If the aforementioned work from RenMac and Richard Bernstein is correct, that should be a tailwind for the average investment strategy on the Orion Portfolio Solutions platform. More research from last week that would also fortify the aforementioned work is from Research Affiliates and their well-known founder Rob Arnott. In short, in their 20-minute read Research Affiliates Research Report they talk about how from January 2007 to September 2020, the relative valuation of value moved from the most expensive quartile to the cheapest percentile in history and how this valuation change explains more than 100% of value’s underperformance during this time frame (my emphasis added). Bottom line, the Research Affiliates conclusion was this:

- When most liquid asset classes are set to deliver a negative or near-zero real return, value stocks stand out as the only asset class likely to generate a 5%–10% real return over the coming decade. The opportunity to buy value stocks may be short-lived and we may wait decades for an opportunity of a similar scale.

- Cryptocurrencies had a lot of bad news last week, including both public speeches and rumored investigations. The Securities and Exchange Commission is cracking down on crypto projects it views as unregistered securities offerings in the United States. In my opinion, it is not likely that any crackdown will include major digital assets like Bitcoin or Ethereum, but “yield-farming” projects (often called DeFi) are probably at risk. Despite all this bad news, Bitcoin prices are actually up over the last week! As of this writing, Bitcoin is at $44k. Ethereum is just under $3100.

- Here’s a Big Number for you - 41%. That’s the percentage of GenXers who say they think it will "take a miracle" to have a secure retirement. Horizon Investment's Big Number Report continues its exploration of the insecurity some people feel about retirement and how goals-based planning can help.

- Again, I know some of you are fans of James Clear’s book Atomic Habits. In my opinion, his weekly email is worth the free signup and the minute it takes to read. Here’s one saying from last week that applies to investing and living!

- "Always leave room for the unexpected. A buffer of time, a little extra money, a reserve of goodwill. You won't be maximizing every opportunity or squeezing out every last dollar, but what you lose in reward, you gain in safety. Survival is the highest return of all."

- This week on Orion’s The Weighing Machine podcast, our guest is Suzanne Daly from Fidelity Investments in Boston. Suzi was a speaker at Ascent, and she was walking on sunshine (her walk-up song) talking about Holistic Wealth Planning and Outsourcing Money Management.

- Here’s an “Awesome” picture for this week. An early morning picture at Glacier National Park from this past summer. If you like Glacier or hiking or both, you might like this 15-minute video: Chip and Skip's Excellent Adventure 10.0.

- For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or benjamin.vaske@orion.com.

- Thanks for reading and have a great week!

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.