- What a week. The S&P 500 Index closed at another record high Friday, with a 7-day streak of positive returns to start November. The overall US market gained more than 2% last week.

- Notably, small cap stocks exploded to new highs. Small caps were up over 5% last week with small cap value up nearly 6%.

- Over the past year now, the average stock in the US market is up a whopping 55%. The overall market is up 36%. This outperformance by smaller companies has been a nice tailwind for many active managers.

- Also notable is that “the work from home” trade is faltering, led lower by names like Peloton and Zoom. Many of those stocks are well off their price highs.

- Weekend news included digital assets approaching or hitting new highs (depending on the asset), Chinese exports surging over 27% in October as compared to a year ago (above expectations and a nice counter to recent Chinese growth concerns). Elon Musk tweeted a poll asking if he should sell 10% of his stock as a response to political pressure of unrealized gains. According to Old Mission Capital’s morning read, 58% of the respondents said yes - the stock is down more than 5%.

- The big news item last week was the Fed announcing that asset purchases would be trimmed by $15B in November and December, and then by an undetermined as of yet pace after that (most still expect it to be $15B in the absence of some developments either in the economy or financial conditions). This puts the Fed on pace to have a static balance sheet by the middle of 2022, at which point many are now thinking is when the Fed could start raising short-term interest rates.

- Let’s talk earnings because we’re nearing the end of another solid earnings season. In short, according to Bespoke Investments, with earning expectations still rising, the next 12-month EPS forecasts now top pre-COVID peaks by 25%! Given strong earnings, coupled with low interest rates, it makes sense that stock prices are racing higher. As for more meat on earnings season, the current earnings beat rate (companies where actual earnings are higher than expected earnings) is 74%. This compares to the long-term average EPS beat rate of around 67%. Revenue beat rates meanwhile are 68%, which compares to the long-term average of 59%.

- Bottom line, it’s been a great year to be an investor, and we’re likely on track for a strong quarter to finish this year. Something to keep in mind for next year though is that liquidity conditions won’t be as strong as they have been since monetary policy, fiscal policy, and personal income growth have all peaked.

- The big economic number last week was non-farm payrolls on Friday. It was a solid number. Nonfarm payrolls increased 531,000 in October, beating the consensus expected 450,000. There were revisions for the two prior months. The unemployment rate dropped to 4.6% in October from 4.8% in September. Also notable was that average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.4% in October and are up 4.9% versus a year ago.

- Another big number was the non-manufacturing ISM survey of supply managers. In short, it had its best number since the survey started in 1997. The data could suggest that overheating is more likely than stagflation. Supply delays are the second-highest in the survey’s history, behind only the month of Hurricane Katrina in 2005, and the index of prices paid is also the second-highest.

- I was at the Tiburon Conference in Dallas last week. So many tidbits, some of which I’ll share in the weeks ahead. Two hot topics were ESG Investing (ESG Investing - Look for Progress Not Perfection) and digital assets.

- Ten Year Treasury Yields dropped again last week, falling another 11 basis points to close at 1.45%, its lowest level since September 22,2021.

- Bitcoin prices were slightly lower last week, and with quite frankly less price volatility than usual, closing around $61,000. They are off to a nice start this week though, currently at $65,000. Ethereum continues to push to new highs, now at $4700.

- On the topic of digital assets, here’s a hot podcast that I’ve heard referred to several times by investment professionals NOT currently involved in crypto. It’s the Tim Ferris podcast with Chris Dixon and Naval Ravikant (Naval, by the way, is simply fascinating to listen to) on the Wonders of Web 3.0, the potential of NFTs, and so much more. Warning: it’s over two hours long.

- This week’s economic schedule is active again with the highlight (lowlight?) being the Consumer Price Index for October on Wednesday. The consensus is for a 0.6% increase in CPI and a 0.4% increase in core CPI.

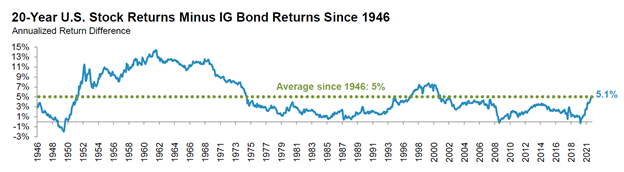

- On the Weighing Machine this week (publication several weeks from now), I’m interviewing Fidelity’s SVP of Asset Allocation Dirk Hofschire. Fido published their recent quarterly outlook, plus a white paper on global debt. Both are loaded with provocative nuggets. One cool chart was this rolling 20-year return comparison between bonds and stocks (below). Quite frankly, it’s fascinating in multiple ways. The easiest answer is that stocks rule, bonds drool for long-term investors. This difference is likely to widen even more given financial repression.

- For more on interest rates, here’s a great chart of 200 years of interest rates in the U.S.

- Speaking of Orion’s The Weighing Machine, this week’s guest will be Simeon Hyman from ProShares. He will be talking about Bitcoin and the ETF BITO.

- It’s growing. At nearly 40 songs, here is the updated The Weighing Machine Spotify Playlist. Of course, this list includes my preferred walk-up song Radiohead's "I Might Be Wrong", which by the way was on the new Radiohead album release from last Friday. Here is the Pitchfork Review of Kid A-mnesia. IMO, Pitchfork is simply the best at music reviews. They are snobs though – not every band gets reviewed.

- Here’s an “Awesome” picture for this week from my trip to Dallas. This picture might be a few weeks early for Thanksgiving, but how about the Chapel of Thanksgiving in Thanksgiving Square?

- For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com.

- Thanks for reading and have a great week!

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.