2022 remains a tumultuous year for global markets. While the initial market shakiness resulting from the shock of Russia’s invasion of Ukraine has subsided, we now enter a new reality.

Russia is facing sanctions from all across the Western world. As they become more and more economically isolated, what does that mean for our global community? Is the era of globalization over? Are we heading into a second Cold War era? And where will China land in all of this?

That’s what we explored in our most recent War Room. Here are the top five takeaways from our discussion.

1. Is this the end of globalization?

The West imposed stringent sanctions on Russia in record time. While we see their impacts within Russia–in the forms of long lines for consumer goods and other headaches for Russian citizens–it’s unclear if the sanctions will be able to halt the Putin war machine.

While the outcome is uncertain, we’ve already felt the decoupling of Russia from the rest of the world. The big question that remains is whether China will side with Russia. Given China’s ties with American big tech, both as producers and consumers of products, it seems unlikely.

With a significant election coming up for Chinese President Xi Jinping, he is in a precarious position. Further isolating China from the West could be an unpopular move that would cost him the presidency.

2. For India and China, it’s all about getting the best deal.

That doesn’t mean China won’t jump at the chance to get cheap oil from Russia. As Europe and the US cut ties with Russia–one of the top three oil-producing countries–Russia will look for somewhere else to sell their oil.

China and India already purchase oil from Iran. If Russia offers them a good deal, they’re unlikely to turn it down, even if the US frowns on that decision.

3. Energy independence doesn’t cost more.

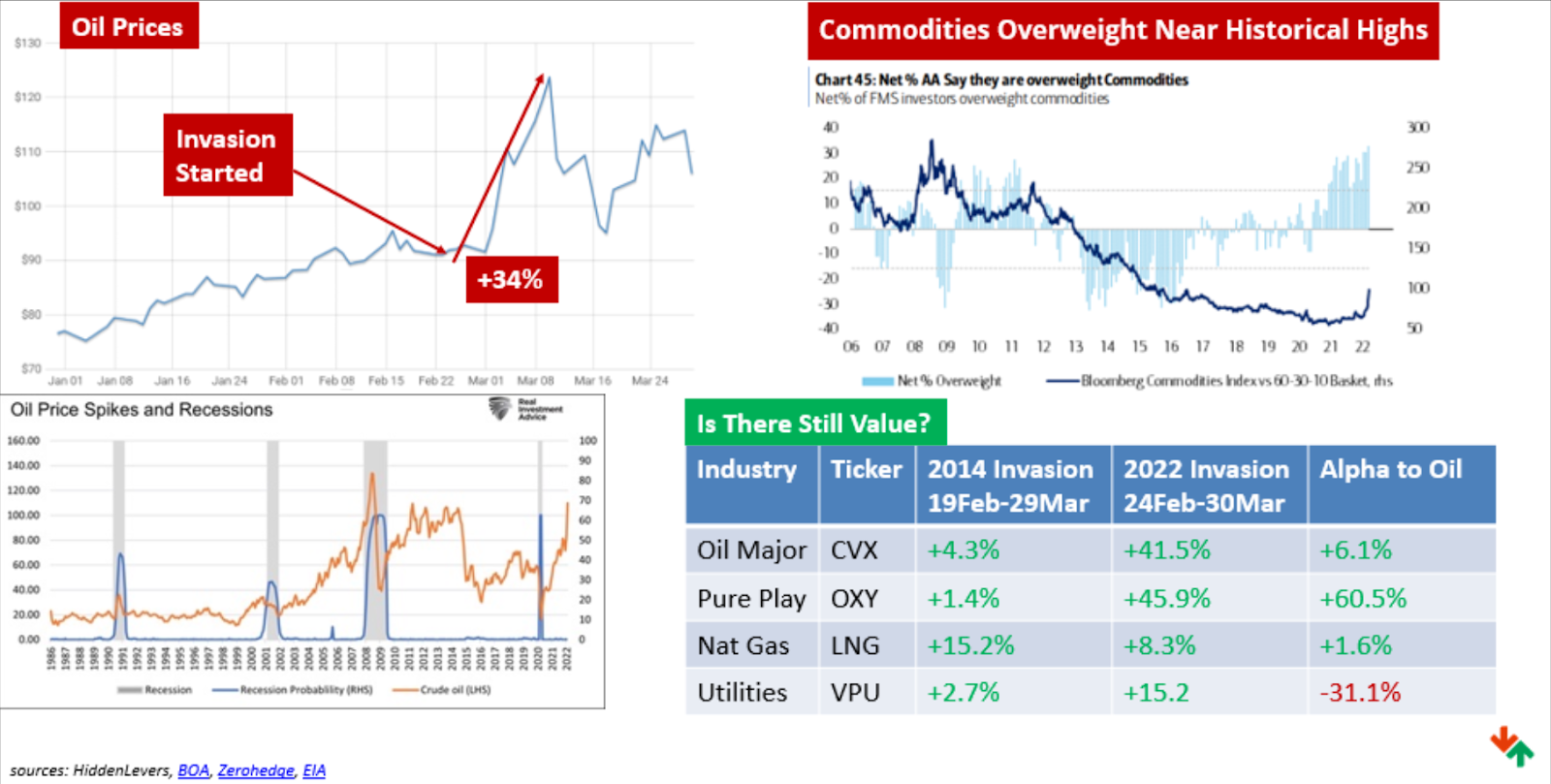

Although the global community’s loss of one of the major oil producers sounds like a significant problem at face value, the markets tell a different story.

Oil majors–companies like Chevron, Shell, and ExxonMobil–who manage the entire supply chain, have actually seen stocks rise since Russia’s invasion. Pure play organizations, who just drill, and natural gas exporters are also doing just fine.

Why are we seeing pure plays and majors outperform the commodity? Domestic oil producers who rely, at least in part, on fracking are producing oil at a low cost and reaping the benefits of selling at north of $100 a barrel.

4. Volatility will continue as long as the conflict lasts.

As the war draws on, we can expect to see continuing volatility. Putin surprised us with the invasion, and the markets responded in kind. Some twists and turns in the course of the war will likely add more volatility to the global economy.

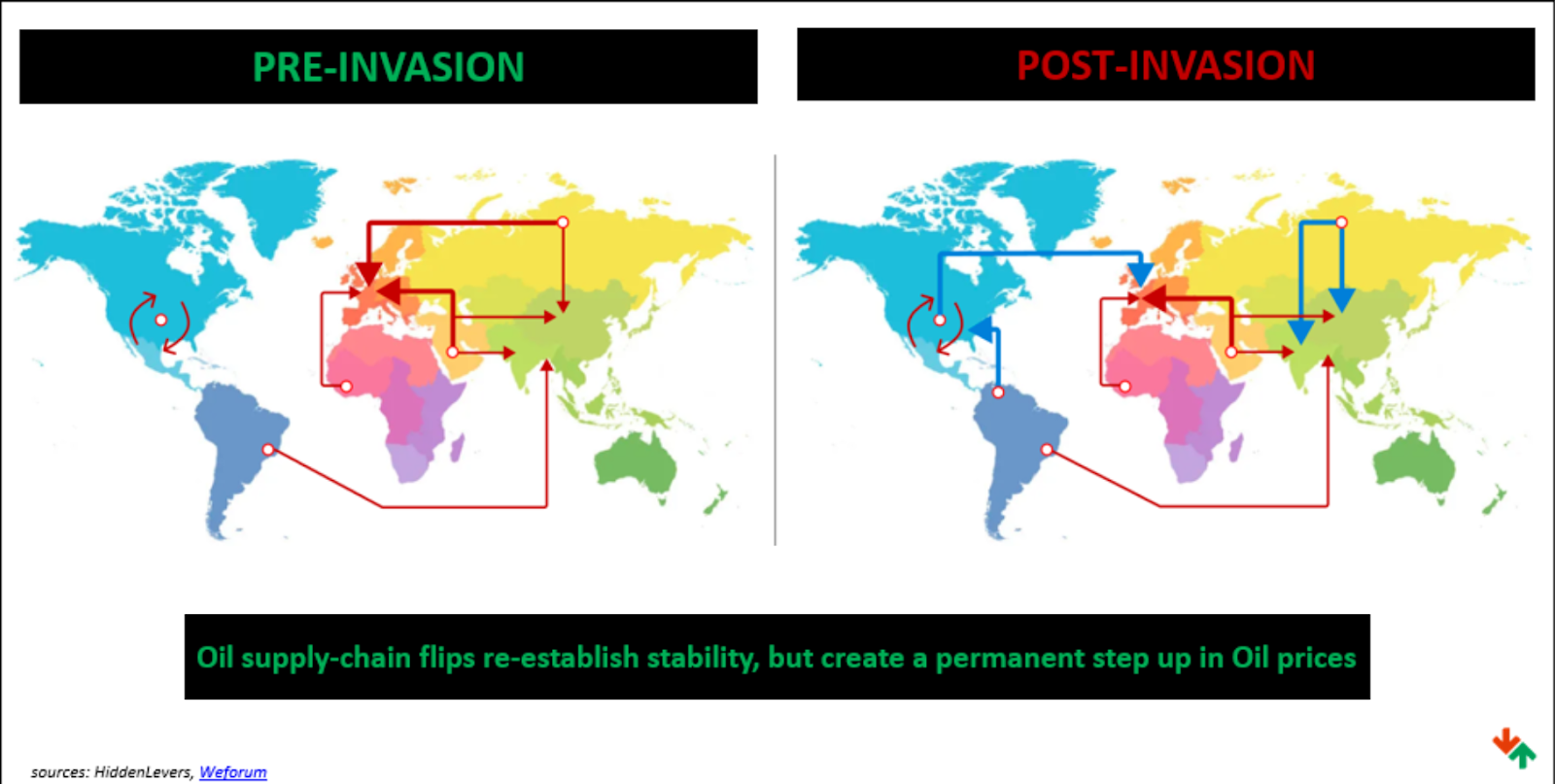

Even after the conflict ends, we may see permanent shifts in the global energy market. In addition to supplying its own oil, the US will provide energy to Europe. Russian oil will be redirected to China and India. Venezuela and Iran may even reenter the global energy space.

5. The good, baseline, and ugly.

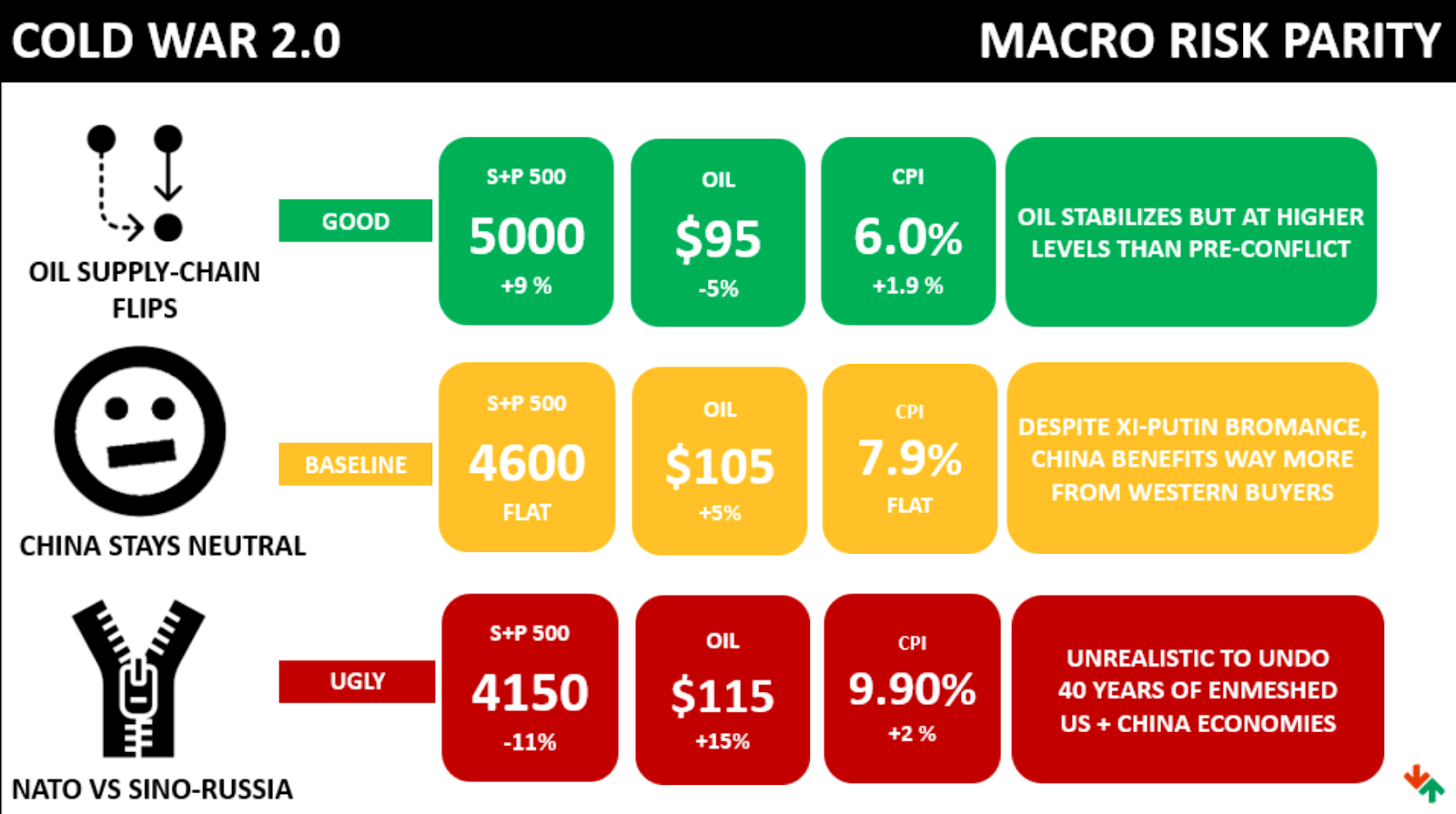

As always, we’ve identified three potential outcomes for this Cold War 2.0 scenario–good, baseline, and ugly.

In the good outcome, the oil supply chain simply flips. The US supplies Europe, Russia supplies India and China, and Venezuela and Iran re-enter global markets and pick up any slack in the West.

Redirecting US oil to Europe presents opportunities to invest in infrastructure for that delivery, but it also means we can expect to see a more permanent increase in oil prices.

In the baseline scenario, China resists drawing a new Iron Curtain. While they turn to Russia for cheap energy, they are hesitant to ally with them entirely. They rely too heavily on their relationship with the West, particularly the US, to isolate themselves.

In the ugly scenario, we see NATO powers square off against a Sino-Russia faction. China, which has already isolated itself from the West culturally, digs its heels in further. The Western private sector “cancels” China, regardless of the US administration’s response, and the US and Chinese economies split.

Much remains uncertain as the world feels the ripple effects of Russia’s invasion. HiddenLevers continuously updates its scenario library to incorporate the latest relevant shifts. Check in as the conflict continues to unfold.

Learn how the dynamic fintech combination of HiddenLevers and ORION can help you better serve your clients.

Access to the services presented is provided solely as a service to financial advisors. HiddenLevers does not make recommendations or determine the suitability of any security or strategy. Past performance of a security or strategy does not guarantee future results. HiddenLevers research and tools are provided for informational purposes only. While the information is deemed reliable, HiddenLevers does not guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with respect to the results to be obtained from its use.

0567-OAT-4/5/2022