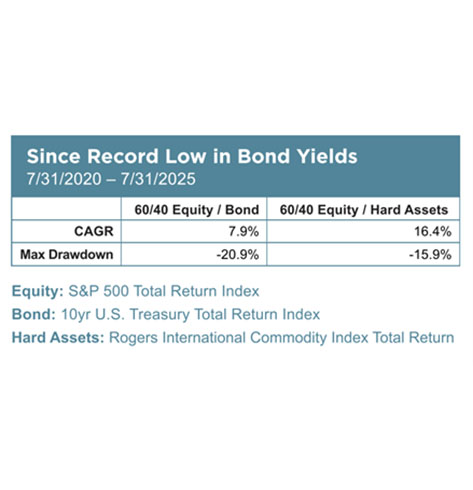

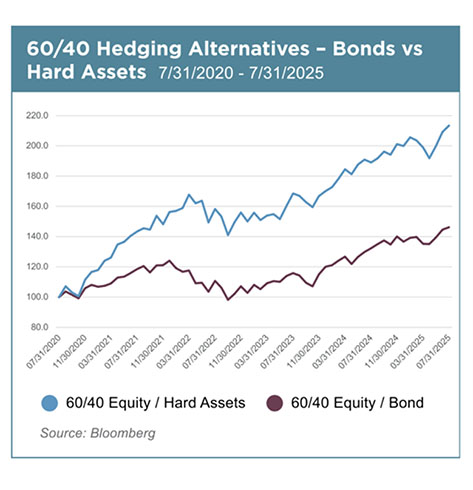

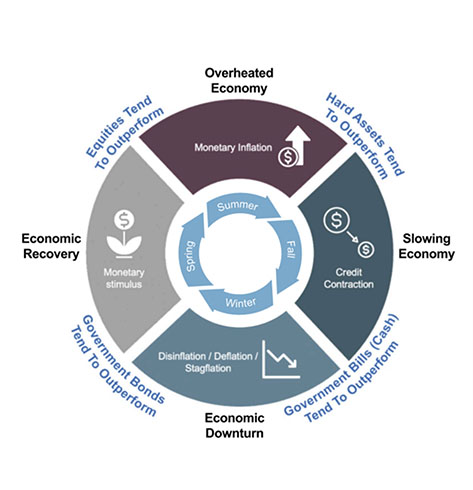

For decades, 60/40 portfolios (60% Equities/40% Bonds) have been a standard blueprint for investors and financial advisors. But rising deficits, trade tensions, and persistent inflation are testing the reliability of bonds as a complement to equities. We believe the market and economic environment favor Hard Assets over Bonds as an effective complement to an Equity portfolio today and for the foreseeable future.

While Equities have outperformed other major asset classes over the long run, an all-equity portfolio behaves with an unacceptable level of volatility and risk of loss for all but the most intrepid of investors. Consequently, investors and their advisors seek an effective complement to the Equity portion of their portfolio to manage risk and potentially lessen the probability of a major drawdown.

The 60/40 Portfolio

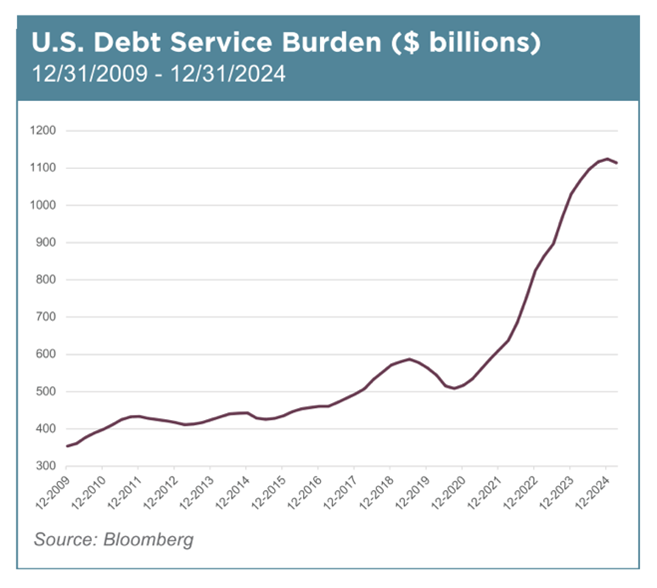

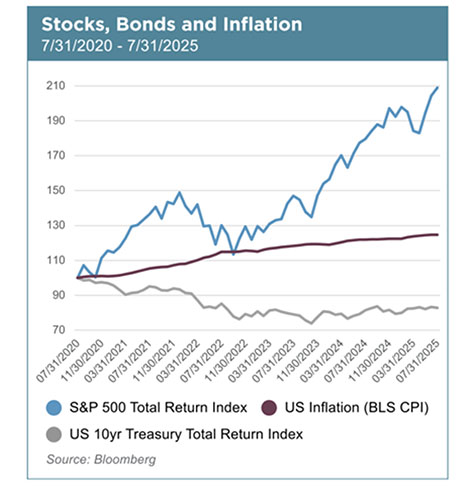

A solution that has enjoyed widespread adoption since the early 1980s has been the so-called 60/40 portfolio (60% Equities / 40% Bonds). The idea behind this strategy is that while Equities are likely to generate higher returns over time, the Bond portion of the portfolio is meant to dampen overall volatility and large drawdowns. It is no surprise that 60/40 portfolios became highly popular starting in the 1980s. The early 1980s marked the beginning of the greatest bull market in Bonds in U.S. history that lasted until the summer of 2020, with 10-year U.S. Treasury Bond yields falling from over 15.8% in September 1981 to 0.5% in July 2020. As a result, Bond holders enjoyed large capital gains during this period along with high interest income during much of the period. When Equities would correct under the threat of an economic slowdown, Bond yields would typically decline more than normal, contributing capital gains to the 60/40 portfolio that at least partially offset losses from Equities.

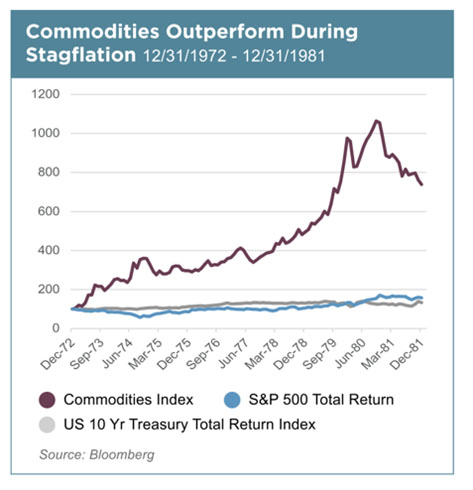

Since July 2020, the Bond portion of the 60/40 portfolio has no longer served as an effective complement to the equity portion, yet many investors haven t recognized that the very conditions that supported Bonds from 1981 through 2020 no longer exist. All too often, investors stick with practices that worked in their past and fail to recognize that the drivers for success of a past strategy are no longer present. In fact, one of the worst environments for a 60/40 portfolio would be a 1970s-style stagflation rising inflation coupled with a weakening economy. Rising inflation typically leads to capital losses from Bond holdings while a weakening economy typically leads to a stock market correction, leaving a 60/40 portfolio defenseless.