Over the last few years, the US housing market has defied expectations as prices, helped by constrained supply, have remained resilient—despite high mortgage rates and affordability challenges for homebuyers. But the outlook appears to be darkening, with recent headlines seizing on potentially adverse trends. We think these fears are overblown, as market fundamentals suggest a more nuanced and less fraught outlook than headlines imply.

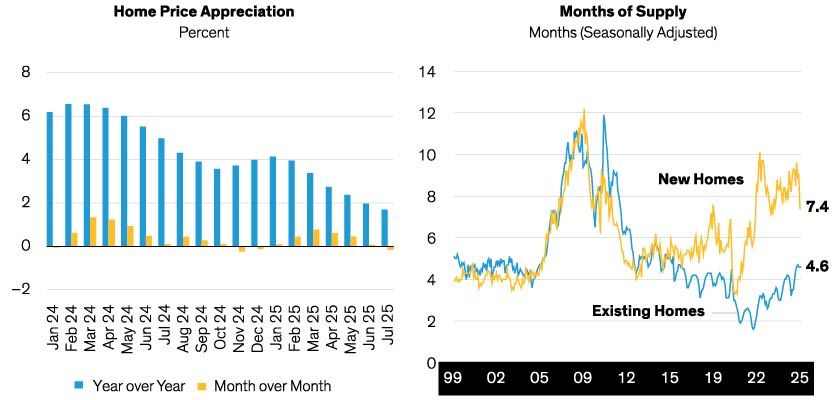

We regard signs of slowing home-price appreciation (Display, left) and an increase in supply (Display, right) as noteworthy but expect their impact to be muted and that home prices at a national level will remain flat to slightly positive over the coming year.