A clear theme stands out from this earnings season: Operating leverage is stronger than expected, with companies posting healthy revenue growth while keeping expense growth in check. This productivity dynamic is boosting margins and supporting continued earnings growth despite tariff pressures and rising costs.

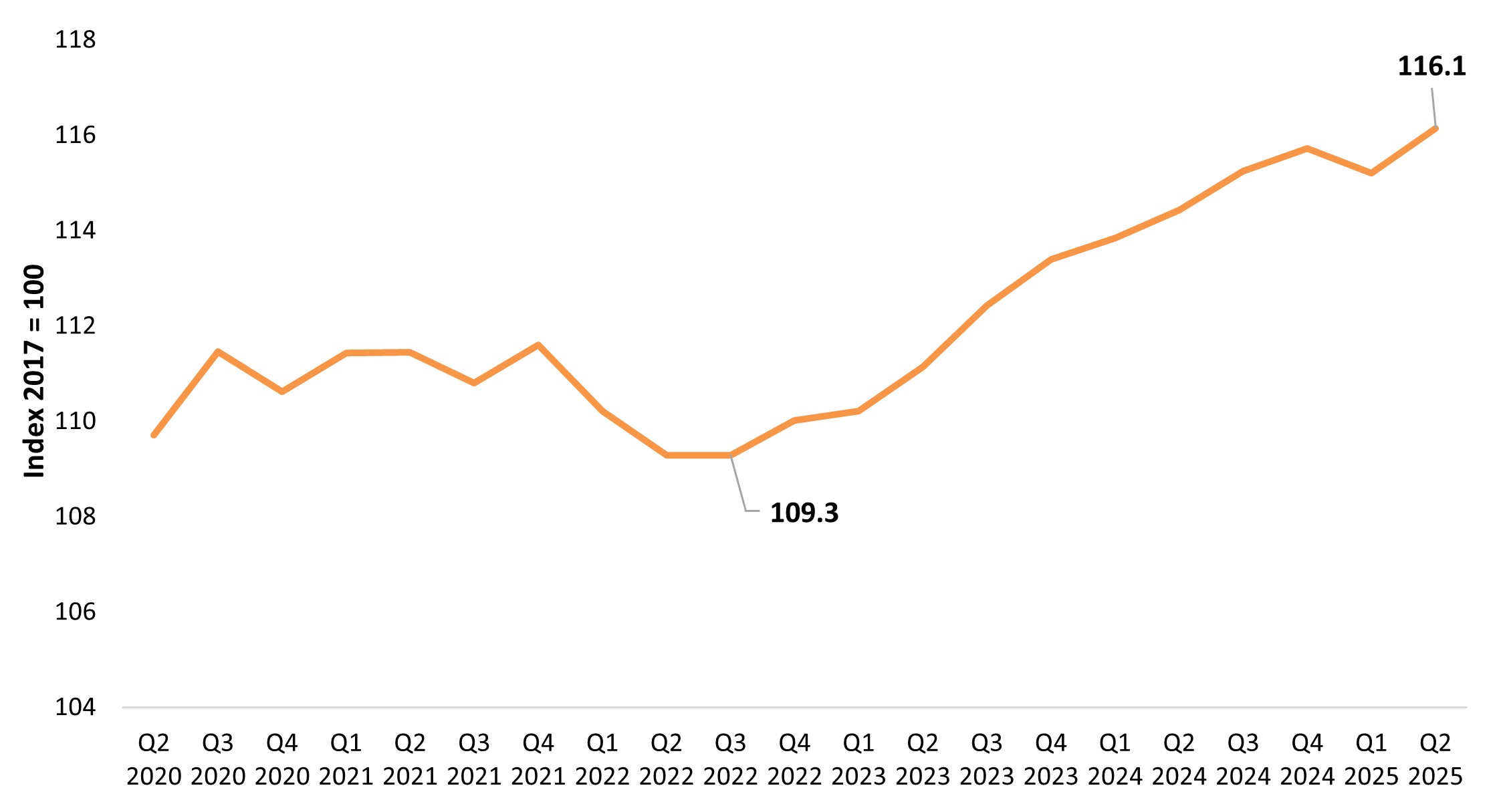

The productivity tailwind is increasingly evident in companies’ earnings results. The S&P 500® Index’s net profit margin reached 12.3% in the second quarter, above both last year’s 12.2% and the five-year average of 11.8%. This marks the fifth straight quarter with margins above 12%, with consensus estimates projecting further increases through year end.1

Three sectors stand out with year-over-year margin improvements: Communication Services, Information Technology, and Financials. These gains reflect where companies can best leverage technology to improve operations, and it appears years of heavy technology spending are now paying off.

Tech and internet firms exemplify this trend. After investing heavily in digital tools and software capabilities, these firms streamlined operations and reduced headcounts. Now they’re realizing the benefits through lower sales, marketing, and research costs while maintaining – or growing – revenues.