You want your clients’ families to one day become your clients as well, but 80% of heirs leave their families’ advisors.1

An opportunity too big to pass up

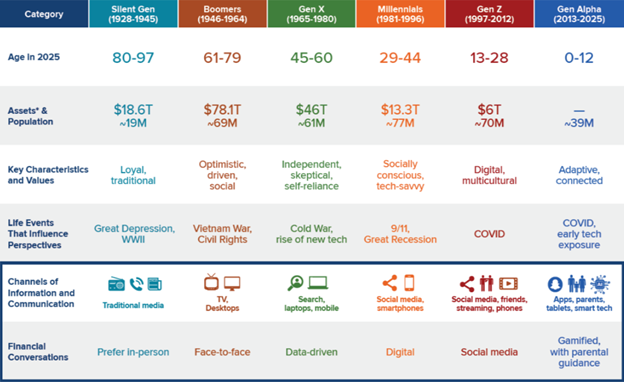

It can be a complex challenge to establish relationships with client family members. However, it’s a challenge that isn’t just about client retention but growth. Millennials and Gen-X are expected to inherit $73 trillion between 2021 and 2045 and $16 trillion of that could be within the next decade.2

Here’s the good news: Many heirs can be open to meeting with advisors. One study showed that 87%3 of heirs plan to meet an advisor when they inherit. The same research showed that the openness to meet with an advisor is over 50% if the heir has a relationship with the advisor as an adult, but it’s much higher if the relationship is established first as a teen.4 At minimum, experts say to be sure to engage with family members at least five years before a possible wealth transfer.

Regardless of when you start, you need to know your audience if you want them to be your clients one day. Watch Ocean Park Asset Management’s webcast, “Building the Whole Family Relationship,” to learn about practical steps you can take to help establish your advisor role with your clients’ heirs. To start, let’s share some highlights from the webcast.