Are your client portfolios prepared for the next market selloff?

A sharp market selloff can come out of the blue.

It’s easy not to think about that when the market’s in an uptrend. However, the tariff-driven market plunge in April 2025 is just one recent reminder. In addition to the April selloff, four of the top 10 largest market drawdowns since 1927 have occurred after the year 2000.

We believe major market declines happen frequently enough to be an expected part of your clients’ long-term investment horizon.

Assessing Portfolio Risk with Five Questions

The time to explore hidden risks in your client portfolios is before a market selloff and not during one. A quick risk audit is a good first step. You may find that slight portfolio shifts are all that are required to help improve portfolio risk management.

Five key questions that an advisor should include in their risk audit:

- Is your sell discipline well defined, consistent and successful?

- When volatility spikes, how much of your portfolios can you shift into cash or other defensive positions before misaligning risk profiles?

- Are there underperforming investment managers that you should switch but haven’t?

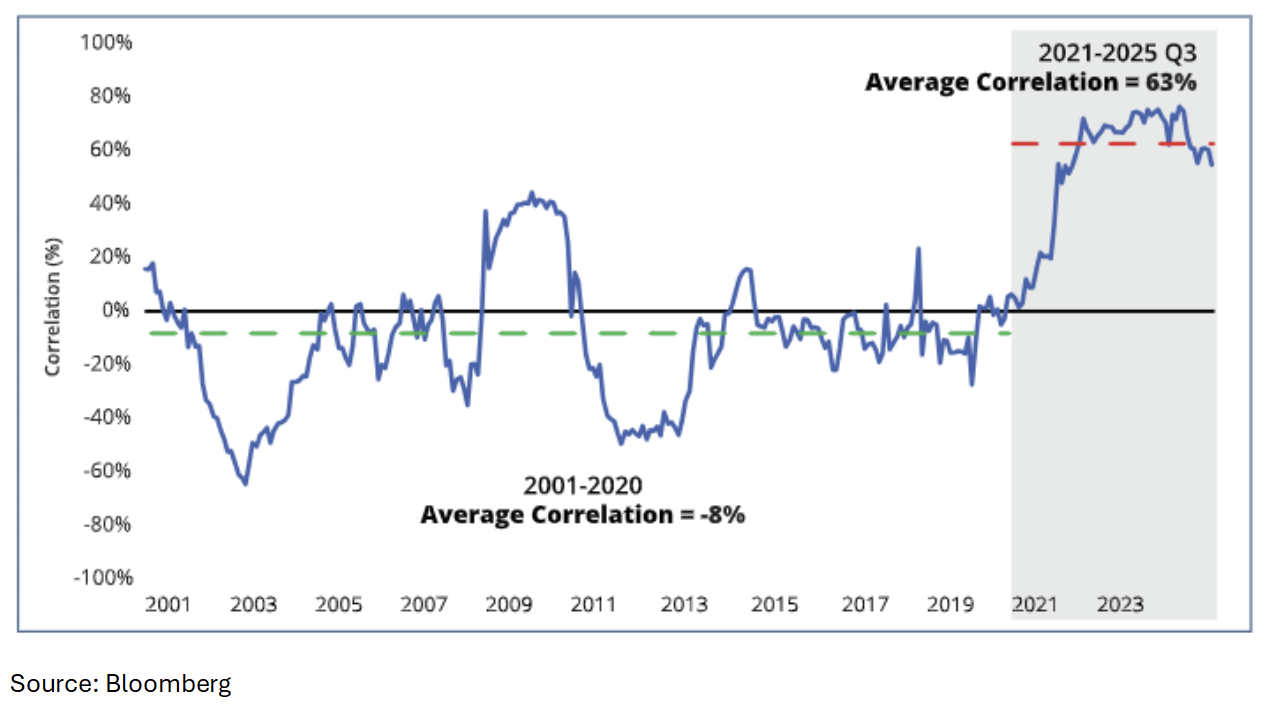

- Have you done a correlation analysis among portfolio allocations and exposures?

- How concentrated are your portfolios – by sector, asset class or manager – and what happens if those areas face pressure?