On July 4th President Trump signed into law the “One Big Beautiful Bill Act” following a series of revisions in both chambers of Congress. The 870-page document is far from an easy read! We picked out the provisions in the bill that, we think, should matter most to investors.

At a high level, the bill can be described as an extension of the Tax Cuts and Jobs Act of 2017, with some additional spending initiatives added in. The tax cuts from eight years ago were set to expire at the end of 2025, spurring urgency for Republicans to accelerate the Trump administration’s agenda. The price tag of the bill is forecast to cost an estimated $3 - $4 trillion spread out over 10 years, with the primary benefits intended to fuel economic growth.

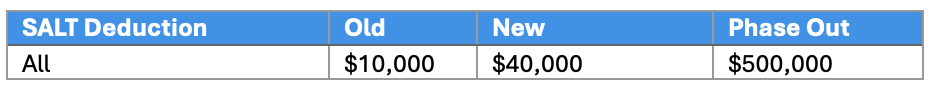

Budget hawks on both sides of the aisle scrutinized the bill for months in the House and the Senate, weighing the economic pros against the ever-growing national debt. Cuts to Medicaid, the increase to the state and local tax (SALT) deduction limit, and the debt increase proved to be the most divisive issues for elected officials. While the One Big Beautiful Bill is far from perfect, there’s still a lot to like from a Wall Street perspective.

A Net Positive for Wall Street:

- Broad tax hike averted by extending 2017 tax cuts / brackets.

- Tax cuts and spending incentives are immediate; spending cuts are back-end-loaded.

- Workers earning tips and overtime get a tax break (with some qualifiers).

- The state and local tax (SALT) deduction gets a meaningful bump (probably the biggest policy hurdle Republicans had to clear).

- Americans over 65 will pay less tax (ties back to “No Tax on Social Security” pledge, with some qualifiers).

- A regulatory boost for energy industry.

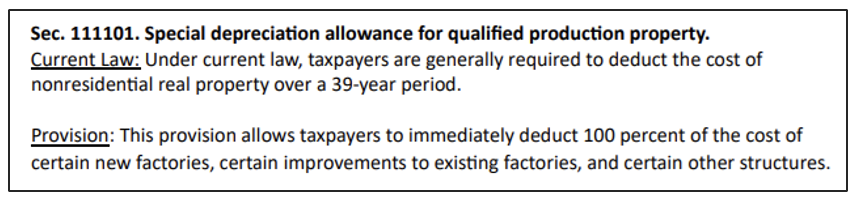

- Domestic manufacturers are incented to spend (depreciation and amortization treatment).

- Uncertainty around the bill is alleviated.

A Few Tax Provisions Stand Out:

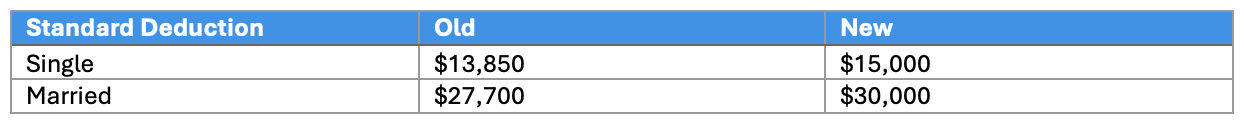

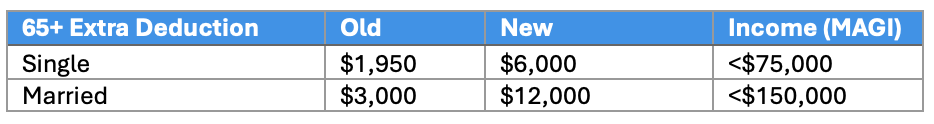

Admittedly, we are not CPAs by trade, however a few noticeable tax provisions stand out in the bill. First and foremost, the standard deduction increases for all tax filers, resulting in higher paychecks for Americans. Americans 65 or older get an extra deduction, which should help soften the burden of higher costs for many living on fixed incomes.

Real estate investors should also be excited by the semi-permanent extension of opportunity zones. Beginning in 2027, state governors will review locations designated for economic development at their discretion every 10 years.

Another big one is the increased cap for the state and local tax deduction, commonly referred to as “SALT.” The cap on the deduction rose by $30,000, from $10,000 to $40,000.

These tax code changes should lead to higher paychecks, tax returns, and discretionary spending for millions of Americans.

Raising the standard deduction:

Americans 65 or older get an extra deduction:

The cap for the State and Local Tax (SALT) deduction increased:

Two Big Growth Incentives We Really Like:

1)

Tax treatment for plant, property, and equipment should be a big growth incentive, as businesses can now take advantage of the improved flexibility of the tax code to expand their physical footprint. Companies with domestic manufacturing operations should especially benefit. New projects or expanded operations may be greenlit under the amended language in the bill, which could spread to the labor market, profit margins, and broad economic growth.

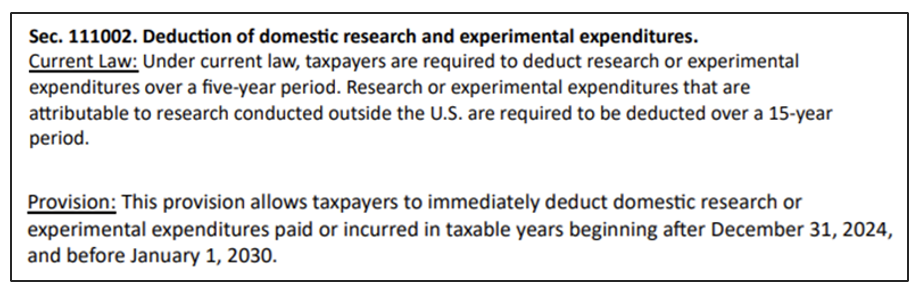

2)

Similar to the first idea, companies are now able to front-load tax deductions for research and development expenses. The new tax treatment incentivizes businesses to pursue new innovation, new products, and new service offerings to customers. Because the language incentives early tax deduction, as opposed to spreading these deductions out over time, companies may opt to initiate research and development sooner rather than later, boosting broad economic growth in the process.

What We Don’t Like:

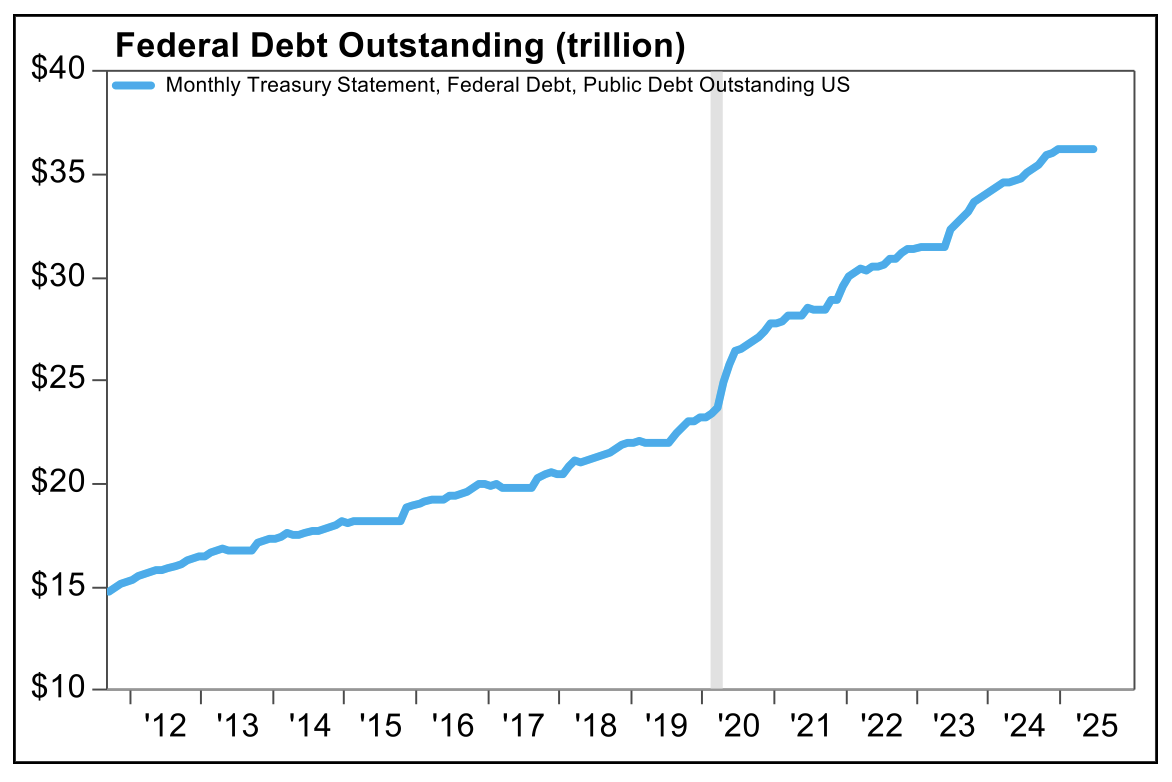

- The One Big Beautiful Bill Act is expected, on balance, to add to the national debt as the government continues to spend more than it takes in. That said, were the bill to spur faster than expected economic growth that should lead to greater than expected federal tax receipts.

- Some measures that were advertised, such as “no tax on tips” included qualifying fine print, which created a discrepancy between expectations and the final language in the bill.

- Regulatory adjustments favored select industries, notably domestic industrials and traditional energy, but may prove to be a headwind for others; for example, alternative energy producers face new cost hurdles.

- The 21% corporate tax rate from 2017 was extended but not made permanent.

- The Bill may complicate tariffs and trade policy, should inflation pick up. Will businesses lean into growth incentives if costs are rising?

Source: FactSet

Raising the Debt Ceiling is a Big Deal:

Finally, the One Big Beautiful Bill Act raised the US debt ceiling by $5 trillion, from $36 trillion to $41.1 trillion. A debt ceiling-driven US government shutdown is likely off the table for another year, with 2026 expenditures funded. The Treasury also has ample room to issue new debt, and Federal spending obligations will be met (think defense, social security, Medicare / Medicaid, etc.).

This is subtly a big deal, simply by removing one less source of stress for Wall Street. Markets do not like uncertainty, and historically, the political calamity associated with the process of raising the debt ceiling has dented returns and spiked volatility.

The Big Picture:

While the One Big Beautiful Bill Act is far from a perfect piece of legislation, we think it’s a net positive for Wall Street, especially in the short term. Yes, America’s tab certainly got bigger, some of the growth incentives are narrow in scope, and the lower end consumer takes a hit; but the bill should spark meaningful tailwinds to GDP, corporate earnings, capex, hiring activity, domestic manufacturing, and business cash flow. The US consumer also gets some relief in the form of lesser tax and improved discretionary income, in aggregate.

The alternative scenario of the 2017 tax cuts expiring, is one that could have brought negative consequences for investors, including tighter fiscal policy and slower economic growth.

It has been quite a year for the markets and the economy, with stocks up close to double digits, corporate earnings growth on pace for double digit growth, and investors looking past trade uncertainty. We think that the One Big Beautiful Bill stimulates these trends in the back half of the year, and we remain optimistic on risk assets.