- While the headlines continue to be dominated by debt ceiling talks, and individual investors remain in a funk, it should be noted that the overall economy continues to surprise to the upside. Corporate fundamentals such as revenues and earnings (while still below average), are doing better than anticipated. The overall economy is also doing better than expected, with estimates for 2Q23 GDP now approaching 3%.1

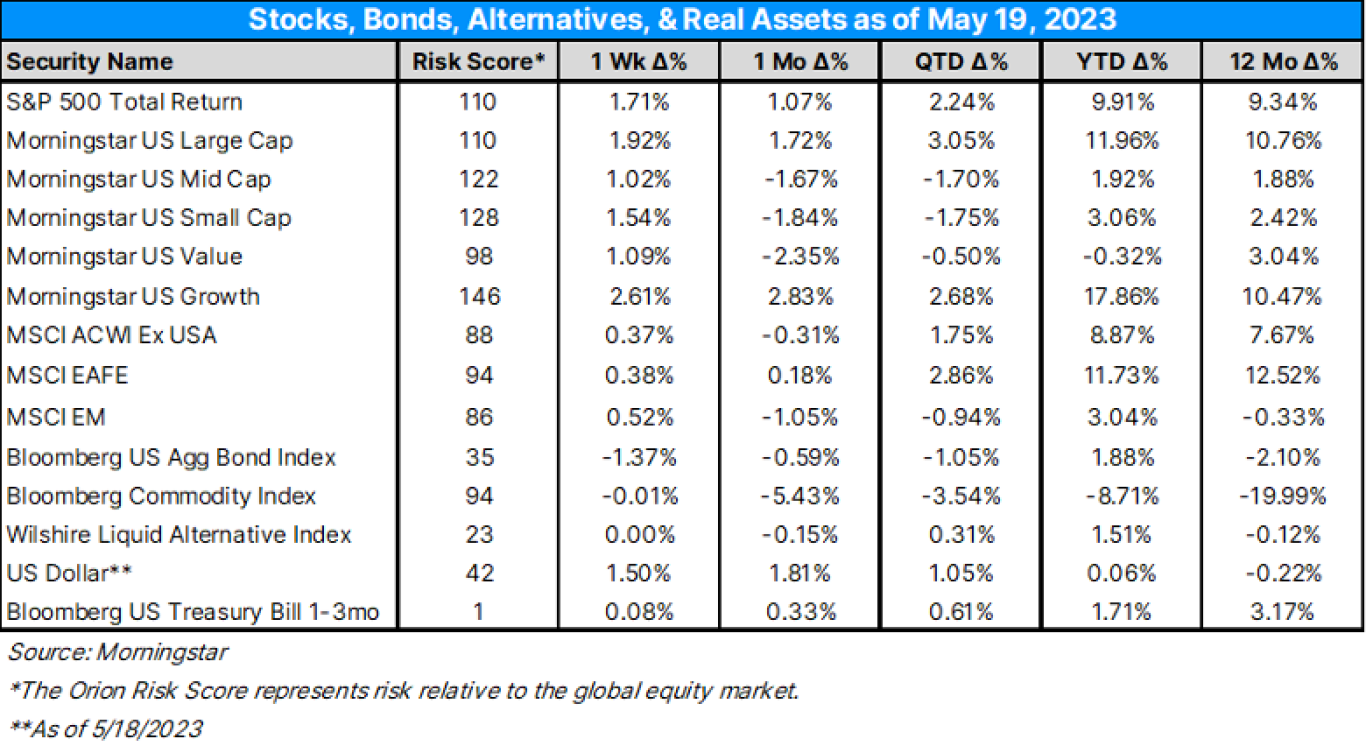

- As for performance last week:

- The overall US market had solid gains on the week, led by large cap stocks, which were up nearly 2%. 1

- There were notable new highs in various markets last week.

- The Nasdaq 100 moved to a 52-week high yesterday.

- Japanese stocks are trading at the highest level since 1990.

- Germany’s DAX is at an all-time high.

- For the quarter, large caps are up over 3%, while mid and small caps are down nearly 2% each. Developed international equities are also up nearly 3%.1

- Looking back over the last 12 months, only emerging markets, bonds, and commodities are negative. Leading the charge in 12-month gains is developed international, despite domestic growth’s strong rally in 2023.

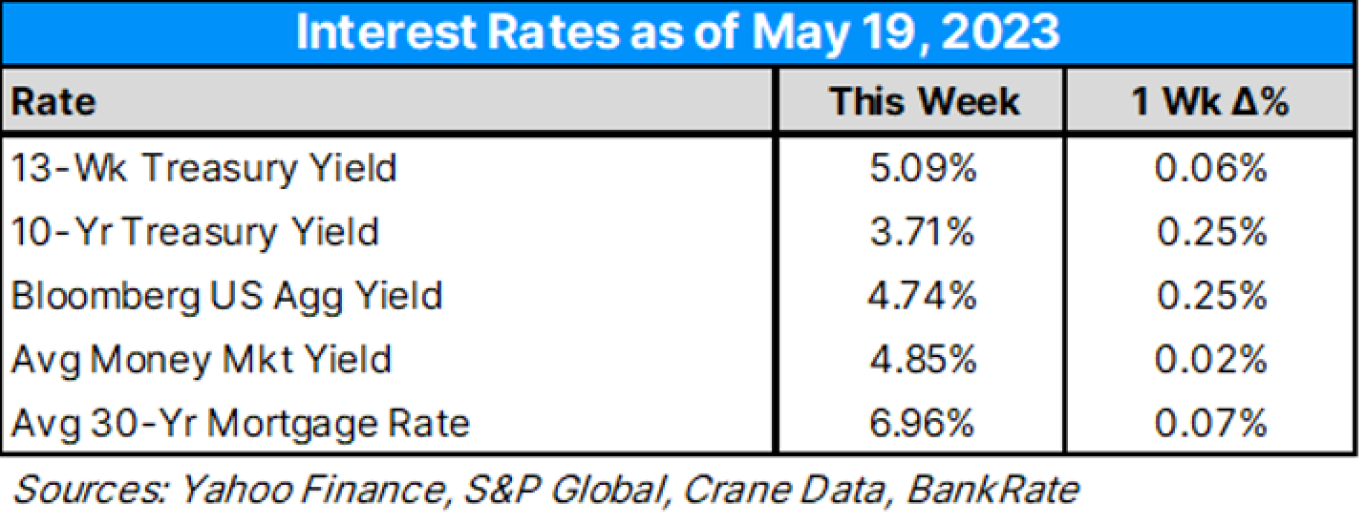

- As for key interest rates last week:

- Rates broadly rose, with the biggest increases coming from the 10-year Treasury and the Bloomberg Agg.

- The average money market yield also continued to creep up toward the 5% mark. Investor demand remains strong for money markets. 1

- The average 30-year mortgage rate also rose, closing back in on 7%. 1

- While mortgage rates are stuck above 6%2, some homebuyers are optimistic that the 30-year rate will come down over the next year. Common factors considered for this belief are decelerating inflation, market suggestions of easing monetary policy, and a general sense of “getting used to” higher rates.

- Speaking of large cap stocks, Apple Inc (AAPL) is now bigger than the entire market capitalization of the Russell 2000 Index. It’s also bigger than the entire Toronto Stock Exchange. Historically, it’s rare when a company like Apple can stay dominant in terms of market cap for long.

- Further, when comparing an equal weighted and market-cap weighted S&P 500 index, we can get a general indication on the health of the market. When the equal weight is outperforming, this tends to be a sign that markets are healthy, since small caps tend to outperform. However, when the market-cap weighted index is outperforming, large (often defensive companies) are outperforming. These conditions are tough on active managers, which overwhelmingly have smaller cap tilts.

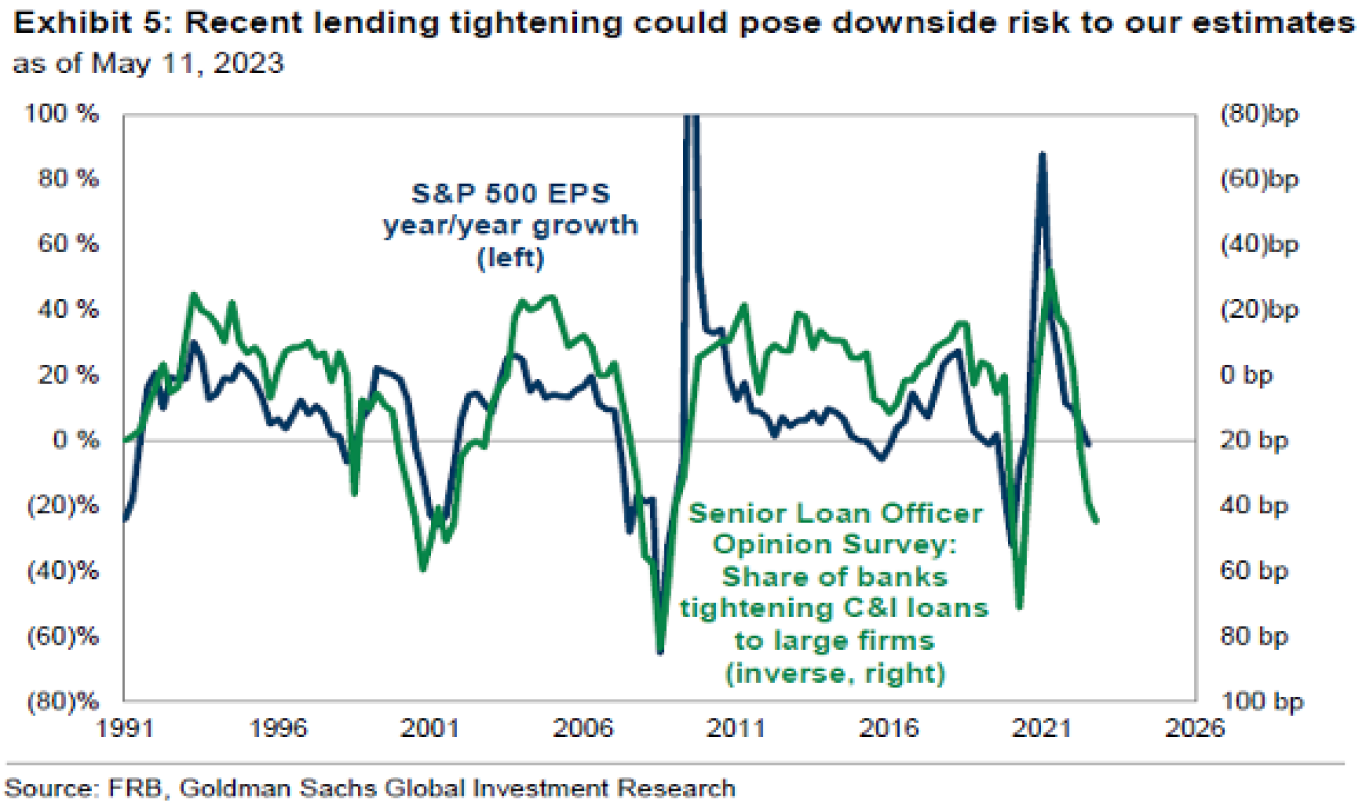

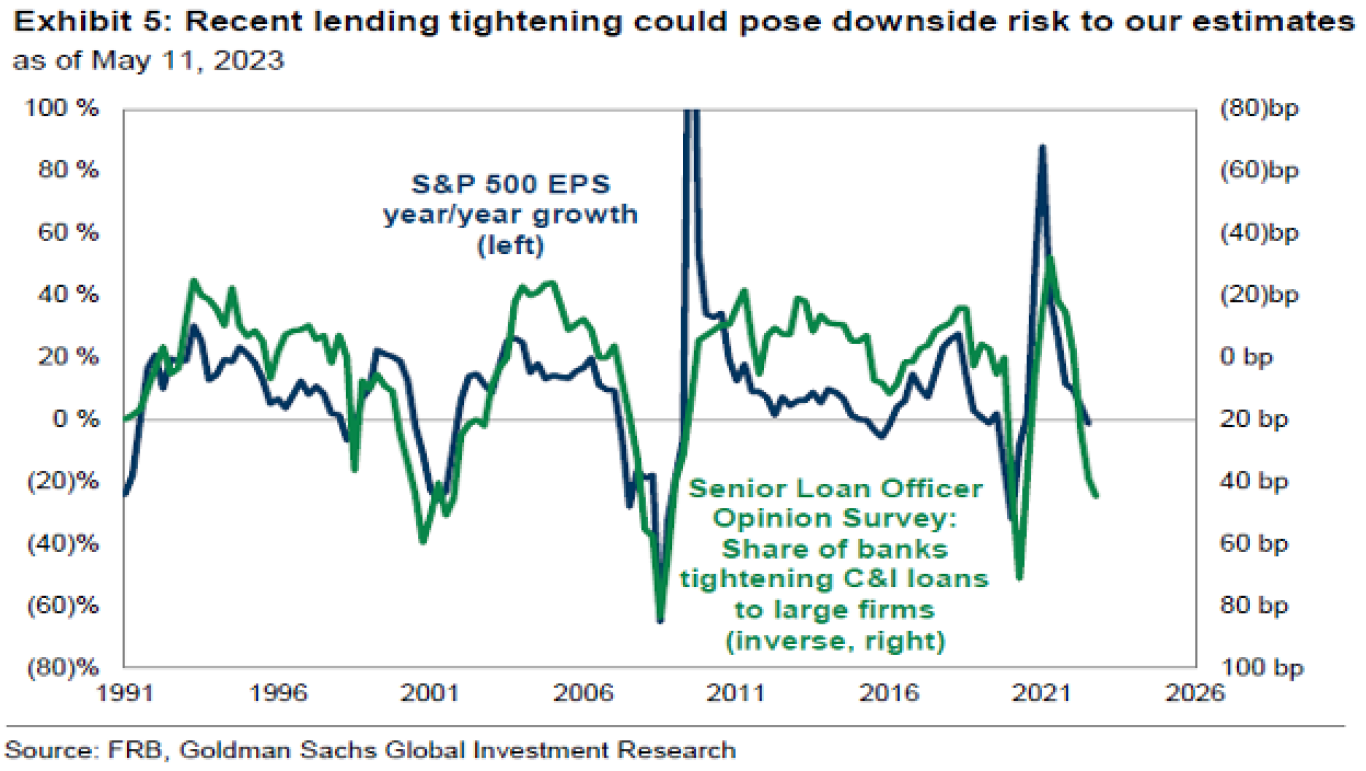

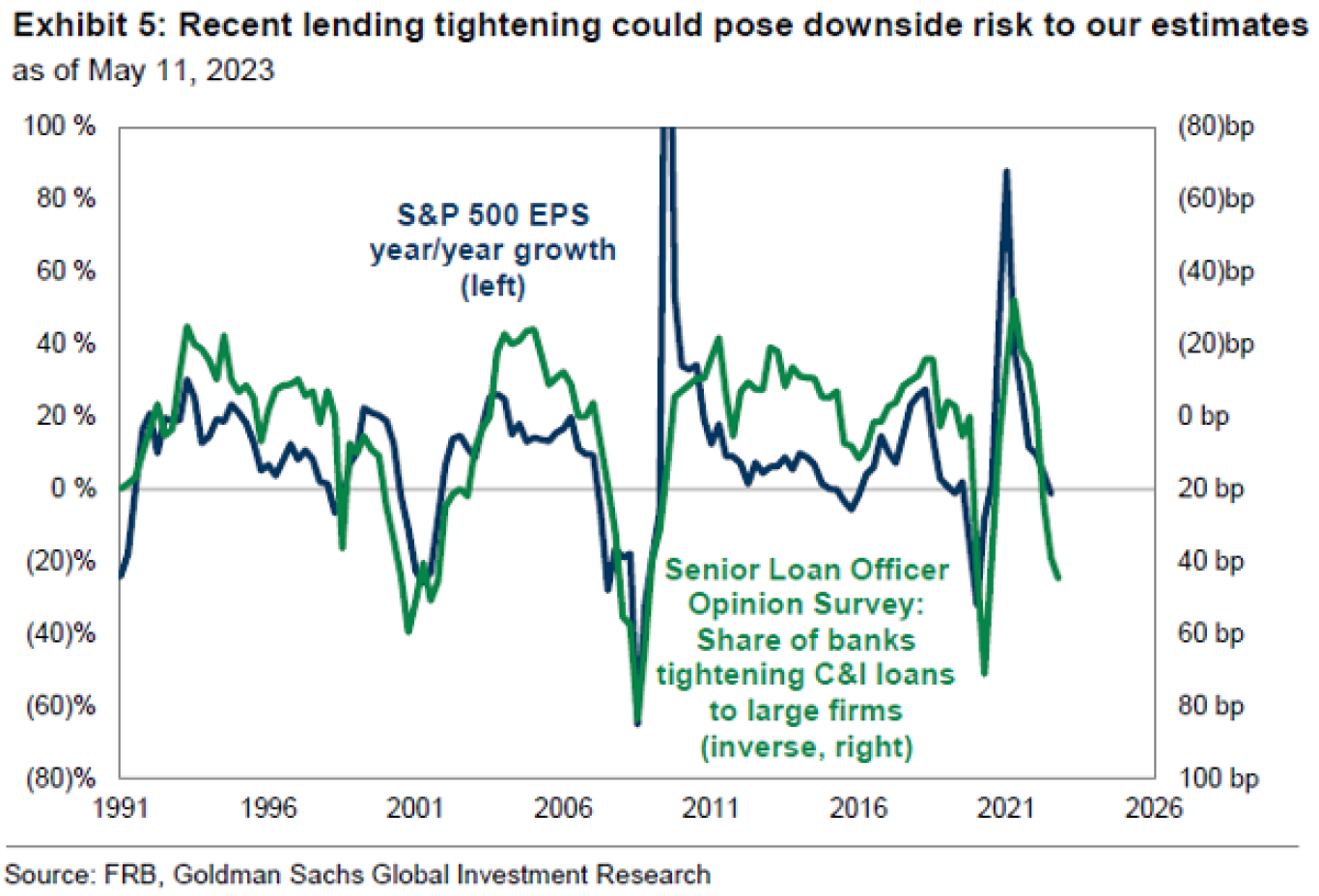

- Add this to the list of indicators which may suggest earnings weakness ahead: banks not lending as much.

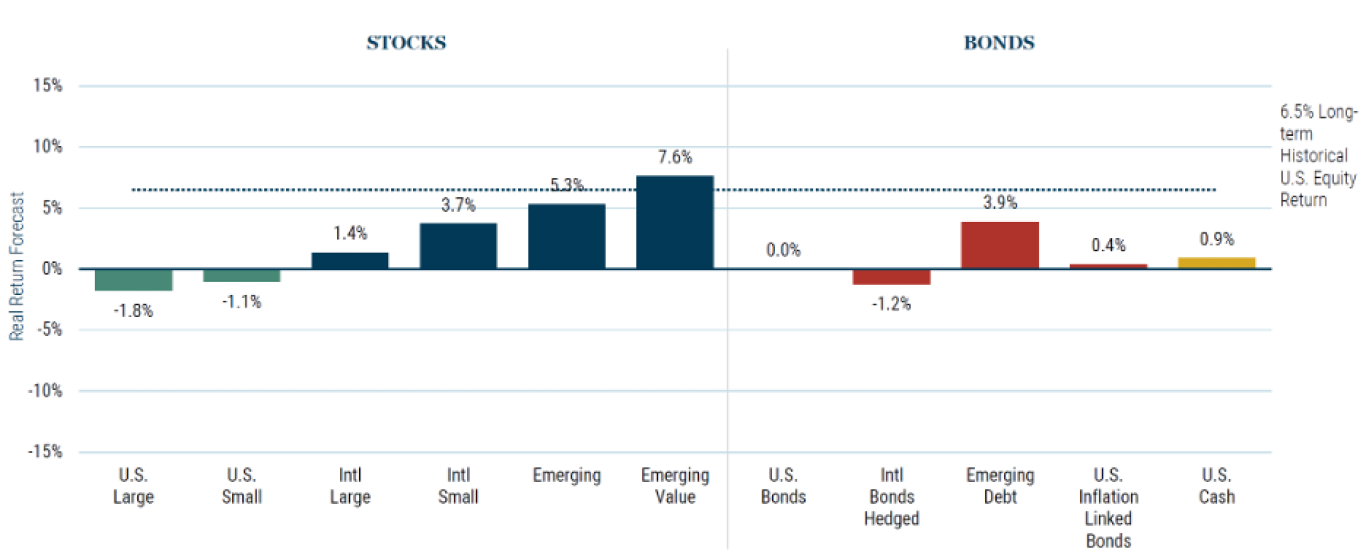

- Boston-based GMO’s latest monthly 7-year forecast for after-inflation returns:

- International equities, especially in emerging markets, and particularly those with a value tilt, seem to offer the best expected returns.

- Emerging market debt also has attractive valuations/expected returns.

Source: GMO

- Hat tip to Meb Faber on finding this article on “The Case For International Diversification.

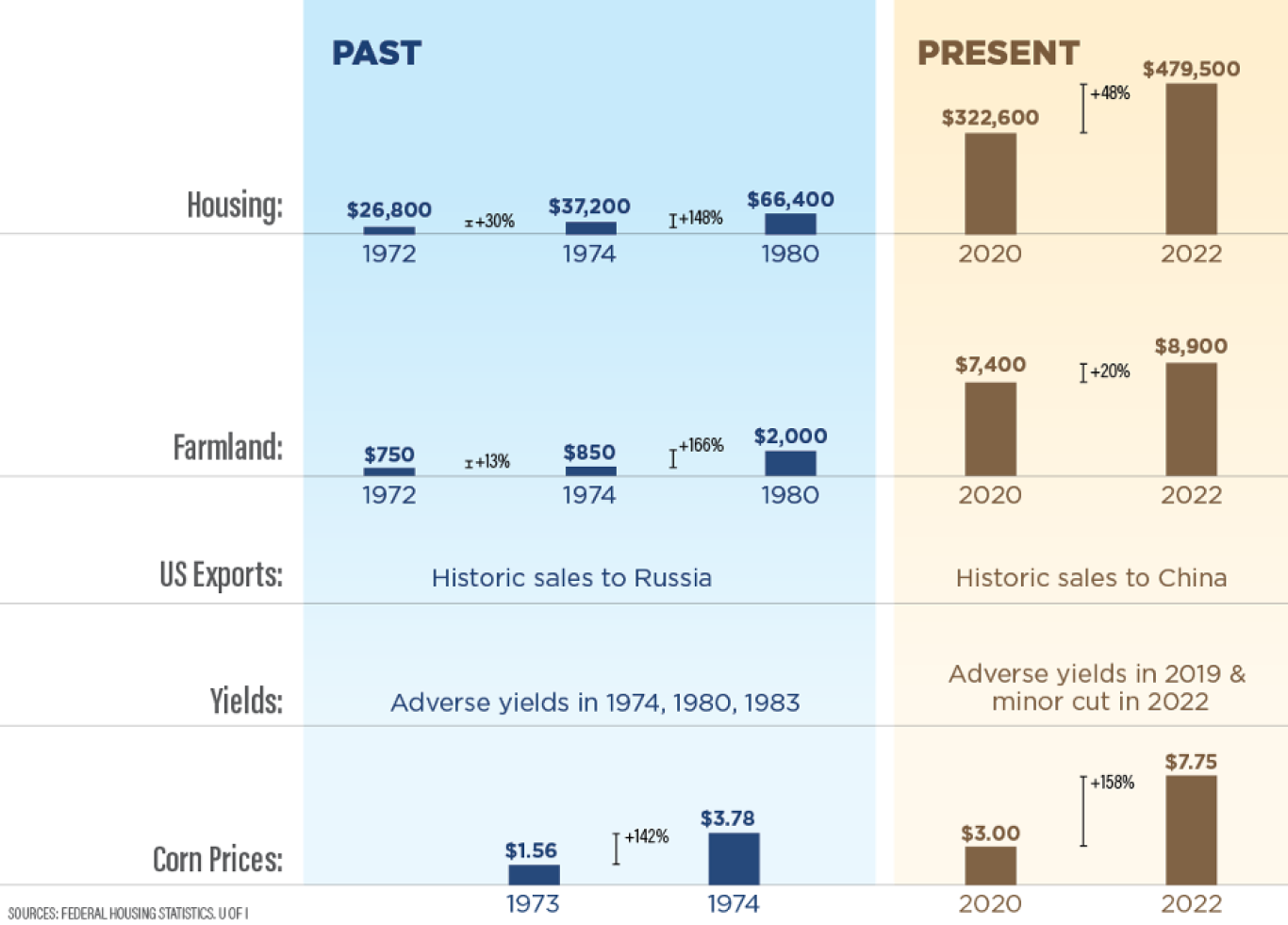

- While this article hones in specifically on farmland, it makes some interesting connections between today and the inflationary period of the 1970’s and 1980’s. The market moves in cycles, and history often does repeat itself.

- 100% plus increased in CPI (2022 saw a 91% increase).3

- Fed increased rates to control inflation, which caused the housing market to slow.

- Corporate earnings began to shrink, and layoffs increased.

- Consumer spending peaked and trading funds began buying up T-Bills and bonds instead of speculative investments.

- We’re now 22 days out from the next interest rate decision, and as of now, according to the CME Fed Watch tool: (which has arguably been one of the key charts to watch this year):

- At a current target range of 500-525, the market is now pricing nearly an 83% chance of no rate action at the next Fed meeting on June 14th. 4

- The Atlanta Fed GDPNow Forecast Tool is setting estimated Q2 2023 GDP at 2.9%, as of 5/17/23. This number continues to improve, as last week the estimate was 2.7%. 5

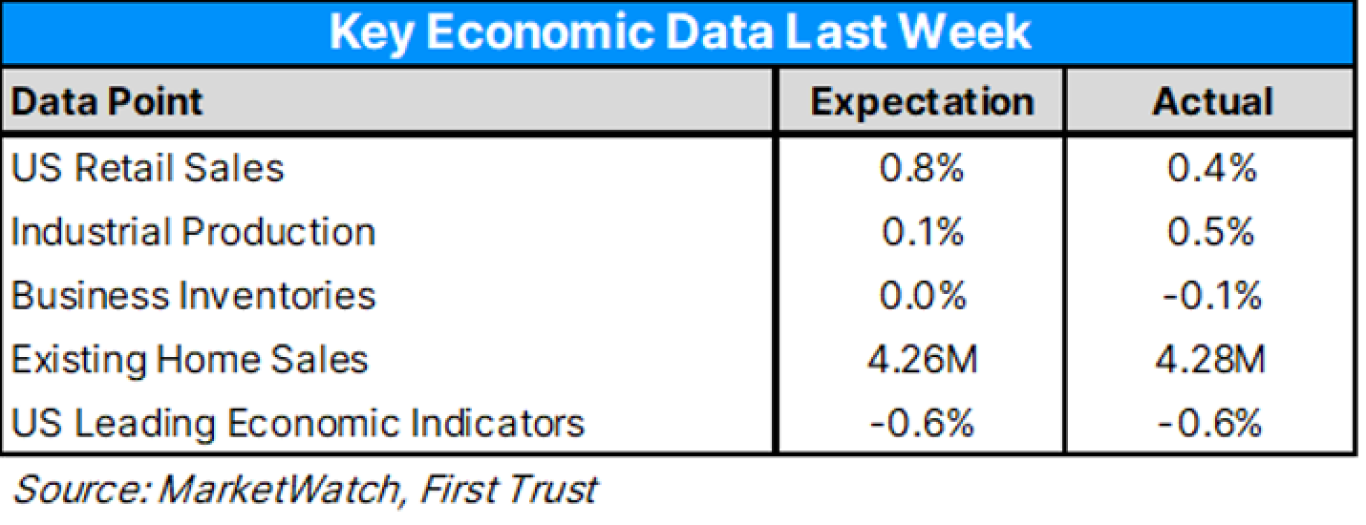

- The economic data calendar last week didn’t pose any major surprises.

- Retail sales rose 0.4% in April and are up 1.6% versus a year ago. The largest increases were internet and mail-order retailers, merchandise stores, and autos. The largest decline was at gas stations. 6

- Industrial production rose 0.5% in April. Auto production rose 9.3% and is up 8.5% versus a year ago, while non-auto manufacturing rose 0.3% in April and is down 1.7% versus a year ago. 6

- Existing home sales declined 3.4% in April, now down 23.2% versus a year ago.6

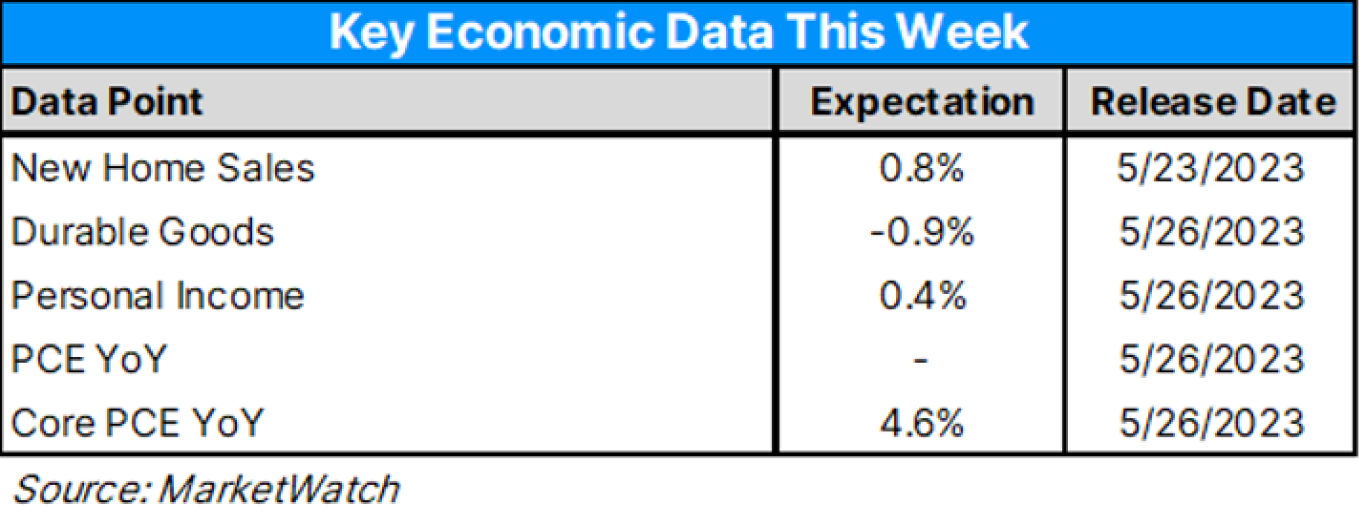

- Here is the economic data calendar for this week.

- The Fed’s preferred inflation indicator, Personal Consumption Expenditures (PCE) will be released Friday.

- Need some economic analysis that’s a little more upbeat? While most economists seem to be more negative than not, RenMac’s economist Neil Dutta continues to believe that the economy remains firmer than many expect: “Job gains remain robust across the country (and) housing continues to be a tailwind.” RenMac’s Friday weekly Friday podcast is typically a solid 15-minute or so overview of what’s going on in the economy, and in the markets and Washington DC.

- This week’s Earnings Insight from Factset:

- Earnings Scorecard: For Q1 2023 (with 95% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS and 76% of S&P 500 companies have reported positive revenue. 7

- Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -2.2%. If -2.2% is the actual decline for the quarter, it will mark the second straight quarter that the index has reported a decline in earnings. 7

- Earnings Guidance: For Q2 2023, fifty-eight S&P 500 companies have issued negative EPS guidance and forty-one S&P 500 companies have issued positive EPS guidance. 7

- For CY 2023, analysts are projecting an earnings growth of 1.0% and a revenue growth of 2.4%. 7

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Cryptocurrency prices were flat last week. Bitcoin hovered just under $27,000, and Ethereum was slightly in the green at around $1,800. Ripple, Tron, and Litecoin all jumped 7-10%.8

- News flow was light again last week. Ripple (XRP) gained after winning a small courtroom battle against the SEC as part of their ongoing investigation. Samsung announced a partnership with the Bank of Korea to jointly conduct research around a CBDC for the country. Litecoin transactions have increased nearly 500% this year as rising Bitcoin transaction costs are helping competitors. 8 Crypto exchange volumes are decreasing as large trading firms Jump trading and Jane Street appear to be pulling back.

- Grayscale’s recent filing (highlighted last week) seeks to invest in spot bitcoin ETF traded in other countries, going after a potential loophole in regulation.

- “A good bet in economics, is that the past wasn’t as good as you remember, the present is not as bad as you think, and the future will be better than you anticipate.” Morgan Housel

- On this week’s Orion's The Weighing Machine podcast Robyn and I talk to Jeff Strese, Principal at Jeff Strese Consulting Group. Courtesy of Schafer-Cullen, we were able to interview Jeff on the value of emotional intelligence for financial advisors and well, everybody really.

- First thing Monday morning, the latest Orion’s Weighing The Risks is released. This time it’s with Kevin Preloger from Janus Henderson. This podcast series discusses top-of-mind concerns for advisors and investors and explores different possible market scenarios. This month’s topic is the 2023 Banking Crisis. This podcast series has been a hit. Our last episode with Phillip Toews from Toews Asset Management, has reached over 5,000 listens so far.

- Arguably the best author and now voice in financial media, Morgan Housel, released another great new podcast episode: "A Few Things I’m Pretty Sure About". This podcast might only be 17 minutes long, but it’s loaded with quotes and goodies. I bet you remember and use some of them too, both personally and professionally.

- Are you excited or nervous about generative AI? Either way, here is a reasonable argument that might help expectations, including for investors: Avoiding Maximalism

- “The reality is that new innovations, even disruptive ones, tend to follow a very predictable pattern and adoption curve.

- A small group of people and companies work on the innovation before it’s really understood by the masses.

- The innovation begins to get traction and more people start to gain interest in the space.

- A few early players launch products that wow the market and catch incumbents off guard. As others start to feel FOMO, there is a rush to catch up and the hyperbole begins.

- Money pours into the space, and people and investors lose their objectivity. This is when you start to hear that “it’s different this time,” as a host of unprofitable and unsustainable businesses chase market share and compete against each other.

- Everyone you know is talking about this new technology. It feels like all you hear and read about, and you start to fear that everyone is getting rich but you.

- The space quickly gets overfunded, and competition gets fierce. The realization also sets in that there is a difference between cool technology, or an exciting free product, and a sustainable business model.

- The market crashes, wiping out about 90 percent of the players as investors run for the exits.

- Slowly, the market begins to sort out the long-term winners and applications. Companies refocus on applications of the innovation that can result in a profitable, sustainable business.”

1 Source: Morningstar

2 Source: Yahoo Finance

3 Source: Federal Housing Statistics, U of I

4 Source: CME FedWatch Tool

5 Source: Atlanta Fed GDPNow Forecast Tool

6 Source: Bureau of Census

7 Source: Factset

8 Source: CoinMarketCap