-

It was a big weekend in Omaha this past weekend with the annual Berkshire Hathaway Shareholder’s Meeting taking place downtown. This event attracts BRK investors from around the world to Omaha - so many in fact that some hotel rooms were listed for as much as $4,000 a night! Warren Buffett (age 92) and Charlie Munger (age 99) gave their closely watched address to investors and touched on many Berkshire and market related topics including their oil and video game company holdings, the U.S. banking sector, U.S. and China relations, artificial intelligence, and more.

-

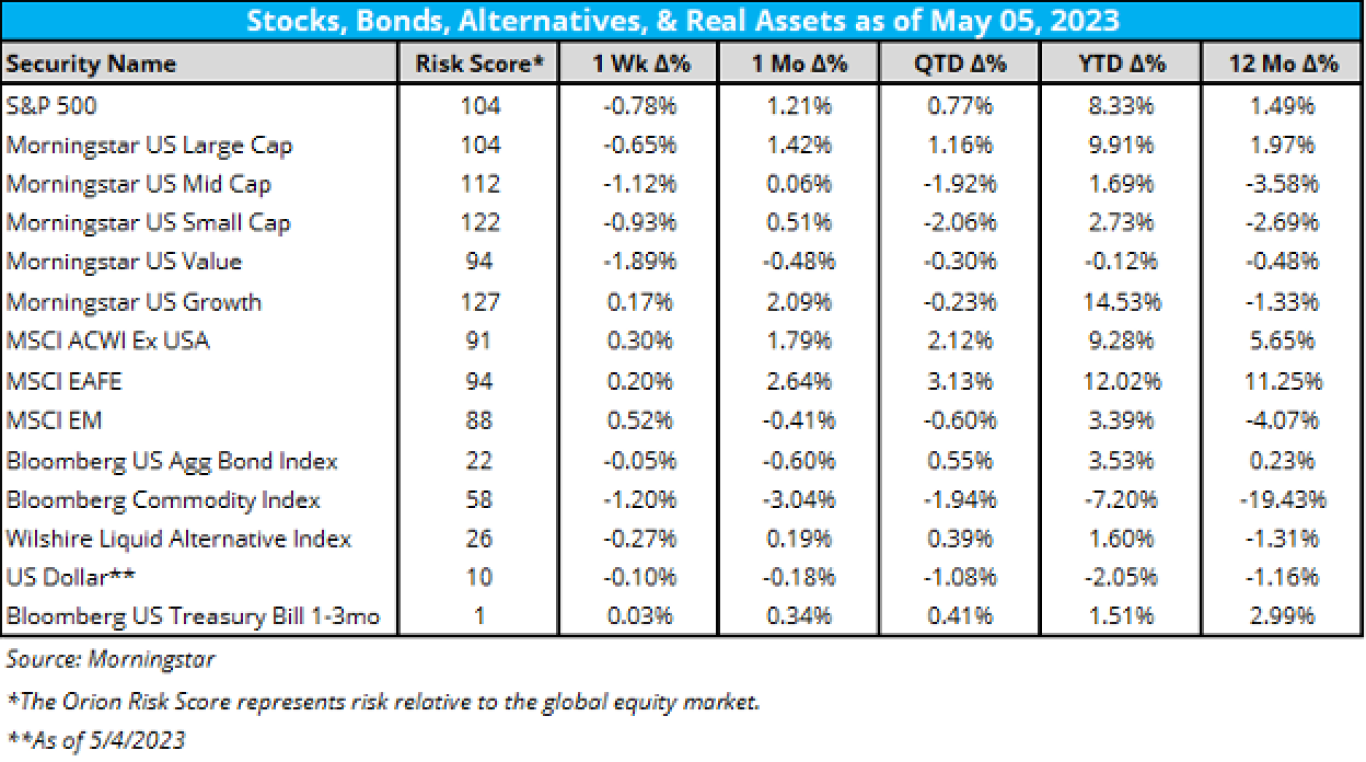

As for performance last week, there definitely was some excitement/volatility, but in the end the overall market only slightly fell last week.

-

Despite jumping nearly 2% on Friday following a strong employment report, the overall US market had a near 1% loss for the week.

-

Gains were led by growth stocks, which were about flat on the week.

-

International stocks also had slight gains on the week.

-

QTD, large cap equities are the only style that have positive returns on the quarter.

-

YTD, growth stocks are up nearly 15%, value stocks are now negative on the year.

-

-

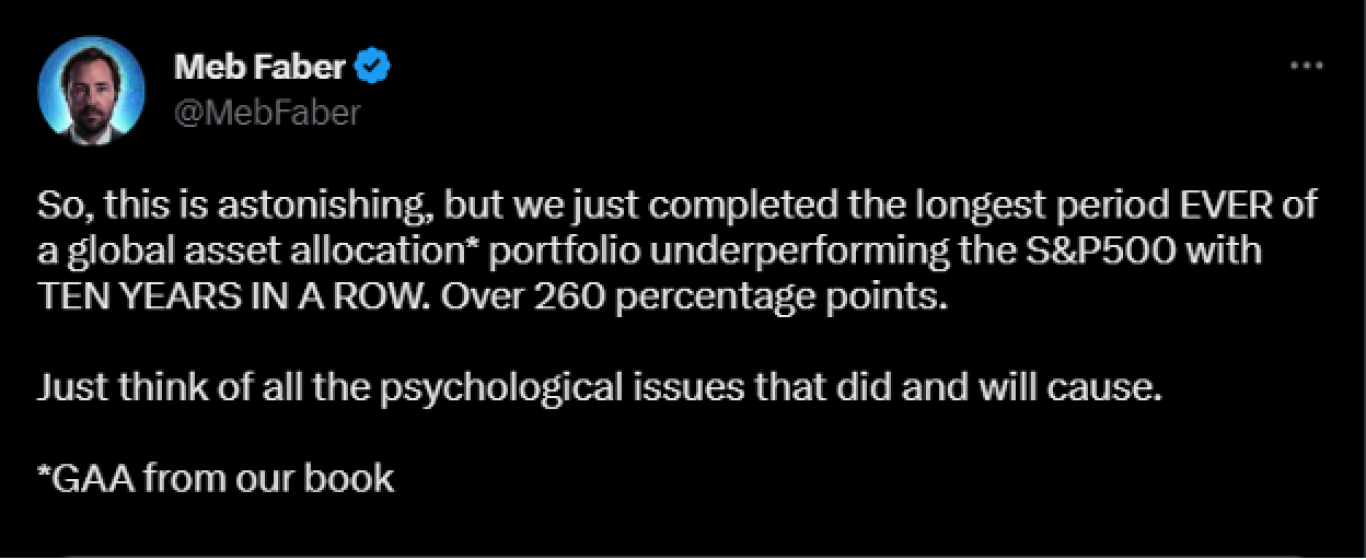

Known as a fan favorite for some in the industry, Meb Faber is a long-time proponent of broadly diversified, multi-asset, and specifically, global portfolio construction. While academics argue that US investors having a heavy home bias is a detractor to long-term performance, Meb pointed out this week that global asset allocation has underperformed the S&P 500 by over 260% across the last 10 years. Generally, US and international over/underperformance moves in cycles, which (anecdotally) last about 10 years. Perhaps the tide has turned? 2022 saw slight outperformance of developed international equities compared US equities, and international is again off to a hot start this year.

-

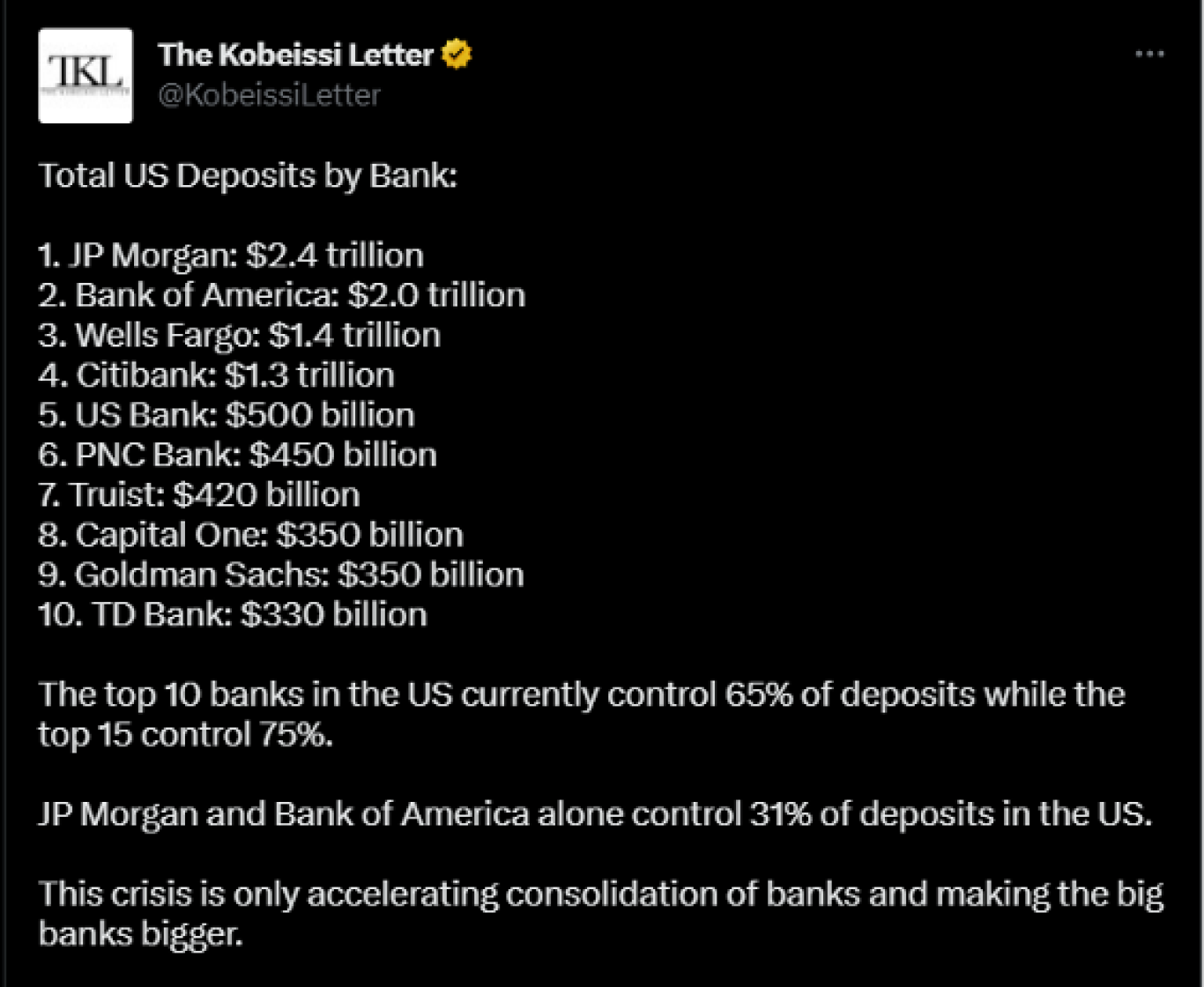

We continue to see consolidation in the banking sector as regional banks continue to fail. According to @KobeissiLetter on Twitter, the top 10 banks in the US currently control 65% of total deposits. Big banks are getting bigger. While this is likely helping increase trust and stability in the US banking sector in the short term, the lack of a strong regional banking system could have unforeseen, potentially drastic, long-term effects, especially for the average consumer.

-

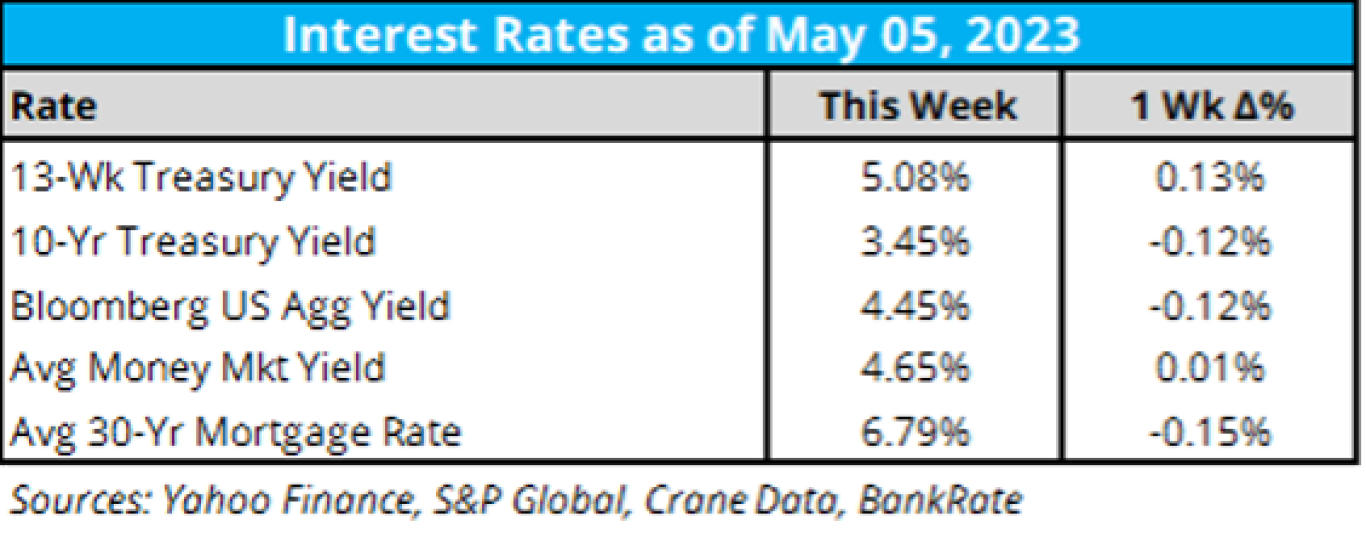

As for key interest rates last week:

- Coming off the 10th consecutive rate increase this week, we’re now 36 days out from the next interest rate decision, and as of now, according to the CME Fed Watch tool: (which has arguably been of the key charts to watch this year):

- At a current target range of 500-525, the market is now pricing in a 90% chance of no rate movements at the next meeting.

- The Atlanta Fed GDPNow Forecast Tool is setting estimated Q2 2023 GDP at 2.7%, as of 5/4/23.

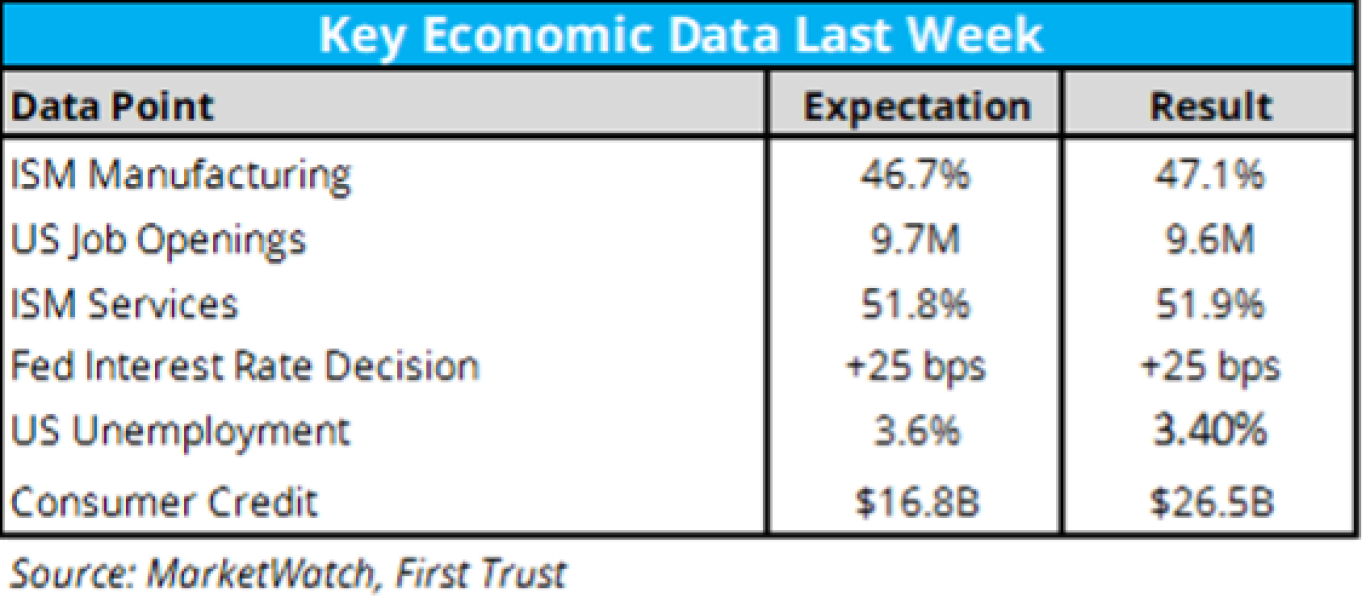

- The economic data calendar last week was packed:

- The Federal Reserve announced its 10th consecutive rate hike this week as they continue their fight against historic inflation levels. This now puts the target Fed Funds rate at 5.00% - 5.25%. The Fed indicated that they will likely pause the hiking cycle at this point.

- US employment continues to surprise on the upside. On Friday, the jobs report showed another decline in the unemployment rate to 3.4%, representing the lowest unemployment rate since the early 1950’s.

- Consumer credit surprised on the upside, led by increases in credit card debt. March’s borrowing hit $26.5B for the month representing the fastest growth in four months.

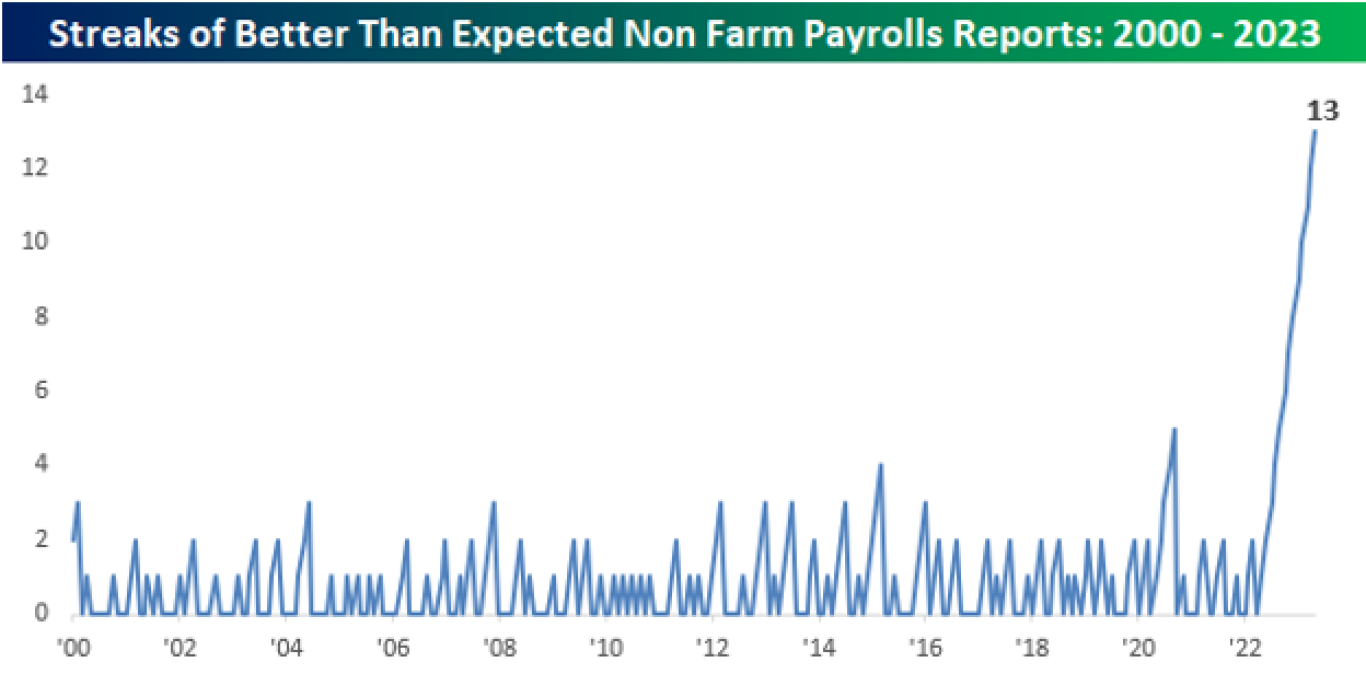

- Here’s a pretty astounding chart on nonfarm payrolls from Bespoke Investments. We have now had 13 consecutive reports with upside surprises, the previous highest streak since 2000 was just 5.

Source: Bespoke Investments

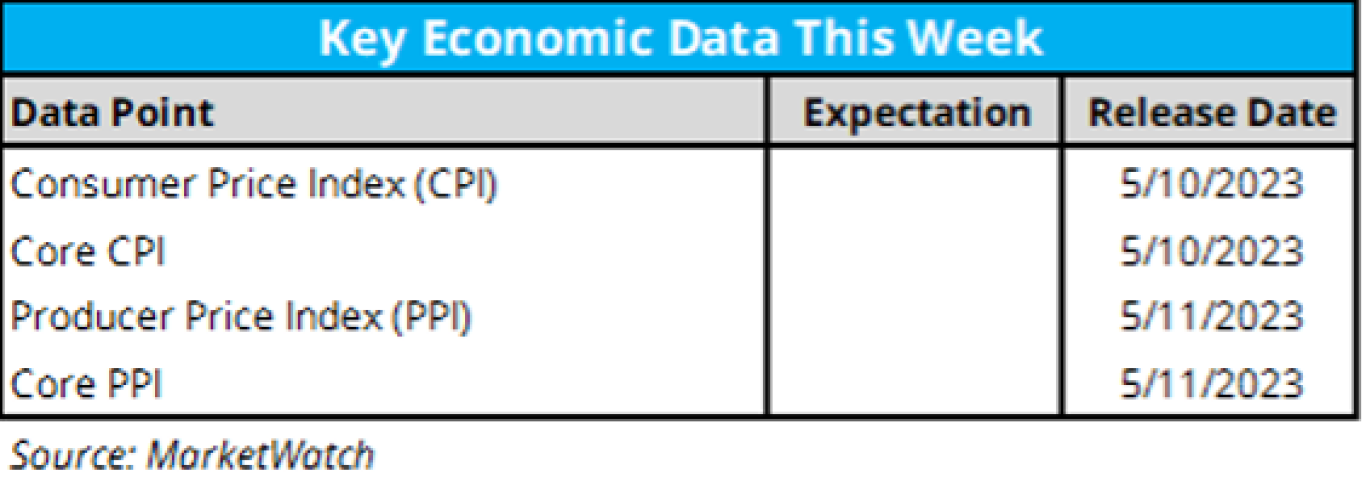

- Here is the economic data calendar for this week:

- The Consumer Price Index (CPI) will be released on Wednesday of this week. This release will get close attention from the market following recent banking sector issues and the Fed’s rate hike last week.

- The Producer Price Index (PPI) will also be released this week.

- This week’s Earnings Insight from Factset:

- Earnings Scorecard: For Q1 2023 (with 85% of S&P 500 companies reporting actual results), 79% of S&P 500 companies have reported a positive EPS surprise and 75% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -2.2%. If -2.2% is the actual decline for the quarter, it will mark the second straight quarter that the index has reported a decline in earnings.

- Earnings Guidance: For Q2 2023, 44 S&P 500 companies have issued negative EPS guidance and 35 S&P 500 companies have issued positive EPS guidance.

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Cryptocurrency prices mostly fell last week, with Bitcoin dropping 2.4% to just under $29,000. Ethereum was flat on the week to hover around $1,900. Tron was the only top 20 asset to rise on the week.

- The White House released a proposed ‘Digital Asset Mining Energy Tax’ last week that would tax miners 30% on energy consumption (proof-of-work or proof-of-stake) regardless of where their energy is produced. Auction house Sotheby’s launched a NFT marketplace. Alibaba is building a metaverse platform on the Avalanche network.

- No new digital asset ETF news.

We’ve quoted James Clear’s quick 3-2-1 newsletter many times (which again, we recommend signing up for), and here’s another great thought. If you’d like, share your hobbies or interests with us, there’s bound to be some fun surprises.

- "Broaden your interests. It's nice to have at least one surprising hobby or passion. People find it interesting. In many ways, the part of you that is least expected is more respected." -James Clear

On this week’s Orion's The Weighing Machine podcast we talk to Phil Voelker, CIO at Advanced Asset Management Advisors (AAMA). Phil, Rusty, and Robyn take a look at the current market environment. This includes historically significant volatility levels, historically significant inflation levels, and unprecedented banking sector turmoil. All these hot topics make for a solid episode of TWM.

Why Women are Better (Investors) Than Men

- Men in general, they reported, earned almost 1% less than women per year in their stock-picking endeavors, while single men underperformed their single women friends by 1.44% per annum!1

- “The tendency of women to outperform is not only seen in retail investors,” writes Dr. Daniel Crosby in his book, The Laws of Wealth. “Female hedge fund managers have consistently and soundly thumped their male colleagues as well.”

1Source: The Behavior of Individual Investors, Barber and Odean, 2011.

1294-OAS-5/9/2023