We thought you might find of value our high-level thoughts on recent developments in the US banking system – specifically the shuttering of Silicon Valley Bank in California and Signature Bank in New York – and what those developments might portend for the economy and capital markets.

While not being dismissive of the second and third largest bank failures in the history of the United States, we don’t believe the developments at Silicon Valley Bank and Signature Bank are indicative of systemic risk for our economy and markets, or, said differently, we don’t believe they reflect the early days of a financial contagion, something akin to what we saw in 2008 and onset of the Global Financial Crisis.

We do think the dynamics that led to the failure of both banks were specific to both banks, including meaningful exposure to clients in the digital assets space, a segment of the economy that has struggled mightily the past year or so. And in the case of Silicon Valley Bank, an undiversified depositor base and poor balance sheet and securities portfolio management that saw the company recognize massive losses on the forced sale of investment securities, a development that further undermined depositor and shareholder confidence in its ability to operate as a going concern.

We applaud the aggressive efforts announced by regulators Sunday to make all depositors at both institutions whole, regardless of the value of deposits held at either bank. We think steps being taken by the Federal Reserve, the US Treasury and the Federal Deposit Insurance Corporation will do much to limit the economic and capital markets impact of the failure of both banks and maintain faith in our banking system.

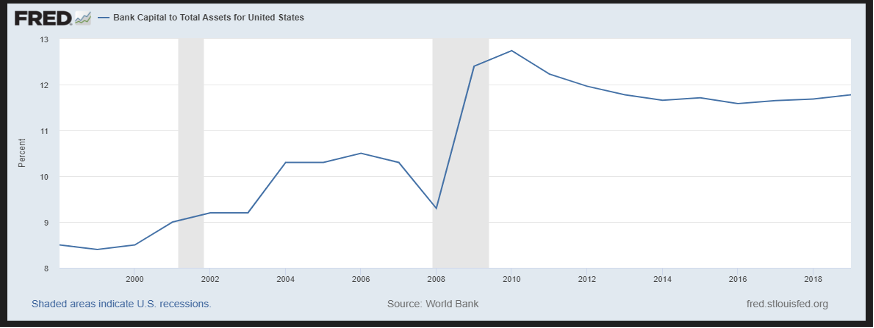

If we had to point to reasons as to why the US economy and capital markets aren’t at risk of a financial contagion, why they aren’t facing systemic risk today, it would be the amount of capital held at major banks and capital markets companies, and the general health of the US economy, particularly residential real estate. More specifically, coming out of the Global Financial Crisis, regulators, including the US Federal Reserve, put in place extremely rigorous capital requirements for systemically important financial institutions, steps which forced leading banks and brokerage houses at the time to raise and retain billions of dollars in high quality capital. And after those firms had shored up their respective balance sheets, the Fed went on to stress test their balance sheets and business models on an annual basis to ensure they could manage through a severe economic downturn. All institutions passed the Fed’s 2022 Stress Test, and today, bank capital to total assets sits near 12%, well above levels seen in the late 2000s…

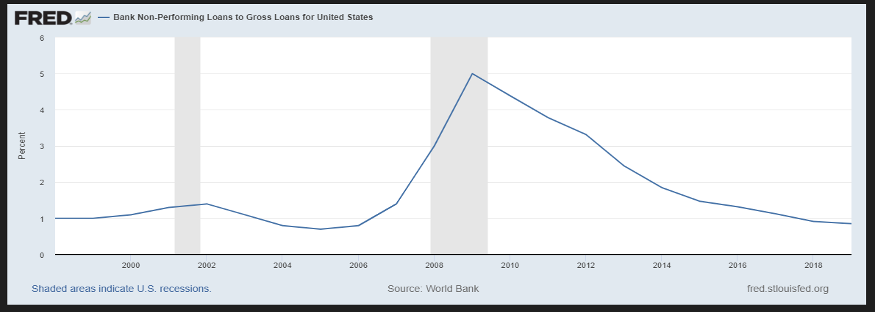

While there are signs of economic weakness on the horizon, we do believe the US economy is on much firmer footing today than it was in the late 2000s, with the US consumer, who accounts for 70% of GDP, supported by a still strong jobs market and a still resilient housing market. Importantly, as it concerns housing, there is little evidence of the oversupply and excessively lax underwriting standards of the mid 2000s that ultimately set the stage for the Global Financial Crisis. Reflecting the overall health of the US economy and US banking system, bank non-performing loans to gross loans remain at a historically low level….

While we don’t believe Silicon Valley Bank and Signature Bank are the first shoes to drop in a broader financial contagion, it is important to keep in mind that we could hear of other troubled banks over the coming days, that there could be other unsettling headlines to come. That said, we think regulators are taking the appropriate actions to safeguard our banking system and capital markets and that the underpinning of our financial system and economy remain strong.

Resources for Investors

Share these resources with your clients to keep them informed on recent market news: We hope you find these comments of value. We will continue to monitor and report on developments as they occur. And thank you for the trust and confidence you have placed in Orion.Chart source: World Bank and fred.stlouisfed.org. Shaded areas indicate U.S. recessions.

The views expressed are those of Orion Portfolio Solutions and are not intended as investment advice or recommendation. Orion Portfolio Solutions, LLC d/b/a Brinker Capital Investments a registered investment advisor.

0724-OPS-3/13/2023