As National Financial Planning month comes to a close, we thought of no better way to celebrate than by hearing from our Financial Planning team here at Orion! We asked this talented team for their best financial planning tips, and we encourage you to take a look and pass them on to your clients!

Tip 1: Small Changes Lead to Big Successes

“My tip, particularly for younger investors, is to remember that financial planning is a marathon, not a sprint. Small changes in the short run can lead to large successes in the long run.

Look at your employer’s 401(k) plan. Do they offer an automatic yearly contribution increase? Instead of putting in a flat 5% year after year, you may have the option to automatically increase your contributions by 1% each year. So you may start with 5% in year one, but then bump to 6%, 7%, and so on. As your salary increases you most likely won’t notice the larger percentage of your income going to 401(k) contributions, but you’ll be saving a little more each year. This small change, which can most likely be done online and should only take a few minutes, may help your 401(k) grow much faster.” - Spencer Fleming, FPQPTM, Financial Planning SME

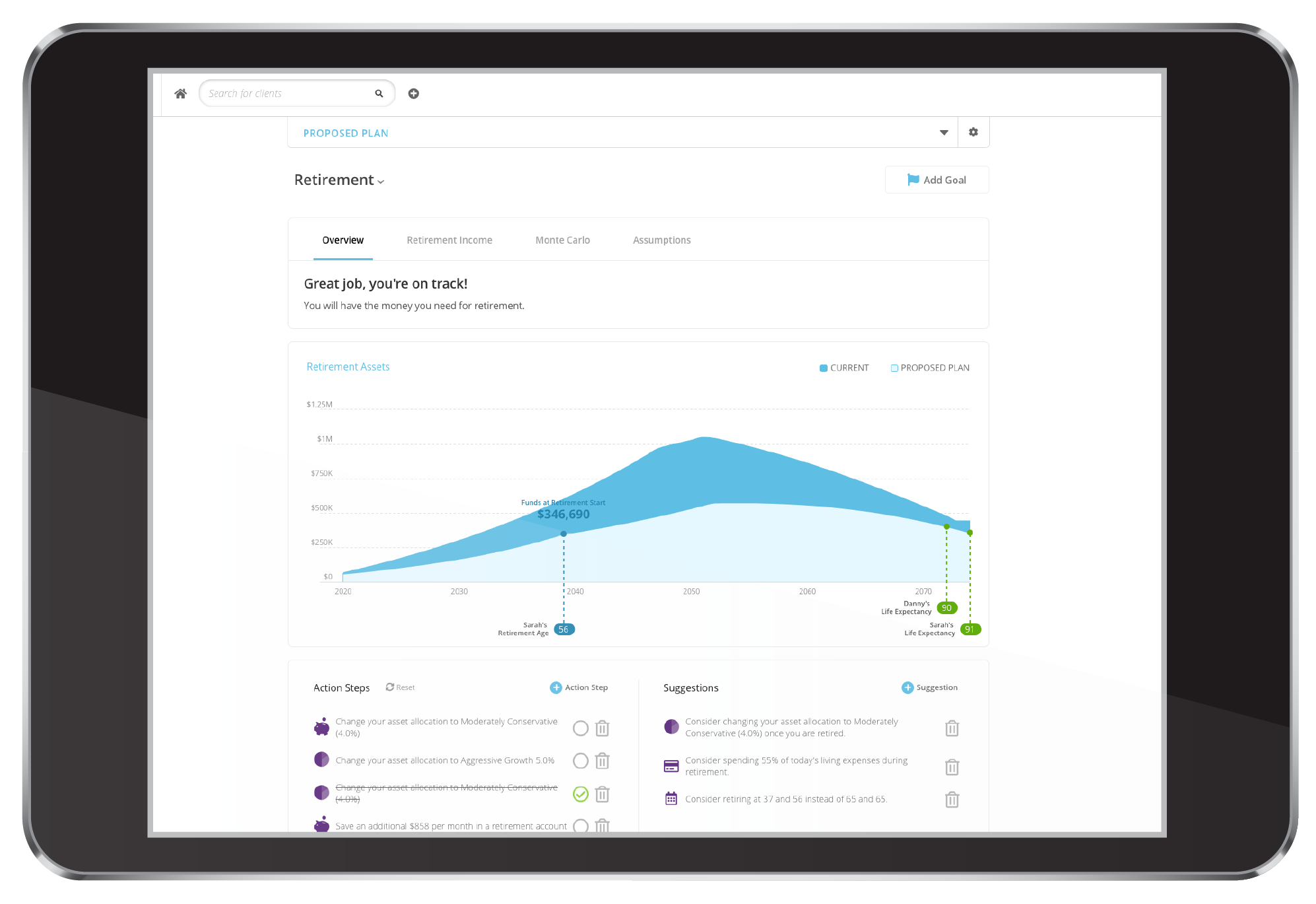

Using Orion Planning you can leverage client data to run meaningful simulations, address hypothetical scenarios, and create actionable steps to ensure financial well-being for today—and for the future.

Tip 2: The Right Time is Anytime

“It’s never too early or too late to start planning for retirement but the sooner you start the better. Scenario 1: Assuming a 5% rate of return if you save $1,000 a year for 10 years you have $13,207 at the end of year 10. Scenario 2: You save $10,000 10 years from now. You only have $10,000 at the end of year 10. Both scenarios cost you $10,000 out of pocket but in scenario 1 you end up with an extra $3,207 because you started earlier and because of the power of compounding." -Randon Lester, CPA, CFP®, Manager of SME Financial Planning Team

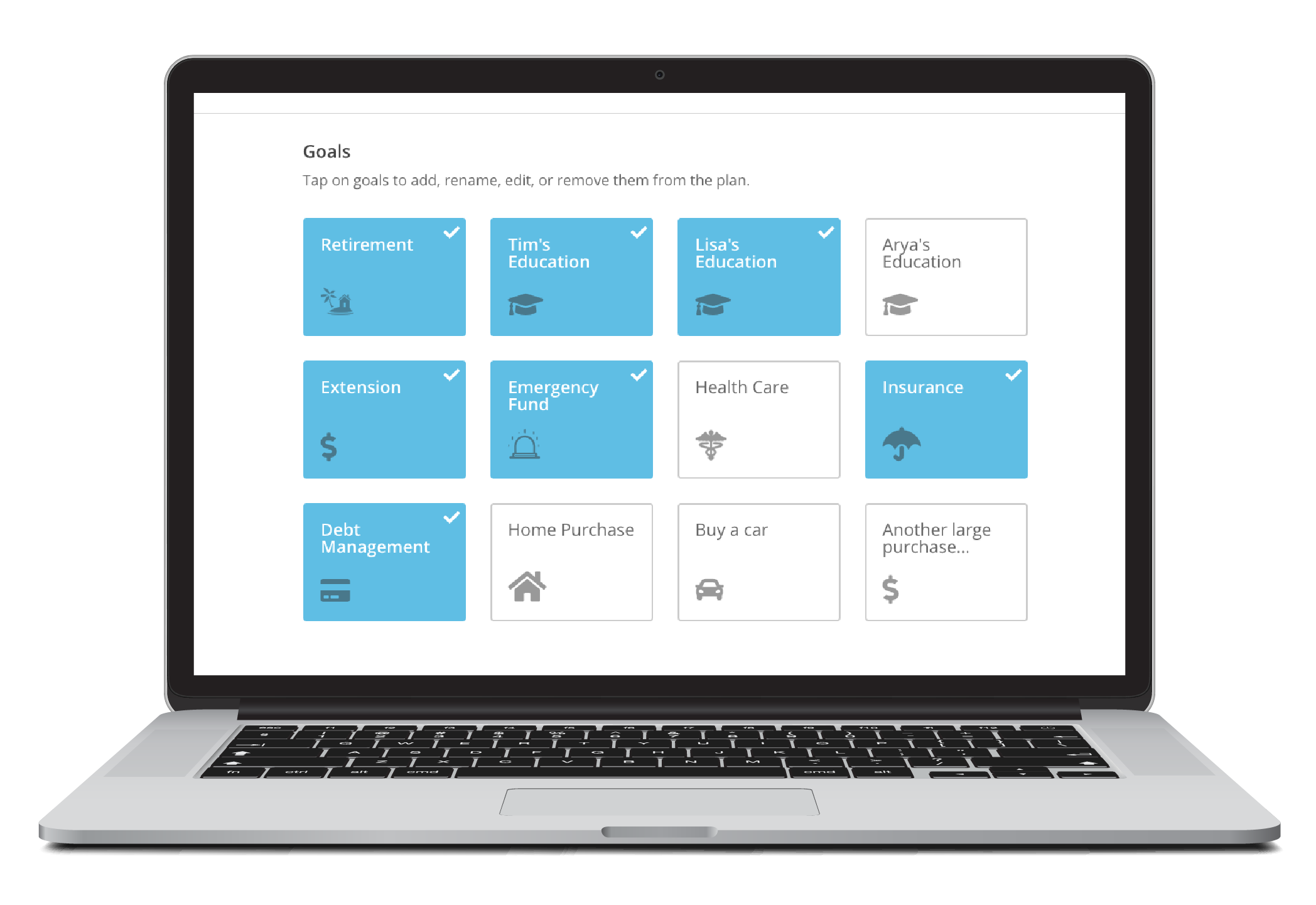

Show your clients how easy it is to start planning with Orion’s quick and easy workflows that gather the necessary information that you need to create dynamic plans.

Tip 3: The Key to Client Success

“Allowing clients to see and understand their overall net worth visually, along with having a detailed budget are key to a client’s success. These two things working together help shape the client’s spending habits and allows them to see that if I do this I can decrease my liabilities and if I do this I can increase my assets, which of course has an overwhelmingly positive impact on their long term financial plan.” -TJ Maher, CFP®, ChFC®, Product Director of Financial Planning

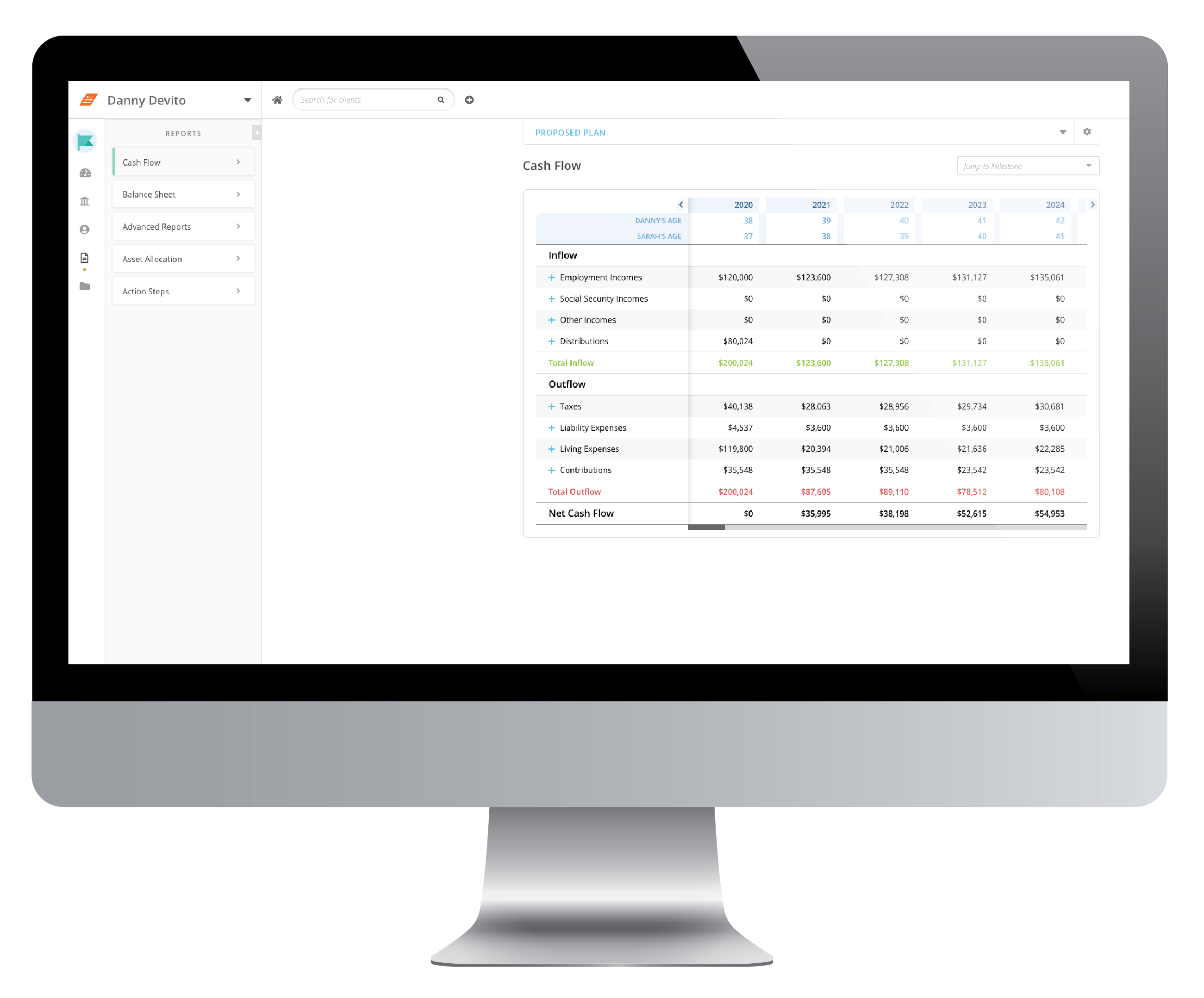

Create reports in Orion Planning to dig deeper into your clients’ financial health and future goals and set the stage to discuss saving and distribution strategies.

Tip 4: Don’t Set It and Forget It

“Once you have a Financial Plan in place, it isn’t something you can set and forget. No one has a crystal ball so it’s hard to predict how our lives will change over time and it’s impossible to predict variables we can’t control like the markets and tax laws. It is important to revisit your plan at least annually to make sure you’re still on track to meet your goals.” -Brian Morgan, CFP®, Product Director of Financial Planning

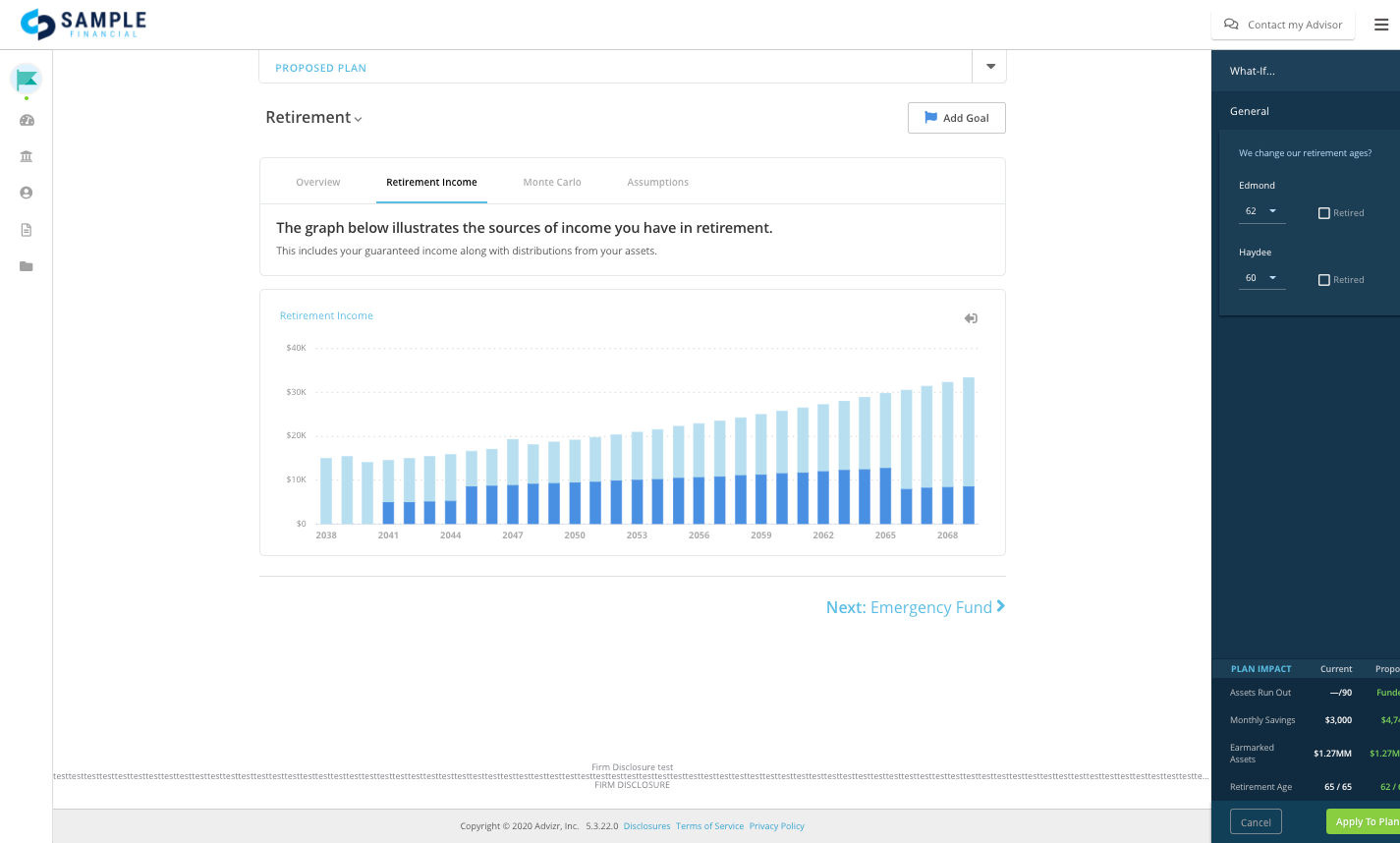

Keep your clients engaged in their finances with our sleek new Client Portal, which houses all of their information in one place.

That’s a wrap on Financial Planning month! We hope you are able to take these tips and ideas and apply them to your business so you can have a strong close to 2020. Check out our webinar to see how you can put these tips into action with Orion Planning. And if you’re not an Orion client yet, what are you waiting for?! We’d love to show you around with a demo.

2843-OAS-10/30/2020