Since the moment it became clear that President Trump was going to be elected for a second term, many investors and consumers have been preparing for a period of higher inflation as tariffs reshape global trade. The voices warning of inflation shocks have been loud for some time now and are likely to continue. In response to the April 2nd “Liberation Day” announcements, Fed Chair Jerome Powell said that if the tariffs are sustained, “they are likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.” JPMorgan Chase CEO Jamie Dimon also advised that “we are likely to see inflationary outcomes” as a result of the trade war.

Even considering Trump’s eventual reversal of some of the shocking initial tariffs that caused a market panic, some may have expected to have still seen some impact thus far from the tariffs that have remained in place.

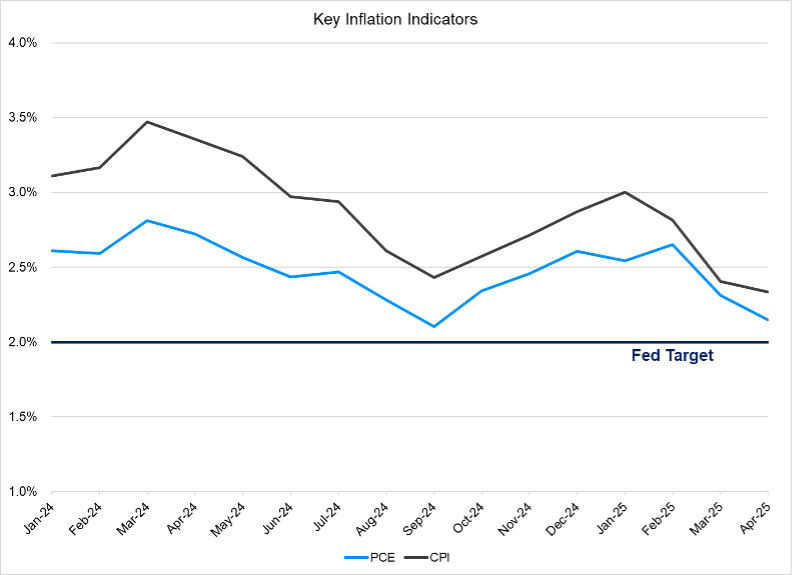

However, the April Personal Consumption Expenditures (PCE) report confirmed what the Consumer Price Index (CPI) report had already suggested: tariffs have not had the immediate impact on prices that some may have expected. Both inflation indicators surprised to the downside in April, with CPI reaching its lowest year-over-year reading since 2021 and PCE coming within 0.1% of the Fed’s target of 2%:

Source: Federal Reserve Bank of St. Louis – FRED

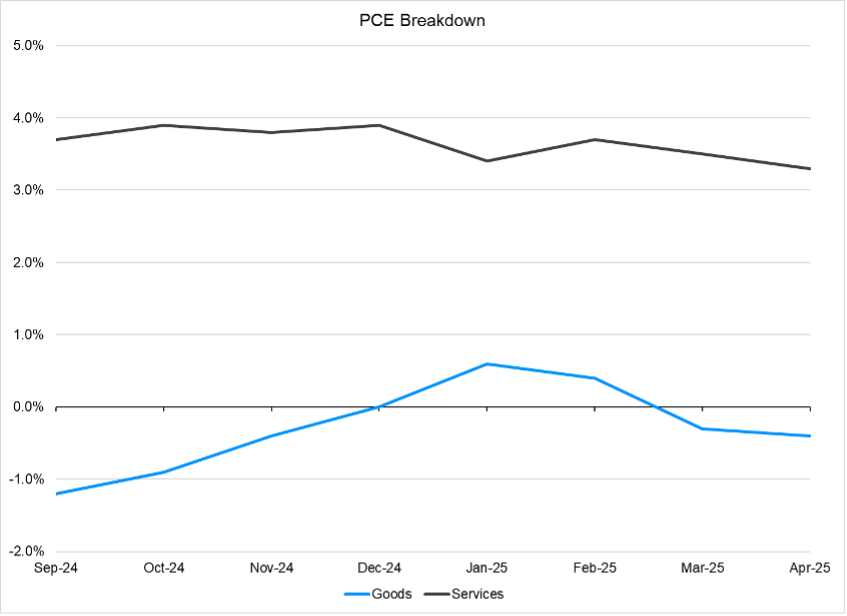

Breaking down the PCE report, we see that services accounted for all of the year-over-year inflation in April, a trend that has been true in six of the last eight reports:

Source: U.S. Bureau of Economic Analysis

Tariff-related inflation would likely directly affect goods while indirectly affecting services, so the relationship of the two components of inflation will be important to watch going forward.

One of the main issues with economic data in such a rapidly developing situation is the time delay. Many economic data releases, like CPI and PCE, are released only monthly. Truflation is a useful tool for monitoring inflation in more real time. It tracks millions of items from dozens of data sources to provide daily updates to their US inflation index. There are key differences between Truflation and the CPI reports, which makes them non-comparable on an absolute basis, but it can help provide directional clues. It is also more heavily weighted to goods than the CPI, which is weighted 64% to services, which is likely why it is currently carrying a lower relative reading than CPI but is also potentially more helpful in identifying the effect of tariffs. The Truflation US Inflation Index rose sharply in May, potentially signaling higher CPI/PCE reports this summer:

Also noteworthy is the difference between consumer and investor inflation expectations. The University of Michigan’s Surveys of Consumers reported year-ahead inflation expectations at 6.6% in May, up sharply from just 3.3% in January. On the other hand, the 2-year break-even inflation rate at the end of May was just 2.6%. The break-even inflation rate is the difference between the yield on a Treasury Bond and a TIPS Bond of the same maturity and is thought to represent the market’s inflation expectations plus a premium for inflation uncertainty. The wide gap between the two figures may be a case study in the polarizing nature and uncertainty of the current economic landscape.

The summer inflation reports will be critical, as the actual tariff effects will become more and more tangible as the current tariff delays are set to expire. If Truflation is any indicator, we may expect to see goods inflation starting to accelerate in the summer CPI reports.

As always, if you have any questions, please reach out to me at nolan.mauk@orion.com, or Orion’s Investment Strategy Team at opsresearch@orion.com.