This afternoon, the Federal Open Market Committee (FOMC) announced another reduction to its benchmark rate, lowering the target range to 3.75%–4.00%. Markets had largely anticipated this move as signs of a cooling labor market have become more visible. Job openings have declined (JOLTS), hiring has slowed (Nonfarm Payrolls), and several major employers have announced layoffs in recent weeks. While the headline unemployment rate remains near 4%, which historically represents full employment, the underlying data tells a more cautious story. Once cracks begin to form in the labor market, weakness can accelerate quickly, which is likely why the Fed has chosen to act sooner rather than later.

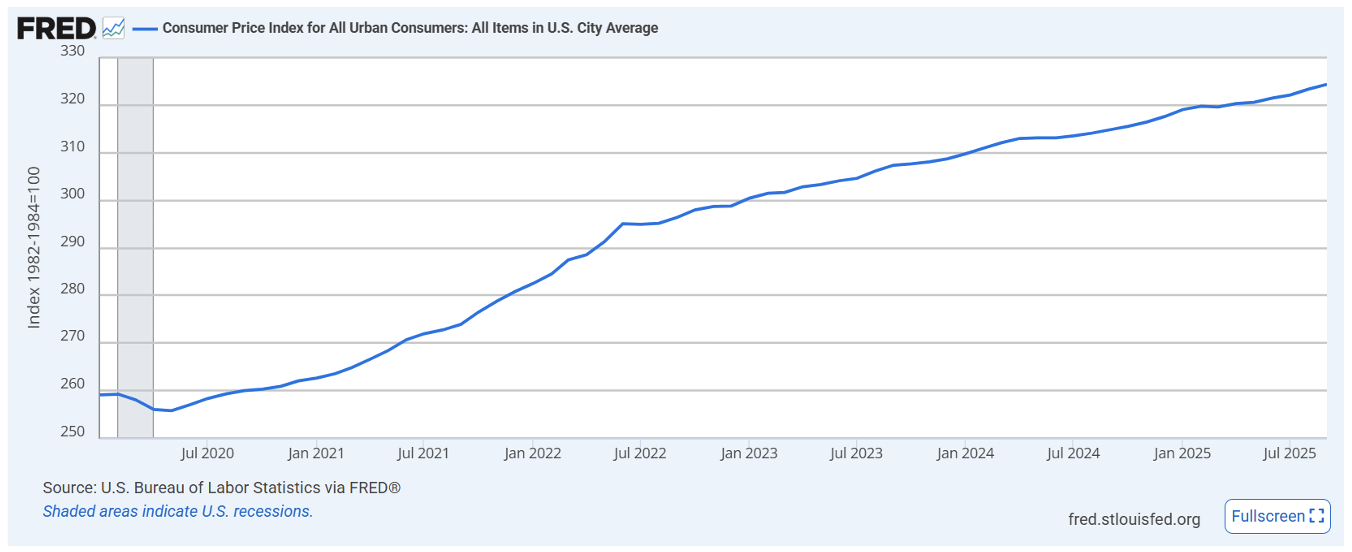

Source: FRED

The Federal Reserve operates under a dual mandate: full employment and price stability. The first of those is showing early signs of strain. The second remains an ongoing concern. Inflation, as measured by the Consumer Price Index (CPI), is currently running at about 3.0% year-over-year. That is well below the 9% peak seen in 2022 but still meaningfully above the Fed’s long-term target of 2%. Since 2020, CPI has averaged closer to 4%, suggesting that price pressures have become more embedded in the economy.

Source: FRED

What makes this recent round of rate cuts more complex is the composition of inflation itself. While categories like used cars, airfares, and consumer goods have cooled, more persistent “sticky” components remain elevated. Shelter inflation, which accounts for roughly one-third of CPI, continues to rise at an annual rate near 5%. Medical services, auto insurance, and dining out have also shown little sign of easing. These are areas that typically respond slowly to tighter policy and could reaccelerate if rate cuts reignite demand.

The FOMC is certainly facing a delicate balance. On one hand, they must respond to signs of slowing growth and labor softening. On the other, they risk undermining their progress on inflation if they ease too aggressively. Tariff developments and supply chain adjustments only add to the potential for renewed price pressures later this year.

For investors and advisors, this environment reinforces the importance of staying diversified, monitoring real returns, and maintaining flexibility across portfolios. The Fed’s next challenge is to sustain growth and a healthy labor market without losing its grip on inflation, a task that has rarely been achieved without some turbulence along the way.