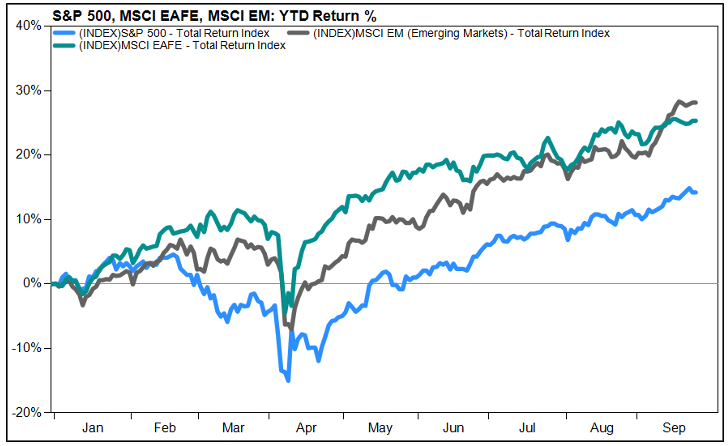

International equities have taken the lead over U.S. stocks this year, on pace to log their greatest calendar year outperformance over US equities since 2006 (MSCI EAFE vs. S&P 500). For a longer-than-average stretch, the U.S. has been the undisputed driver of global equity performance, led by technology and the extraordinary rise of the largest companies in the S&P 500. That story is well known at this point in the year, but what has been less discussed is that conditions are now aligning for ex-U.S. equities to play a bigger role in shaping returns, and investors may benefit from paying closer attention.

Source: Factset, as of 9/23/3035

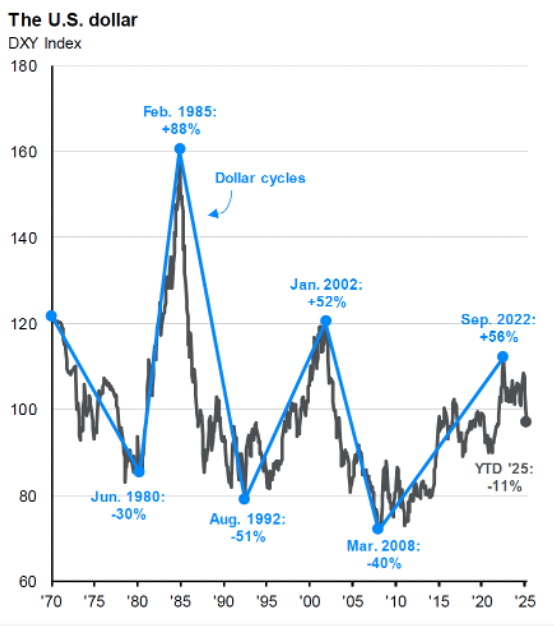

The US dollar is an important place to start. After falling sharply early in 2025, the U.S. dollar has flattened and traded in a relatively narrow range. It may not sound dramatic, but currencies tend to move in long cycles. For years, the dollar has been a headwind for international investing, strengthening against most global peers and eroding currency -unhedged returns for U.S. investors. Now, with the dollar appearing weaker or at least more subdued, that cycle may be turning. A softer currency backdrop creates a natural tailwind for international markets and gives global economies room to gain ground against the U.S.

Source: JPMorgan Guide to the Markets. 6/30/2025

Under the surface, fundamentals outside the U.S. have also shown resilience. Earnings expectations remain intact, economic activity measures (PMIs) are signaling expansion, and recession risks look relatively low compared to the concerns that have persisted in the U.S. and elsewhere in recent years. In Europe, the ramp-up in defense spending is providing a meaningful source of demand. That matters not only due to its boost to economic activity, but also because of the way international indexes are structured relative to the US. These benchmarks lean more toward sectors like industrials, financials, and other value-oriented areas that directly benefit when governments and companies commit to tangible investments in defense and infrastructure.

This sector composition stands in contrast to U.S. benchmarks, which are dominated by technology and growth. While that leadership has been a source of strength for over a decade, it has also created a heavy concentration risk in U.S. portfolios. International markets bring balance, not just geographically, but also in terms of equity style diversification.

Source: Morningstar Direct. As of 9/24/2025

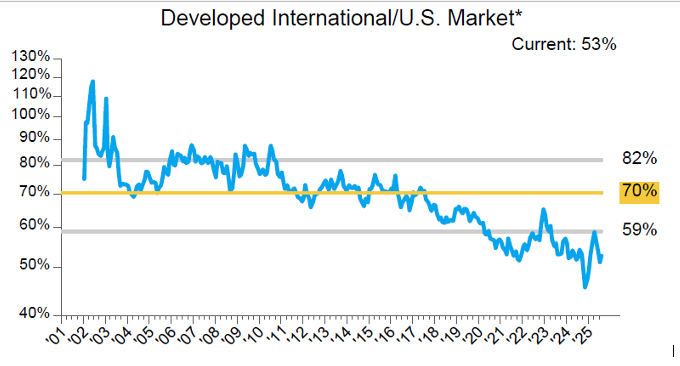

Valuations provide another important angle that has persisted for some time now. Despite this year’s strong performance, international equities remain attractively priced compared to U.S. markets. They are trading at discounts both to their own historical averages and to the premium multiples seen in the S&P 500 today. With U.S. markets stretched by historical standards, international equities offer relative value and, perhaps more importantly, a margin of safety. For investors looking to capture growth without leaning too heavily on already expensive assets, that valuation gap makes the international case even more compelling and potentially set for longer-term strength.

Source: OPS Starting Points Matter Chart Pack. As of 8/31/2025.

Monetary and fiscal policy shifts are also worth noting. Several central banks outside the U.S., including those in the U.K., Europe, Canada, and Brazil, are either cutting rates or leaving the door open for further easing. On the fiscal side, Europe is taking on a more self-reliant role. The U.S. has stepped back from serving as an unconditional security backstop and landing spot for European exports, and the result has been greater domestic investment across the Eurozone. This evolution is pushing Europe toward a more self-sustaining growth path, which we view as a healthy long-term development for both markets and economies.

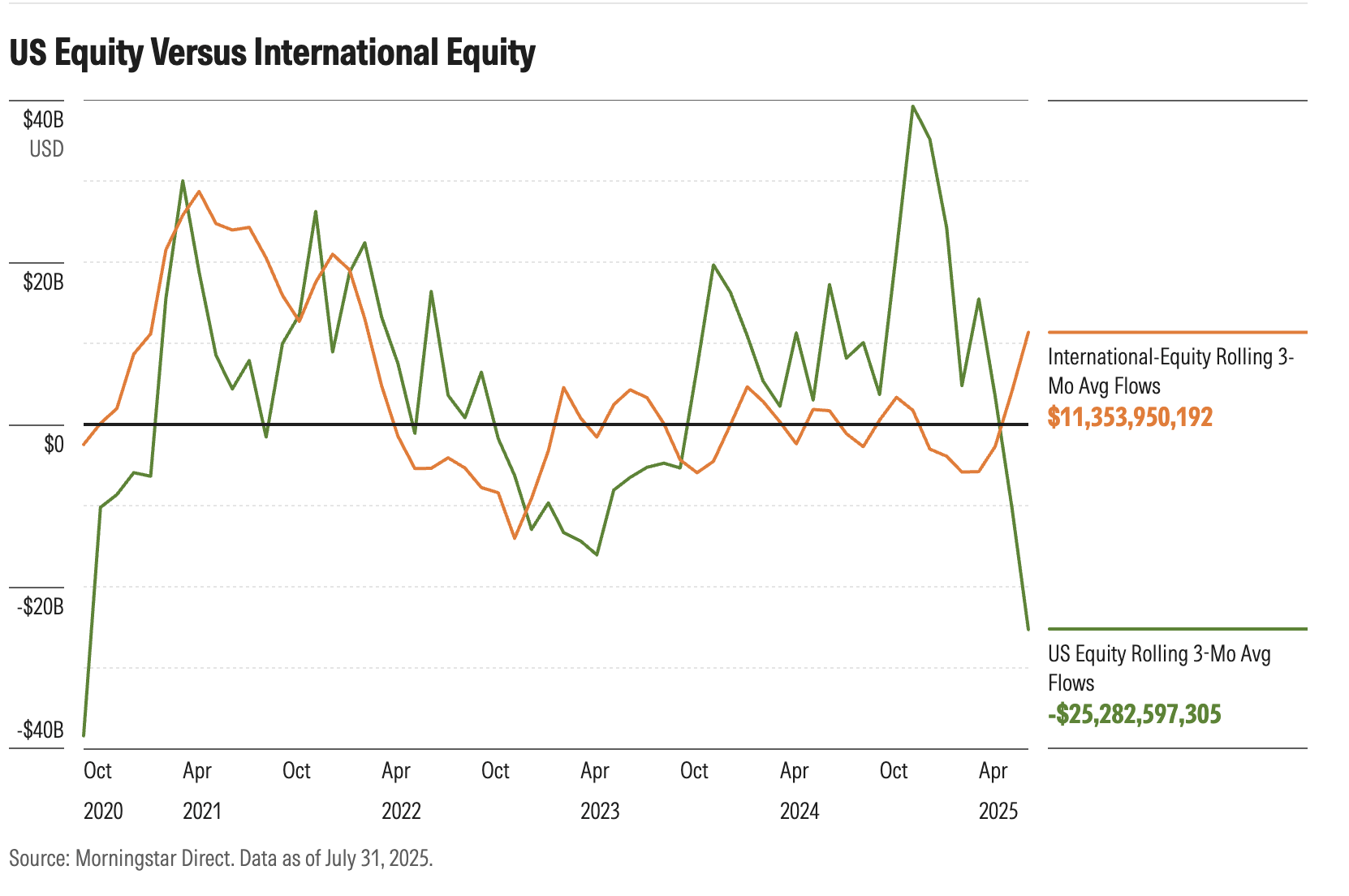

Investor behavior is also beginning to catch up to these changes. Fund flows into ex-US equities have been rising, but ex-US positions remain underrepresented in portfolios relative to market composition despite offering value opportunities. These are incremental moves for now but given how structurally underweight investors have been to international markets for years, even modest rebalancing can serve as a powerful tailwind.

Source: Morningstar: US Fund Flows: Here’s Where Investors Put Their Money in July

All of this points to an important shift in how investors should think about international exposure. For many, the allocation has long been treated solely as a diversification tool, a box to check rather than a source of meaningful returns. Today, the setup may be different. Supportive fundamentals, attractive valuations, evolving policies, and improving flows are all working together to create an environment where international markets are not just offsetting U.S. exposure but are capable of driving performance.

Leadership in markets has always rotated over time. The past decade plus has been defined by U.S. dominance, largely on the back of technology. The next phase may look different. With the dollar on a weaker footing, Europe investing more at home, valuations tilted in favor of foreign markets, and investors slowly rediscovering international opportunities, the conditions could be shifting in favor of larger international positions. For portfolios that have leaned heavily on U.S. growth for years, now may be the right time to make sure international exposure is positioned to contribute.