In a world where markets move faster, headlines hit harder, and investor sentiment whipsaws between fear and euphoria, the simple act of portfolio rebalancing may seem almost pedestrian. Yet, beneath its simplicity lies one of the most powerful risk management practices available to long‑term investors. Rebalancing is the disciplined counterweight to market noise, that silently accumulates over time.

Today’s environment—marked by explosive rallies in technology stocks, surging valuations in AI‑linked companies, and renewed enthusiasm for precious metals—makes the case for rebalancing even stronger. Let’s explore why.

The Silent Risk of Portfolio Drift:

Even the most carefully designed asset allocation is a snapshot in time. The moment markets open, the portfolio begins to drift. If equities rally, your stock exposure grows; if bonds sell off, fixed‑income shrinks. Over months or years, that drift can shift a portfolio meaningfully away from its intended risk profile.

For example:

An investor targeting 60% stocks / 40% bonds might have drifted to 75% / 25% during extended bull runs.

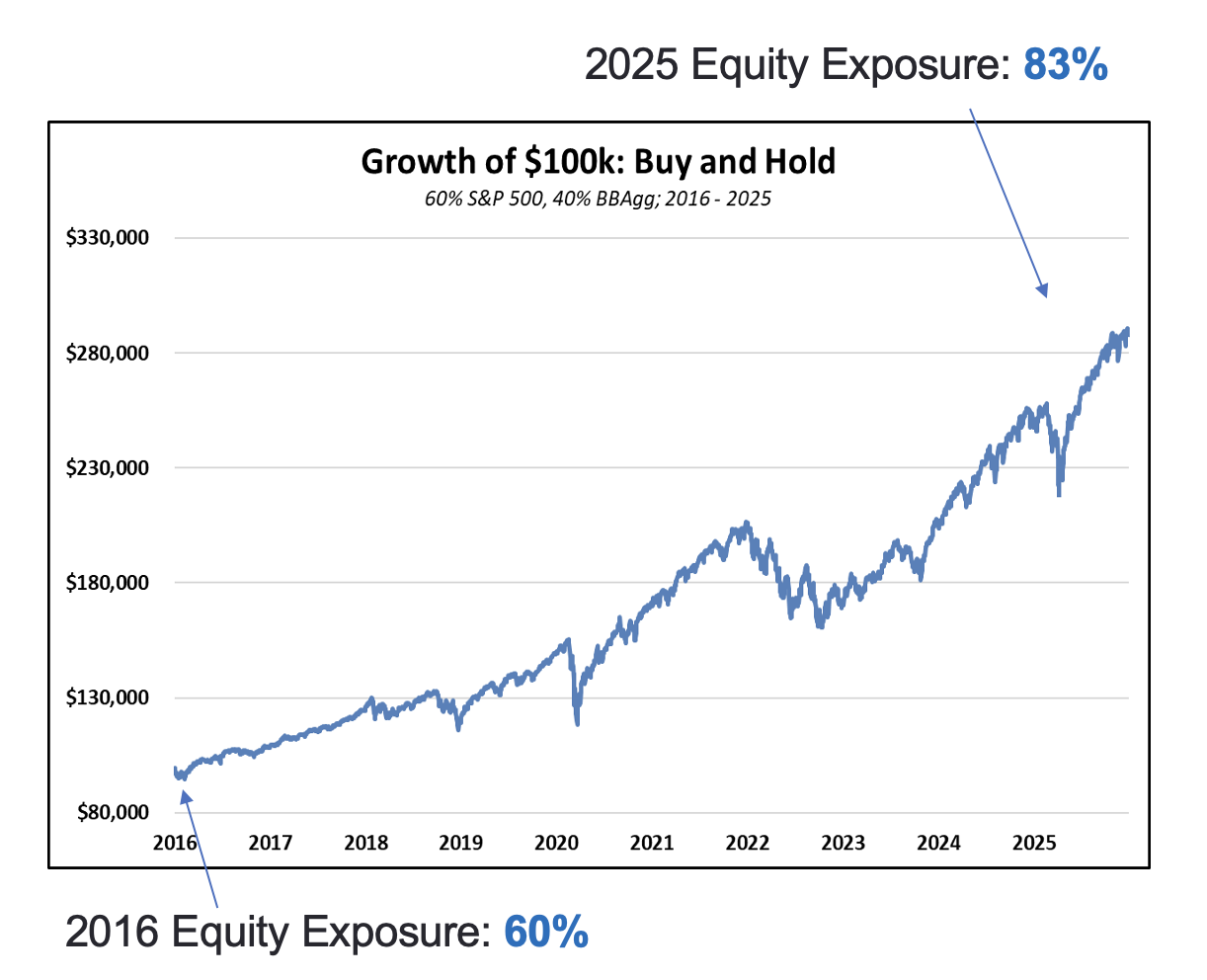

Consider the past 10-year period for US equities. In the absence of a portfolio re-balance overlay, a portfolio that began as a 60/40 risk model would have drifted to 83% equity exposure by 2025. For investors aiming to diversify risk and protect against equity volatility, the absence of a re-balance could leave them significantly over-exposed during the next drawdown period.

Source: FactSet

Why Portfolio Drift Becomes Dangerous:

Portfolio drawdowns rarely occur at convenient times, and they are almost always magnified when drift has inflated risk exposure.

Recent History is filled with examples:

- In 2000, investors overweighted in technology—many unintentionally after years of outperformance—suffered crushing losses when the dot‑com bubble burst.

- Real estate exposure became dangerously high in the mid-2000s, a significant precursor to the global financial crisis.

- In 2008, portfolios that drifted aggressively toward equities during the early‑2000s bull market experienced disproportionately severe losses when the financial crisis hit, as major indices were halved in less than 18 months.

- The commodity super-cycle ended in 2011, as China slowed down global consumption, leaving crude oil, base metals, and precious metals prone to substantial declines.

- In 2022, inflation and interest rate hikes dented growth expectations, which saw tech behemoths fall 50% - 80% from their peaks.

- 2025 brought a two-month decline of -19% for the S&P 500 as trade uncertainty tripped up investors.

Rebalancing effectively forces a systematic reduction of over‑weight positions before they morph into concentration risks that can devastate capital in a downturn.

Avoid Complacent Investing:

Investors are prone to extrapolation; the belief that what has worked recently will continue indefinitely. This complacency takes many forms:

- Sector euphoria: Multi‑year rallies can seduce investors into thinking a handful of thematic companies will forever remain market darlings.

- Short‑term bias: Investors overweight whatever “worked” in the past 6–12 months, treating short performance bursts as long‑term inevitabilities.

- Commodity chase: Sudden spikes in gold, silver, or industrial metals can lure investors into over-allocating to tactical trades that disrupt strategic balance.

- Home‑country bias: Favoring domestic markets simply because they feel familiar—even when global diversification improves stability.

- Confirmation bias: career field expertise, political views, and geographical familiarity can interfere with investment decisions.

- Recency bias: What worked before may not work during the next evolution of the macroeconomic landscape.

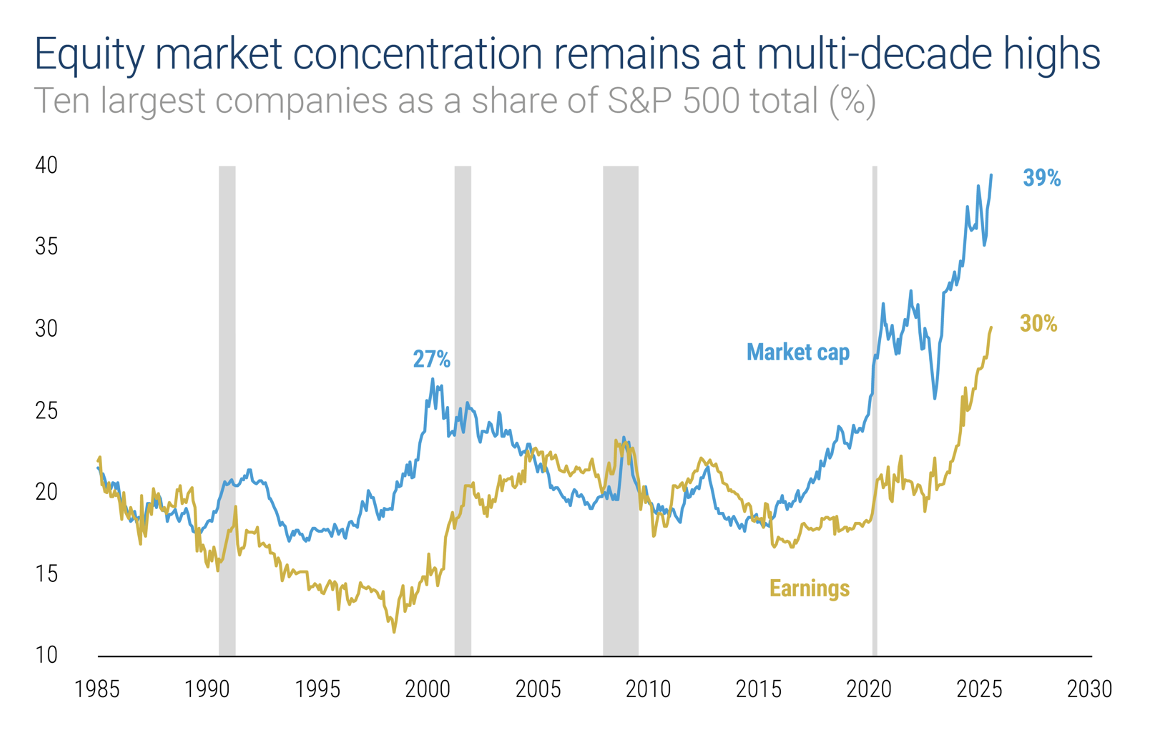

- Unintentional concentration risk: When major indices morph into unrecognizable measures of stock market health.

Without rebalancing, these behaviors accumulate gradually, nudging investors toward portfolios they would never intentionally construct.

Source: Goldman Sachs

A Simple, Powerful Habit:

Rebalancing doesn’t require prediction. It doesn’t ask you to guess which asset class will lead or lag. Instead, it simply requires:

- A target allocation

- A tolerance band

- A consistent schedule (annual, semiannual, or threshold‑based)

It is one of the few areas in investing where a rule‑based approach consistently trumps emotion and instinct.

Final Thoughts:

Portfolio rebalancing protects investors not just from market turbulence, but from themselves. In an investing world overloaded with complexity—factor models, AI‑driven portfolios, tactical tilts—the simple act of returning to your chosen allocation remains one of the most effective, evidence‑based tools for risk control.

Rebalancing returns your footing to solid ground. Because ultimately, successful investing is rarely about predicting the future and can be as simple as preventing avoidable mistakes. Is it a good time to review your client’s asset allocation? We think so!