U.S. stocks are beginning year four of an exceptional bull market that has nearly doubled the S&P 500 level from its bottom in the fourth quarter of 2022 – coincident with the initial release of ChatGPT. The dawn of the AI revolution sent markets into a frenzy and launched a rally characterized by narrow breadth and raging animal spirits on the backs of just a handful of tech powerhouse stocks, driving valuations to near all-time highs.

Although big tech continues to lead in 2025, the exuberance of last year has given way to caution. AAII Sentiment readings have been among the most bearish on record even as the S&P 500 is up nearly 20% year-to-date. Elevated valuations and public speculation around a potential AI bubble have brought nerves and fear back to markets, with small headlines triggering short-term selloffs. As a result, many are reassessing concentration risk and seeking diversification.

However, at the same time that some investors grow more skeptical of large cap growth, cash is needing to be deployed as money market yields continue to drop. We’ve talked a lot about opportunities in international markets and diversifying asset classes, but we can also find diversification opportunities in less crowded areas of the U.S. market.

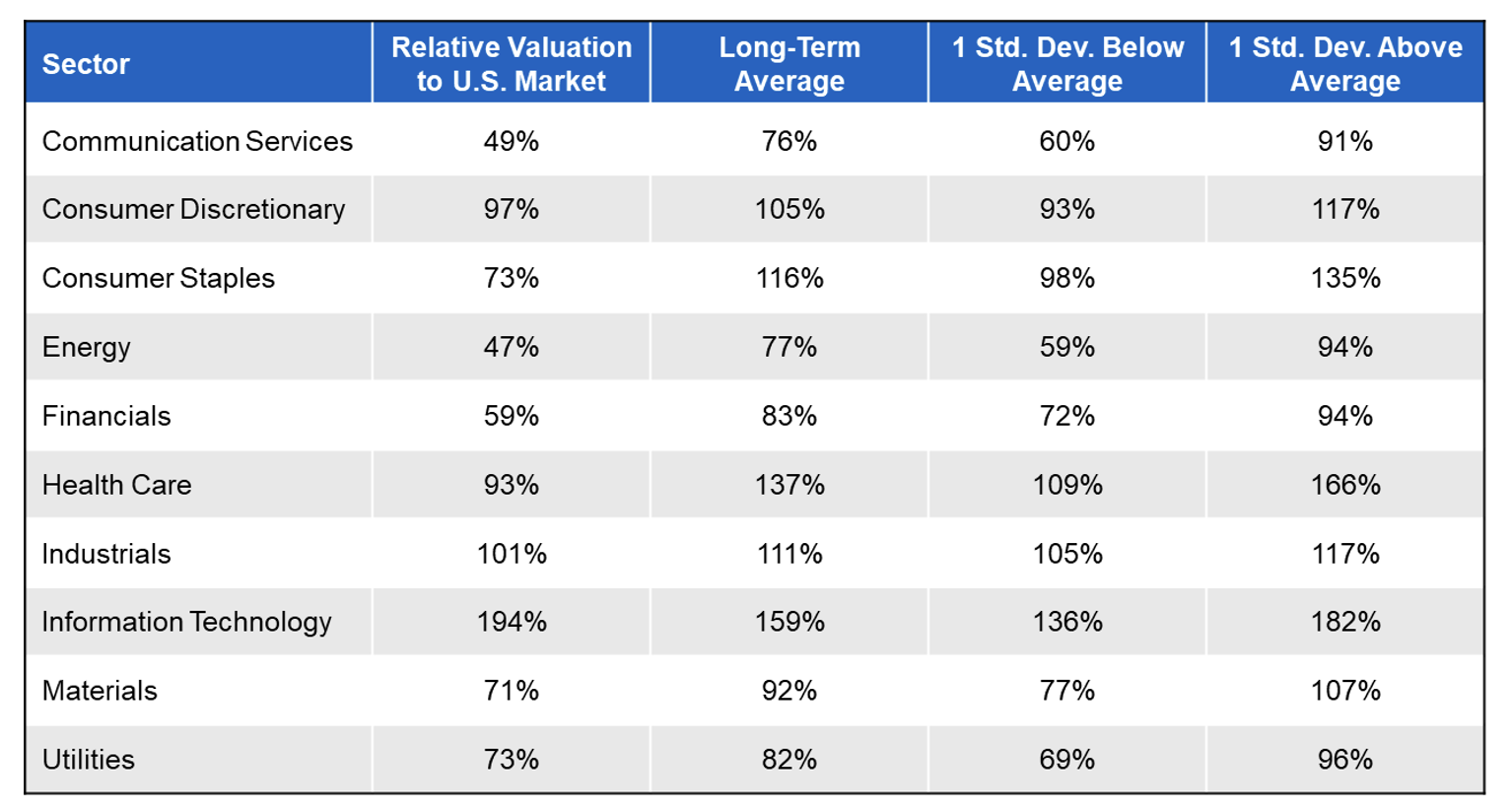

Relative Valuations

We use our Starting Points Matter Monthly Chart Pack to watch long-term relative valuation relationships between market segments. It’s important not to use valuations as short-term market timing tools, as extreme relationships can persist over long cycles, but we do view the chart pack as a tool to identify opportunities for long-term investments, and there are plenty in the U.S. at the moment. Sustained market leadership has led the tech sector to its highest weight in the S&P 500 in history, making up over 34% of the index today compared to 33% in 2000, presenting unique concentration risks to investors in the index. The sector has grown so quickly and become so richly valued that every other sector is trading below its long-term average valuation level relative to the whole U.S. market, and eight sectors are trading more than one standard deviation below average:

Source: Factset, Starting Points Matter Chart Pack. As of 11/30/25

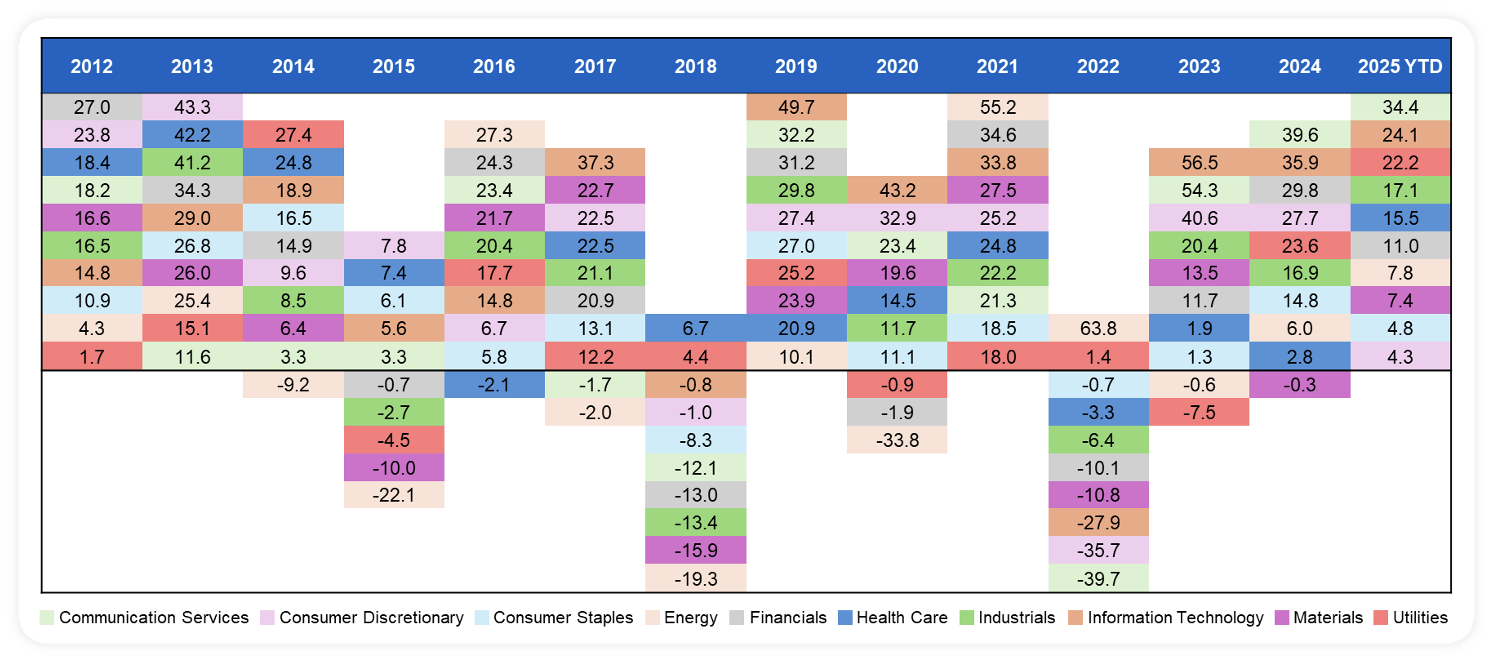

On a relative basis, these sectors are trading at larger discounts or smaller premiums than average, providing a potential entry point for long-term diversification positioning. Just like regions, styles, market caps, etc., sectors go through cycles of relative performance. The quilt chart below shows the annual returns of each sector, highlighting the importance of diversification as individual sectors cycle in and out of favor over time.

Source: Morningstar Direct as of 11/30/25

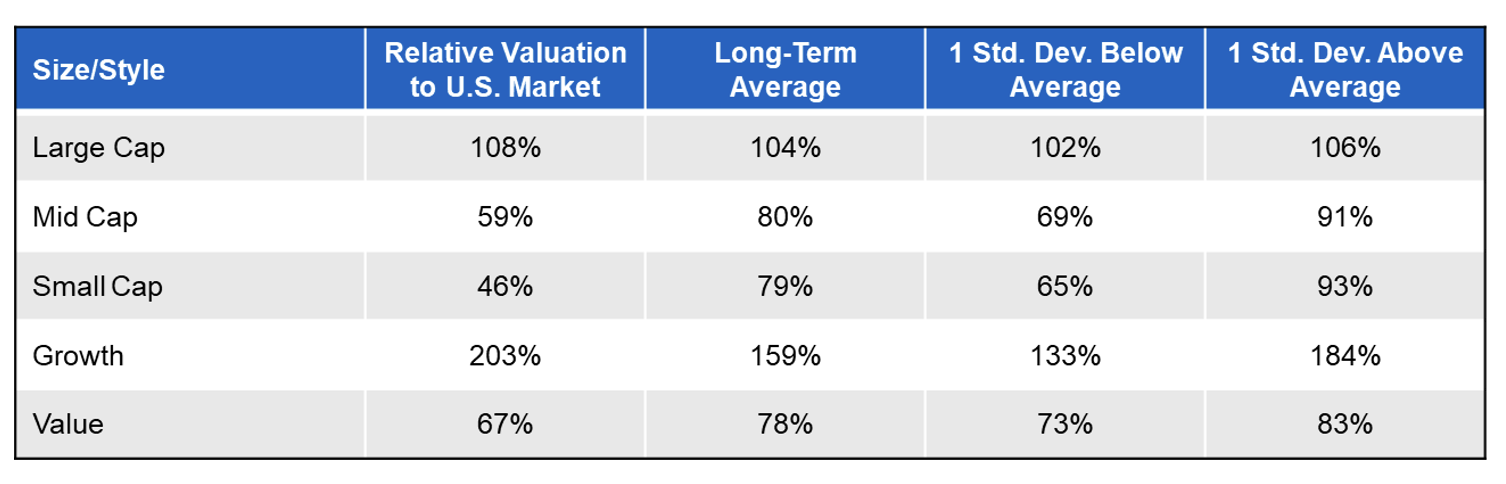

Unsurprisingly, the large-cap growth leadership has left value stocks, small-caps, and mid-caps significantly undervalued relative to the U.S. market compared to history as well:

Source: Factset, Starting Points Matter Chart Pack. As of 11/30/25

Identifying undervalued segments of the market is useful for analyzing relationships and locating long-term entry points, but we believe some catalysts for the rest of the U.S. market to begin to catch up with large-cap growth are starting to take shape and may be approaching.

Outlook on Market Broadening

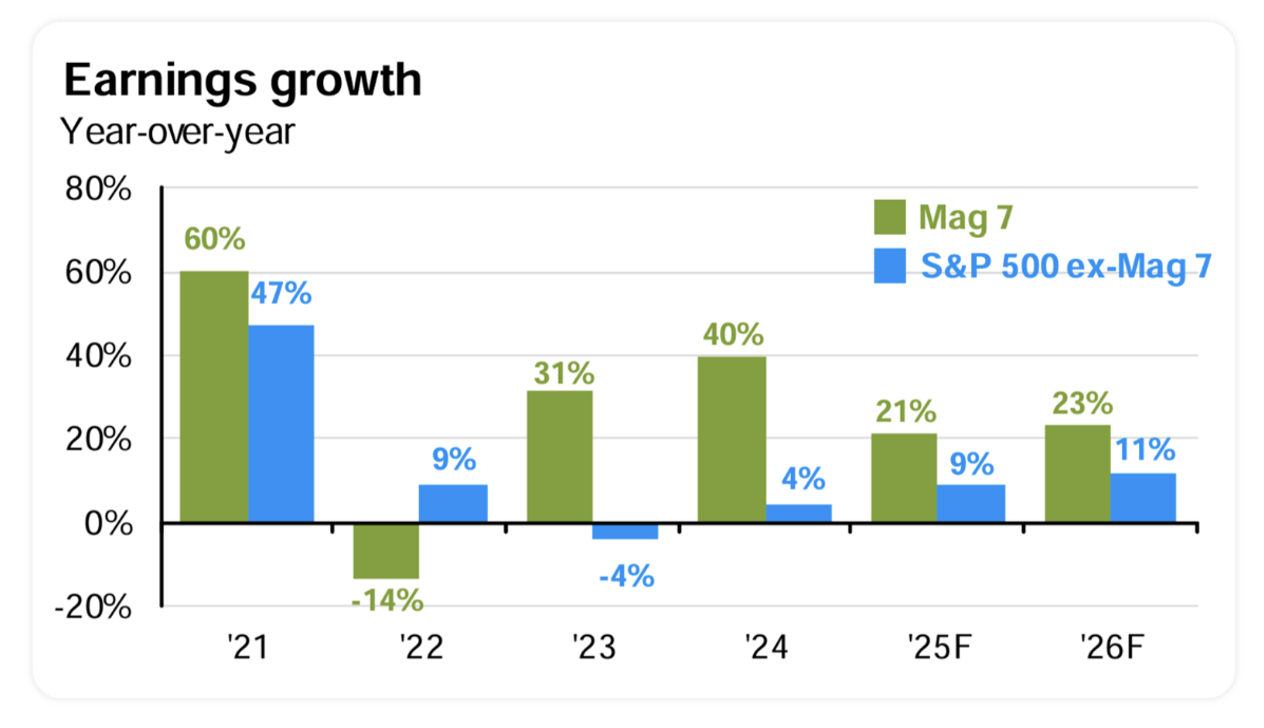

Looking ahead to 2026 and beyond, we see several opportunities for market broadening and the potential for less reliance on a few names for continued market growth. First, within the S&P 500, we’re encouraged by the fact that earnings growth between the Magnificent 7 and the “S&P 493” have started to converge, and analysts expect non-Mag 7 earnings growth to continue accelerating into 2026:

Source: J.P. Morgan Guide to the Markets, as of 12/8/25

We view the outlook for monetary and fiscal policy positively as well. Tax cuts and refunds should have a stimulative effect on the economy in 2026, and interest rates are expected to continue to decline throughout the year, which has especially been a tailwind for small-caps historically. Markets are already seeing this as likely, as the Russell 2000 index has recently stretched to new all-time highs for the first time since October 2021. Strength in small-caps is a positive sign for market breadth heading into the new year.

We also expect to see more positive regulatory developments around banking deregulation, healthcare, and reporting requirements. These deregulatory initiatives have been less of a focus of the administration to this point than some expected, but with midterms approaching it’s feasible that they would become more top-of-mind in early 2026. These developments would be supportive of market broadening as well.

Finally, we don’t view the AI trade as an all-or-nothing outcome where only a select few companies benefit long-term. A key element to technological revolution is mass adoption and integration across all industries. Right now, the winners from AI are the companies involved in developing, powering, and building the infrastructure for further growth in the space. Soon, however, companies who have nothing to do with the creation and distribution of AI may start to become more efficient and profitable from leveraging AI in their own way. This phase may not happen overnight but is an expected long-term outcome of AI integration.

As concentration risks reach all-time highs in the S&P 500, U.S. investors can look to other sectors, styles, and sizes within domestic equity markets to remain diversified for the long-term.