As a financial professional, you’ve likely heard this common client concern when markets are at or near all-time highs:

“If I invest at these levels, won’t I just be buying at the peak? Shouldn’t I wait until markets pull back to invest?”

At face value, the question makes sense. It echoes the intuitive idea of “buy low, sell high.” But history tells us that this mindset, while logical on the surface, can be short-sighted and rooted more in emotion than disciplined investing.

All-time highs can stir up mixed emotions. Clients may feel proud and excited seeing their portfolios reach new records and feel the urge to increase aggression. At the same time, those highs can cause anxiety, as investors worry about how long the good times can last, potentially creating reluctance or fear. These mixed feelings can often lead to rash decision-making if left unchecked. As we, and many others, have emphasized before: emotional decision-making and investing rarely mix well.

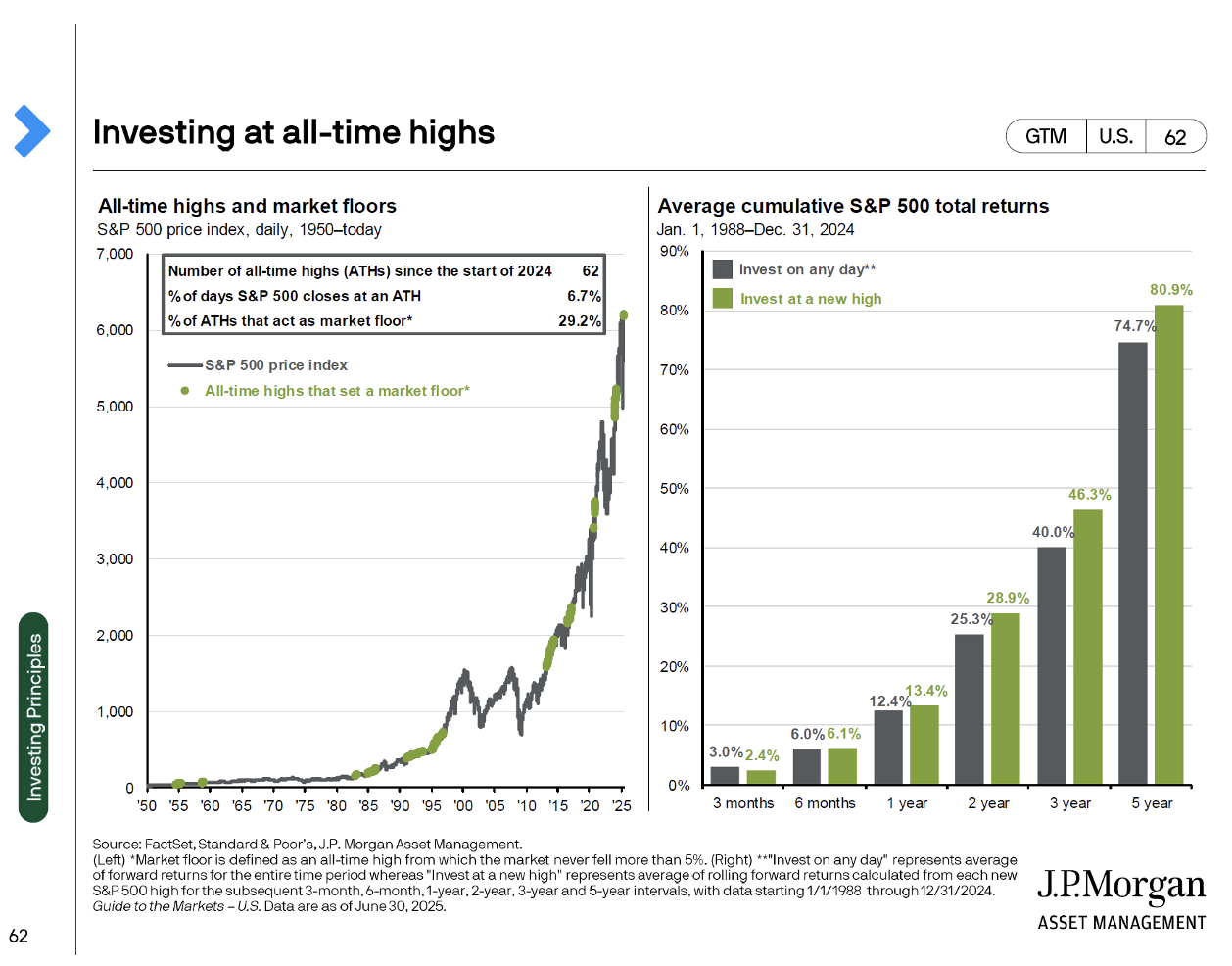

History reinforces this lesson. Since 1950, the S&P 500 has delivered positive returns in 78% of calendar years, or 59 out of the last 75. Naturally, that persistent upward trend has produced a lot of all-time highs. In fact, according to JPMorgan, nearly 30% of all-time highs end up becoming a new “floor,” with markets never pulling back more than 5% from that point. Even more surprisingly, investing at all-time highs has historically produced better, not worse, forward returns*. Since 1988, investors who bought at new highs earned an average 6.2% higher cumulative return* over rolling five-year periods than those who invested on any random day.

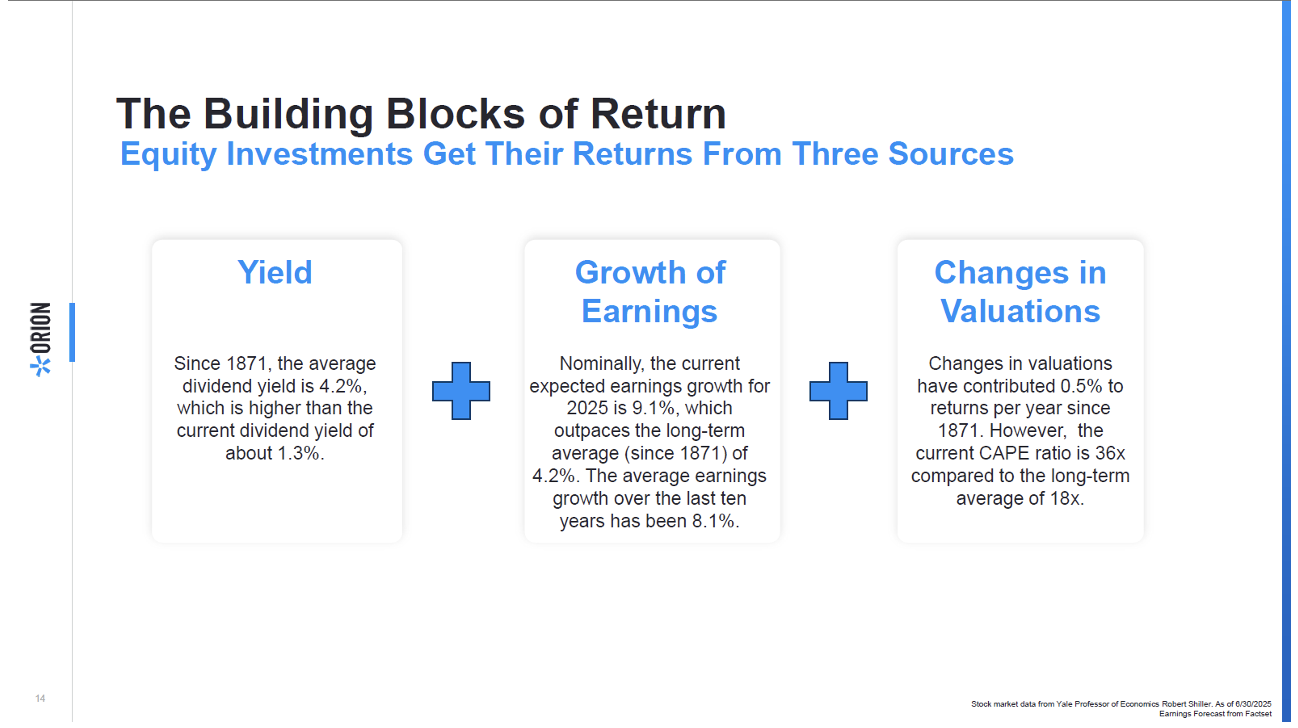

While this statistical framing shows us that the odds are in our favor as investors, risks are, of course, ever-present. Generally speaking, there are three key building blocks of total return in equity investing: yield, growth of earnings, and changes in valuations. Breaking these down, we find that the yield environment is lower than historical average, but earnings growth and valuations are higher than average. This creates both opportunity and risk.

Risks:

- Lower equity yields mean less income as a cushion during periods of volatility, and less natural support for those who rely on dividends.

- Valuations are near all-time highs and are historically mean reverting, which can limit upside and increase the risk of multiple contraction over time.

Opportunities:

- Companies reinvesting cash rather than paying it out as dividends may signal confidence in growth opportunities ahead.

- Earnings growth remains strong relative to history, and higher earnings generally translate into stronger long-term returns.

- Valuations do not move in rapid cycles, and continued earnings strength can justify elevated valuation levels in the intermediate term.

The Bottom Line

All-time highs should not be viewed as red flags. They are a natural outcome of economic growth, innovation, and long-term market progress. While valuations today are high and risks are ever-present, history shows that investing at new highs has been far from a losing strategy and has often been a rewarding one.

For clients, the message is clear: waiting for the “perfect” entry point risks missing the market’s most consistent trend, which is upward progress over time. Staying disciplined, diversified, and invested remains the most reliable path to long-term success.