Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- Much has been written about American Exceptionalism – specifically from an economic point of view – these past few years. If we were to sum up the belief it would be our economy is distinct from and superior to most if not all others, more innovative and dynamic, home to the world’s most successful companies and compelling investment opportunities (think the Magnificent Seven from a business model and stock market return perspective). And the outperformance of the US economy and US markets relative to other developed and emerging economies and markets going through and coming out of the pandemic drove this idea home.

- Recently, some have questioned the durability of American Economic Exceptionalism citing US debt and policy uncertainty as catalysts for global investors to reconsider America as a home for their capital. As proof points, the outperformance of international equities and the drop in the US dollar year-to-date are cited.

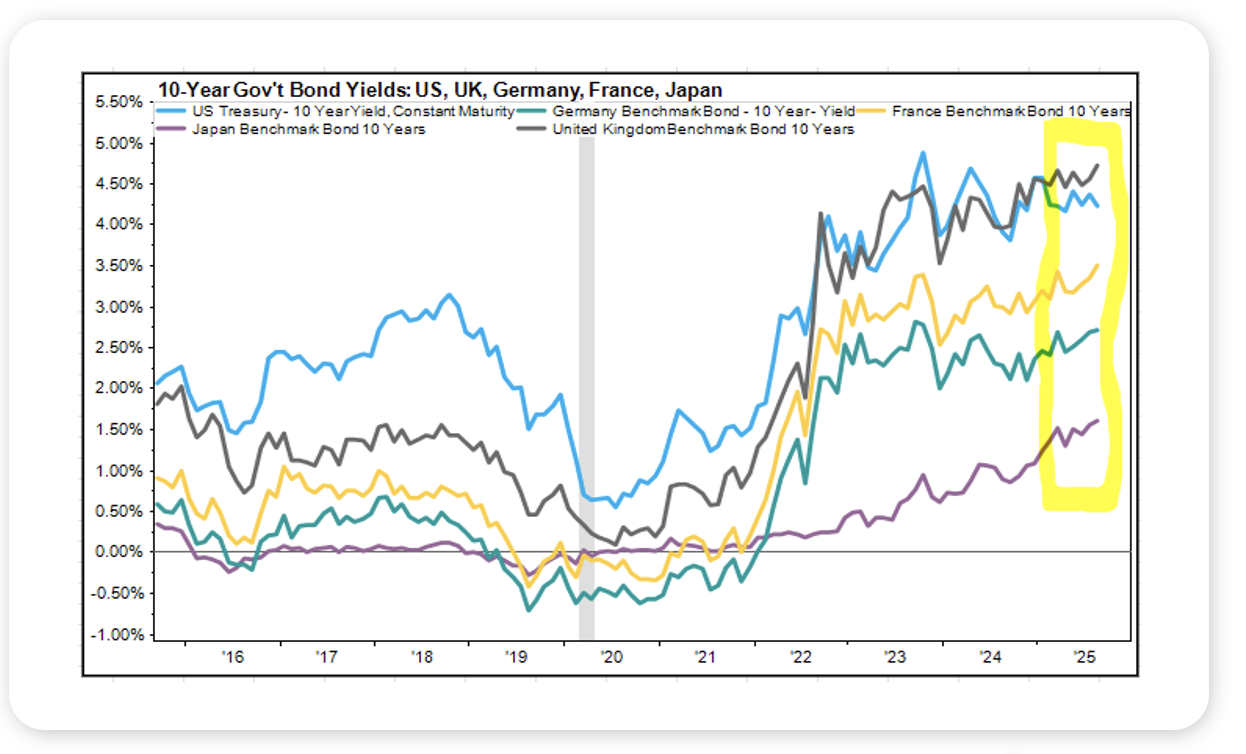

- While our investment team is optimistic on international equities, we don’t think of investing as a zero-sum game, believing international and US equities can rally in tandem (and we have seen that in 2025, with the S&P 500 up 11%). As it concerns the dollar, it trades well within its 30-year range and above where it traded for most of the 2000s. More importantly, we think the performance of global bond markets of late speaks to the ongoing attractiveness of US financial assets. Consider that US government bonds have rallied in 2025, pushing yields lower, while government bonds in other important markets – the UK, France, Germany and Japan – have sold off, pushing yields higher (see chart, far right). As it concerns weakness overseas, at the risk of oversimplification, catalysts seem to include concerns about political and fiscal stability. Here at home, one could argue economic weakness and the prospect of lower rates are pushing yields lower. That said, if global investors were genuinely worried about the US from a structural point of view, one might think our borrowing costs would be moving higher, not lower.

- The US confronts – as always – any number of economic challenges. Yet, we remain home to the world’s largest, most important economy and the world’s reserve currency and we don’t see any of that changing anytime soon.

Source: FactSet, September 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets posted another strong week, with the NASDAQ 100 rising nearly 2% finishing the week with three consecutive record high closes. Global equities broadly advanced, and bonds extended their 2025 strength as falling rates pushed core fixed income up more than 2% for the quarter and more than 6% YTD. The US dollar slipped nearly 1% and is now down more than 10% YTD, continuing to provide support for international equities.

Economic data delivered few surprises. The Consumer Price Index rose 0.4% in August and is up 2.9% year-over-year. Producer prices told a different story, falling 0.1% versus consensus expectations of a 0.3% increase. Both measures support the view that inflation is moderating, even if year-over-year readings remain elevated.

Rates moved lower across the curve. The 10Y Treasury yield is once again approaching 4%, its lowest level since April, while mortgage rates have fallen quickly in recent weeks. The CME FedWatch Tool shows a 100% probability of a September cut, with markets assigning a 6% chance of a 50 bps move and an 80% chance of at least three cuts before year-end.

This Week

The Federal Reserve’s September meeting on Wednesday is the headline event. Markets expect a 25 bps cut, with the statement and Powell’s press conference likely to drive more reaction than the cut itself. Retail Sales data will also be closely watched, as it provides a direct read on the US consumer.

Earnings season is largely quiet, with only a handful of companies reporting. According to FactSet, Q3 earnings growth for the S&P 500 is expected at 7.6%, which would mark the ninth consecutive quarter of growth.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.