Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- Beyond trade, the topic most on Wall Street’s mind these days is monetary policy; more specifically when will the Federal Reserve cut rates. As of now, investors are convinced that after passing at its January, March, May, June and July meetings, the Fed will cut rates by a quarter point at its September meeting – and more than a few pundits believe the Fed wishes it had cut rates at its July meeting in light of the very disappointing July jobs report that landed just two days after the central bank met and decided to hold the Fed Funds Rate steady between a range of4.25% and 4.50%. Barring a bit of shockingly bad inflation data between now and the Fed meeting on September 17th, we think the Fed will cut next month, and we think the bond market is giving it the greenlight to do so.

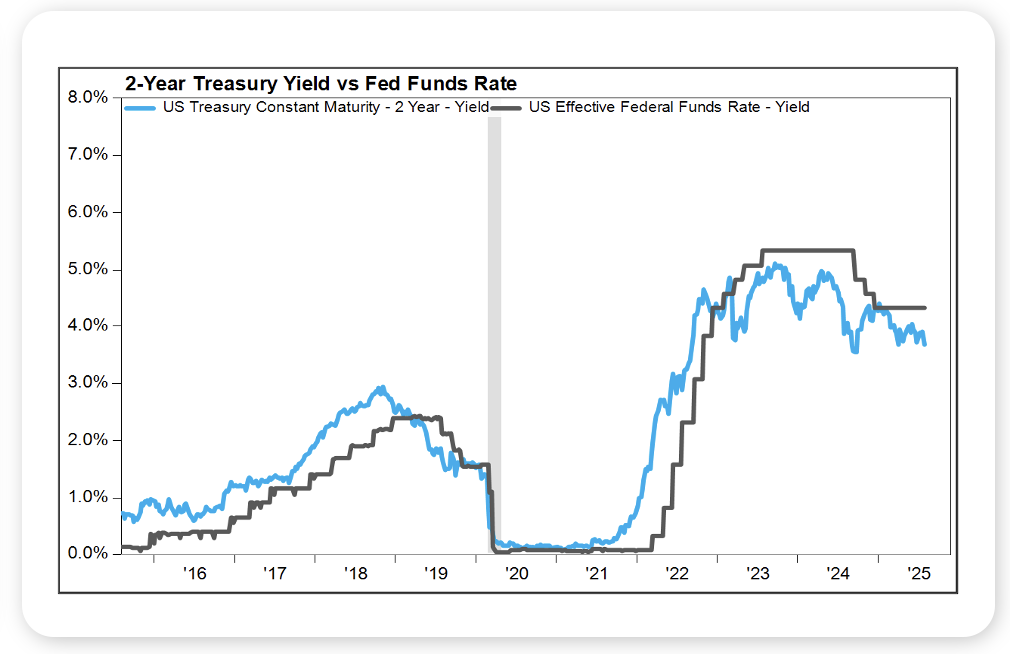

- As we know the Fed has a dual mandate – maximum employment and stable prices – and the best explanation we have come across that speaks to how the Fed uses monetary policy to achieve those goals comes from the Fed itself (see box below). As the Fed notes, and we think most economists would agree, monetary policy most directly affects the current and expected future path of short-term interest rates. Well, the bond market seems to be anticipating a more dovish Fed, as the yield on the US 2 Year Note has fallen to 3.70%, more than 50 basis points below the Fed Funds Rate (see chart below). The bond market is giving the Fed the greenlight to cut rates in September, and maybe in October and December too.

Source: Federal Reserve, 2025

Source: Factset, August 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Equity markets pushed higher last week, with global equities gaining over 2% despite the reimplementation of many reciprocal US tariffs on August 7. Gains were led by US technology stocks and developed international equities, while the US dollar fell nearly 2% following a sharp rally the week prior. Fixed income prices fell slightly on higher rates, and all major asset classes remain positive year-to-date, with international equities still leading domestic and large caps ahead of small caps.

Q2 earnings results remain robust. With 90% of S&P 500 companies reporting, 81% have posted positive EPS and revenue surprises. Earnings growth for the quarter stands at 11.8%, marking the third consecutive quarter of double-digit growth.

Market structure trends continue to draw attention. The top 10 stocks in the S&P 500 now represent over 40% of the index, the highest concentration on record. The largest 10% of US stocks now make up 76% of total US equity market capitalization, surpassing prior peaks from the Dot-Com era.

Economic data offered mixed signals. The US trade deficit narrowed slightly in June to $60.2 billion, below expectations. ISM’s Non-Manufacturing Index slipped to 50.1 in July, just above the expansion threshold, suggesting services activity is losing momentum. Labor market concerns remain in focus after recent softness in payroll data, though job openings have stopped declining — a potential sign that conditions may be stabilizing.

On the rates front, the yield curve steepened last week as short-term rates fell and long-term rates rose. The average mortgage rate declined slightly. The market-implied probability of a September rate cut climbed to 89% from 80% the prior week, with futures still pointing to two or three cuts before year-end.

This Week

The week ahead brings key inflation data, with the July Consumer Price Index due for release. A softer-than-expected reading could push short-term rates lower as expectations for Fed easing strengthen, while an upside surprise may dampen that view.

Trade developments will also be watched closely, as the US and China face an August 12 deadline to extend their tariff pause or finalize a broader agreement. Earnings season continues, with several AI-related companies set to report.

Earnings season continues, but the heaviest reporting period is now behind us.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.