Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- The Fed is top of mind once again (maybe it’s always top of mind?) as Wall Street digests President Trump’s effort to fire Fed Governor Lisa Cook. As has been widely reported, the President has cited an accusation of mortgage fraud as grounds for the firing, an effort Governor Cook is resisting. Our best guess is Governor Cook’s fate will be decided by the courts, most likely the Supreme Court. It is worth noting, that if the President succeeds in firing Governor Cook, he will have two vacancies to fill on the Board of Governors, ultimately enabling him to appoint four of seven Governors.

- That written, this note is focused not on the fate of the Board of Governors, but on the fate of FAIT (the Fed’s “Flexible Average Inflation Targeting” framework). Adopted in August 2020, FAIT made the case that the Fed, instead of targeting a symmetrical 2% inflation target overtime, could allow inflation to overshoot 2% to make up for prior periods where inflation ran below target. The introduction of FAIT followed an extended period of modest US economic growth and inflation; a stretch largely attributed to the deflationary effects of the Global Financial Crisis and was seen by many as biasing the Fed towards the full employment side of its dual mandate (and away from price stability). FAIT’s launch, in hindsight, was poorly timed, as it coincided with the onset of the worst US inflation in 40 years.

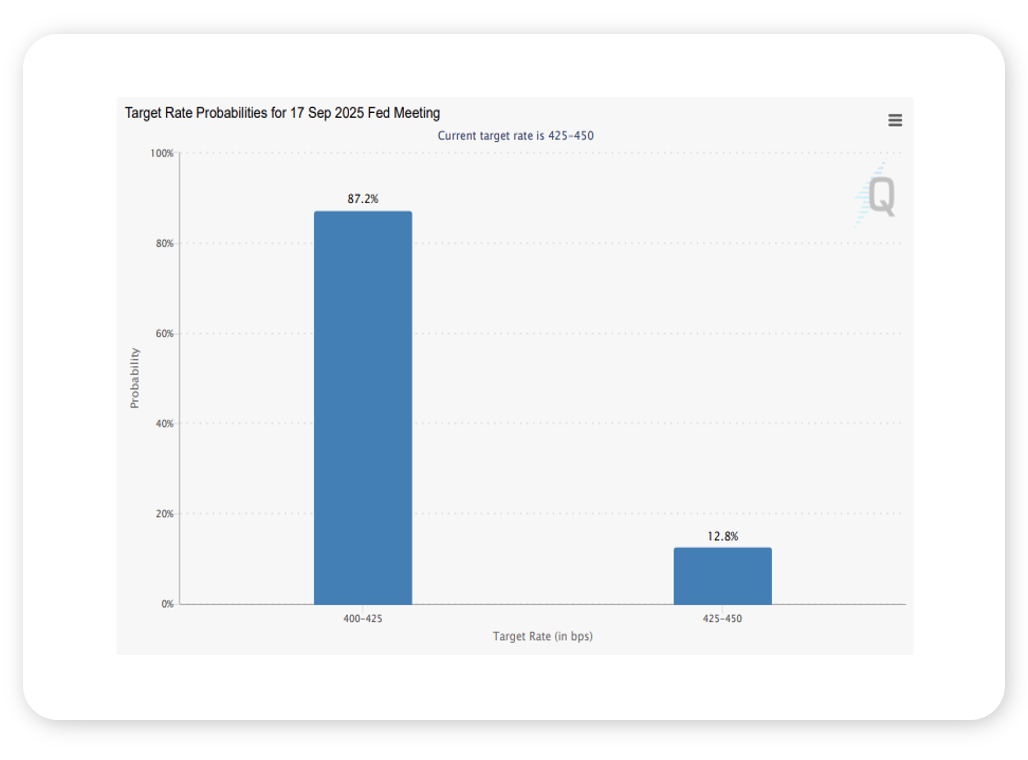

- Well, the Fed just retired FAIT and introduced a new Monetary Policy Framework, as it does every five years. The new MPF, to most pundits, reorients the Fed to a balanced approach to its dual mandate; a consistent, long-term inflation target of 2%, and higher rates over time, which is ironic as the new MPF was explained by Fed Chair Powell in the same Jackson Hole address where he was seen as teeing up a September rate cut, a move the market overwhelmingly expects (see table).

- The Fed, like any institution, will get things right and wrong, will have its wins and losses, and we don’t come to praise or condemn the world’s most important central bank but acknowledge that setting monetary policy for the world’s most important, largest economy is no easy feat. And while the Fed doesn’t need our advice, we think a September rate cut is warranted, and that Wall Street is right to expect one.

Source, CME FedWatch, August 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets were quiet overall. US equities slipped slightly, with the S&P 500 still up just over 4 percent for the quarter and nearly 11 percent year to date. Large and small caps were flat, while mid-caps saw modest losses. Treasury yields edged lower across the curve.

Economic data took center stage, with second quarter GDP revised higher to 3.3 percent from 3.1 percent. This marks another upward revision after stronger net exports and builds on earlier upward revisions to Q1. The stronger growth backdrop has helped lift third quarter GDP expectations as well, with the Atlanta Fed GDPNow model jumping to 3.5 percent from 2.3 percent the prior week.

The PCE deflator, the Fed’s preferred inflation gauge, rose 0.2 percent in July and is up 2.6 percent from a year ago. Core PCE increased 0.3 percent in the month and 2.9 percent year over year, still above the Fed’s 2% target. Encouragingly, income growth was led by private sector wages and salaries, which rose 0.7 percent, shifting away from government transfers that had previously driven much of the growth.

Earnings season brought another closely watched NVIDIA report. The company once again beat consensus estimates, with EPS up 54 percent year over year and topping expectations by 4 percent. Revenue also edged higher than expected, though data center revenues came in light, which investors treated as a blemish. The US dollar fell nearly 1 percent, providing some support for international equities.

This Week

The holiday-shortened week still brings plenty of data that could influence rate expectations. Job openings, the ADP employment report, and Friday’s nonfarm payrolls and unemployment data will be key drivers. The September Fed meeting remains in focus, with futures pricing an 86 percent probability of a cut, little changed from last week. Labor market results could shift those odds.

Earnings season is winding down, with several retail names reporting this week. According to FactSet, with 98 percent of S&P 500 companies having reported, Q2 earnings growth stands at 11.9 percent, marking a third straight quarter of double-digit gains.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.