Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

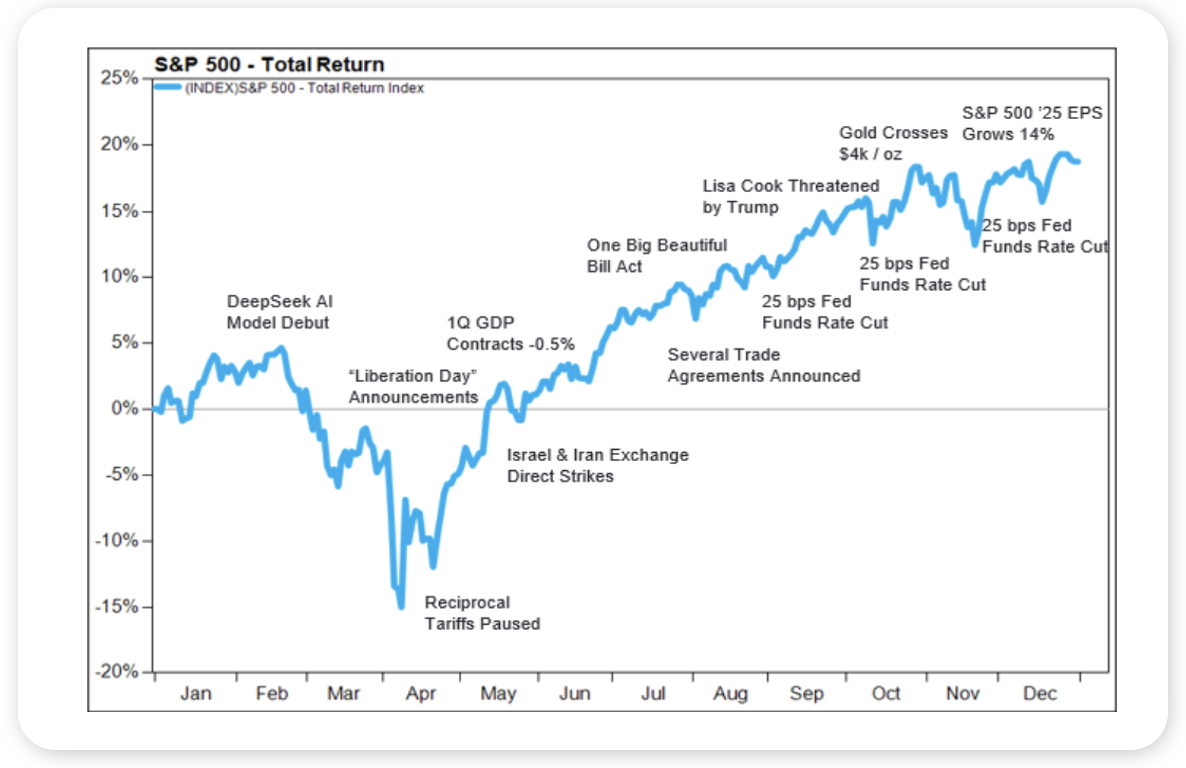

- The S&P 500 was up 17.8% in 2025, the third consecutive year of an above average return for the world’s most important equity index (the S&P having gained 25% in 2024 and 26% in 2023). If one considers the headwinds buffeting the market last year, including “Liberation Day” tariffs, a negative Q1 GDP print and war in the Middle East (see chart), the performance of US stocks is even more impressive. And as we say hello to 2026, investors rightly wonder if the S&P 500 can “Four-Peat” and deliver a fourth consecutive year of gains. We think it can, but a “Four-Peat” likely stands on these “F.E.A.T.” (The Fed, Earnings, AI and Trade).

- The Fed – three quarter point rate cuts in 2025 were a tailwind for stocks (and bonds). Wall Street expects two quarter point rate cuts in 2026. We don’t think the market needs the Fed to be super accommodative in the new year, but what investors don’t want to see is an inflation scare and a pivot back to rate hikes.

- Earnings – the S&P 500 has strung together four consecutive quarters of double-digit earnings growth and Wall Street expects 14% earnings per share growth in 2026. Robust earnings growth would do much to mitigate concerns over the market’s multiple (the S&P 500 trades at an elevated 22x next twelve months EPS).

- AI – the AI trade wobbled a few times in 2025, early in the year when China’s DeepSeek released its large language model and later in the year when Wall Street grew concerned about overvaluation and overspending among the public (e.g., Oracle) and private (e.g., OpenAI) companies driving the AI trade. Investors will likely want to see the AI cap ex cycle continue in 2026 but also want greater evidence that recent and expected investments will prove profitable.

- Trade – The Trump Administration inking trade deals with the EU, UK and Japan, and tariff rates coming in below “Liberation Day” expectations boosted investor sentiment in 2025. That said, the US still needs to solve for trade with China, Mexico and Canada in 2026.

- If history is any guide, the US economy and US markets will face challenges this year, and stocks will experience periods of great volatility, but when all is said and done, we believe the economy should grow and stocks should rise. And before you know it, we will be looking back on 2026 and looking ahead to 2027.

Source: FactSet, December 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Domestic markets closed out the final week of the year slightly lower in holiday-shortened trading. U.S. equities posted modest declines, led by weakness in large caps and technology, while value and small caps held up better. Interest rates moved slightly higher, which pressured investment grade bonds.

The U.S. dollar strengthened modestly last week, gaining about 35 bps. Even so, international equities continued their relative strength into year-end. Emerging market equities gained more than 2% just last week and finished 2025 as the top-performing equity asset class.

Geopolitics returned to the spotlight over the weekend after the U.S. conducted a military operation in Venezuela and captured Nicolas Maduro. Markets, particularly oil, will be closely watched for any near-term reaction. Historically, market responses to geopolitical shocks tend to be temporary, with fundamentals regaining focus once uncertainty fades.

Despite the soft finish in the US, 2025 was a strong year overall. All major asset classes finished positive, including U.S. and international equities, investment grade and high yield bonds, alternatives, and real assets. Balanced, globally diversified portfolios delivered solid returns through a volatile year.

This Week

It is the first full trading week of the new year, and the economic calendar is busy. Key releases include ISM Manufacturing, ADP Employment, Consumer Credit, the U.S. Trade Balance, Nonfarm Payrolls, and the University of Michigan Consumer Sentiment Survey.

Markets will also continue to digest geopolitical developments following events in Venezuela, including potential implications for crude oil. Venezuela holds the world’s largest proven oil reserves, and any shift in U.S. sanctions or trade flows could have implications for heavy crude markets.

As investors enter 2026, optimism remains elevated. The percentage of U.S. consumers expecting stock prices to be higher over the next 12 months sits near historic highs. While reasons for caution are always present, the long-term takeaway remains unchanged: staying invested matters far more than trying to time short-term market moves.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.