Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- More than a few investors have wondered how – in the face of so much geo-political and policy uncertainty – US equities, at least as measured by the S&P 500 and the NASDAQ Composite, could be sitting at all-time highs, up 8% and 9%, respectively, year to date, as of July 23rd. Well, at the risk of really oversimplifying things, we think that it’s because of us, we the US consumer – the most powerful economic force on this big, blue marble we call home.

- Consider that the US economy is 70% consumption driven, so more than anything it is the eclairs, electronics and Espadrilles (for those who remember the 1980s and Miami Vice) we buy – or decide not to buy – that propel the economy forward or hold it back. And as of now, despite the headwinds the US economy has faced in 2025 and continues to face as we move deeper into the second half, the US consumer is hanging in there, with arguably the most important pillar of support for spending being a still solid jobs market, marked by a 4.1% unemployment rate; a bit more than one job opening for every American seeking employment, and 150,000 jobs created in June.

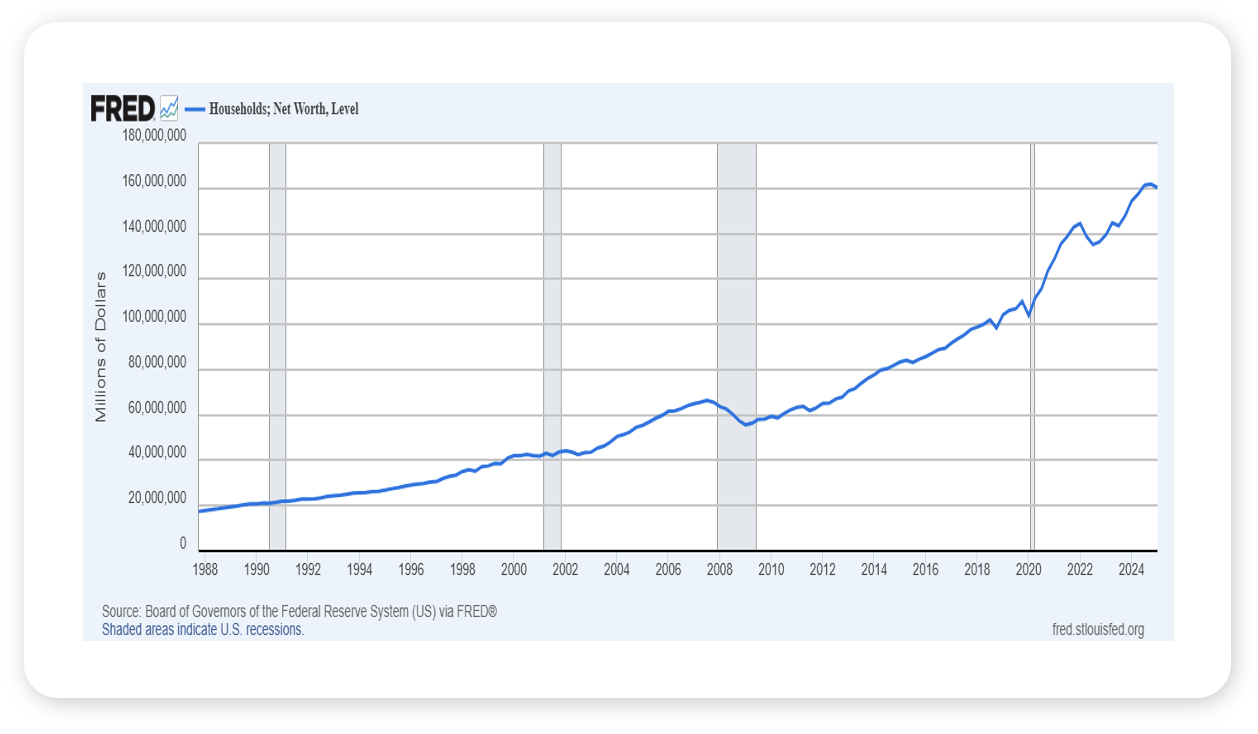

- As it concerns what corporate America thinks of us, when several big banks reported quarterly earnings results two weeks ago, they had generally good things to say about how we were doing, and why that was a good thing for their lending and credit card businesses (see the quote below from JP Morgan). Finally, the US consumer, particularly those in the middle-income cohort and above, are getting a big financial boost from what is essentially record Household Net Worth of $160 trillion dollars, itself pushed up by record high stock and home prices (see the chart below). For now, the US consumer is doing okay, and if the US consumer is doing okay, the US economy should be okay, and if the US economy is okay, corporate profits should be okay and if corporate profits are okay, US stocks should be too.

Source: : Federal Reserve Bank of St. Louis, July 2025

Source: Barron’s, July 21, 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets climbed again last week, with the S&P 500 gaining about 1.5% and developed international equities rising around 2%. The advance adds to what’s been a strong summer stretch, led by continued strength from tech, international momentum, and signs of easing trade tensions. The US dollar and broad commodities each lost over 1%, with the dollar returning to a double-digit decline year-to-date.

Over the weekend, the US and China agreed to extend their tariff truce another 90 days, and President Trump announced that a trade deal had been reached with the European Union. Throughout 2025, tariff pauses have generally acted as tailwinds for equity markets.

Economic data was mixed. Existing home sales declined 2.7% in June to a nine-month low, held back by persistently high prices despite improving inventory. New home sales rose 0.6% but missed expectations and remain down 6.6% from a year ago. Durable goods orders fell 9.3% in June, worse than expectations, driven largely by a sharp pullback in commercial aircraft orders, which had spiked earlier in the year. Leading indicators declined again, reinforcing the slow-drift narrative we've seen in recent months.

Q2 earnings are off to a strong start. According to FactSet, 34% of S&P 500 companies have reported results, with 80% beating EPS and revenue estimates. The blended earnings growth rate now stands at 6.4%, up from 4.9% at the start of earnings season. This would mark the lowest earnings growth since Q1 2024 but still reflects an improving picture.

This Week

This week brings one of the most data-heavy calendars of the year. We'll see official Q2 GDP (expected at 2.4% per Atlanta Fed), the Fed’s interest rate decision, PCE inflation data, and the July nonfarm payrolls report. The Fed is widely expected to hold rates steady at their interest rate decision meeting on Wednesday, with CME FedWatch showing a 98% probability of no change. Markets still expect two cuts by year-end, though that outlook continues to drift.

It’s also the busiest week for Q2 earnings, with more than 30% of S&P 500 companies reporting. Highlights include Microsoft, Meta, Amazon, and Apple.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.