Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- We Americans love our cars – actually, we love our cars and trucks, as the Ford F-150 was the best-selling vehicle in the US from 1977 to 2024. And as a nation of drivers, we are a nation attuned to the price of gas, and the price we pay at the pump has a big impact on how we feel about our economy and our expectations for inflation and, for economists, inflation expectations are a big deal as many believe they are a self-fulfilling phenomena – if folks expect prices to head lower, they will behave in a way that helps push prices lower, and if folks expect prices to head higher they will behave in a way that helps push prices higher.

- And inflation remains an incredibly important topic as the Fed renews its rate cutting campaign – the Fed cut rates a quarter point at its September meeting, and Wall Street expects quarter point cuts at its October and December meetings – and if there is one thing that could scuttle those expected rate cuts it's an unexpected spike in inflation (and the Fed doesn’t have a ton of wiggle room on that front, as inflation has remained above its long-term target of 2%).

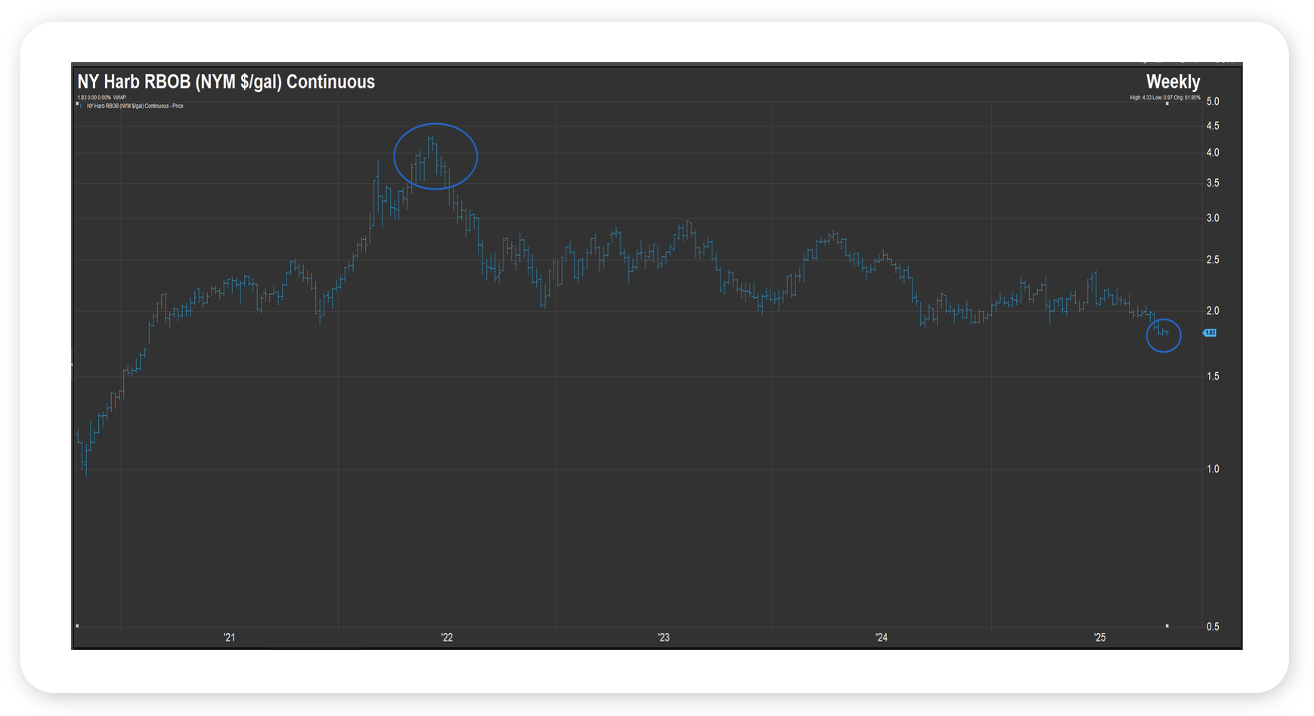

- Which brings us to the point of this week’s note, and a bit of good news for the American consumer, and a bit of good news in the ongoing inflation fight, and that is the price of gasoline. As measured by the NY Harbor RBOB Futures Contract, the price of gasoline is near a five-year low, recently changing hands at $1.79 on October 17th (see chart, far right; the price is slightly higher as we take pen to paper on news of US sanctions on Russian oil companies), well off its 30-year high of $4.33 hit in June of 2022 (see chart, far left). We should stop and consider that for a second – the price of gas hit a 30-year high three years ago. Now, the NY Harbor RBOB Futures Contract doesn’t fully reflect the price we pay at the pump – that will be higher due to additives, taxes and other factors – but it lets us know where gasoline prices have been and are likely headed, and they have headed down, a development which should put more money back into Americans’ pockets and should put downward pressure on inflation and inflation expectations, good news for our consumer driven economy and good news for a rate cutting Fed.

Source: FactSet, October 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets advanced again last week, with the S&P 500 closing at a new all-time high (its 34th of the year) after coming close to a bear market in April. Small caps and growth stocks led gains on the week, bolstering global equities to about a 2% gain. The balanced 60/40 mix of U.S. and international equities is now up more than 21% year-to-date.

September’s CPI report, which was delayed by the government shutdown, came in below expectations at 3.0% year-over-year. However, this was the highest inflation reading in several years. The softer-than-expected CPI print helped drive Friday’s rally and supported expectations for additional rate cuts by year-end.

Over the weekend, the U.S. and China reached an initial trade framework to ease recent tensions. The agreement included China’s delay of rare earth export restrictions and a commitment to purchase more U.S. soybeans, marking a notable de-escalation following renewed tariff threats in recent weeks.

Internationally, emerging markets continued to outperform developed peers and remain the leading equity region in 2025, up over 32% year-to-date. On the fixed income side, Treasury yields declined slightly, led by the short end of the curve.

This Week

This week brings several market-moving catalysts. Nearly half of S&P 500 companies are set to report earnings, including five of the “Magnificent 7.” Consensus expects Q3 earnings growth of 9.2%, which would mark the ninth straight quarter of gains.

The Federal Reserve will announce its October policy decision on Wednesday, with markets pricing a 97% chance of a 25 bp rate cut. GDP and PCE reports are also scheduled for release but may be delayed if the government shutdown continues.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.