Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- Democrats are celebrating electoral successes in New York City, Virginia, and New Jersey, Republicans are trying to determine what lessons should be learned, if any, from last week’s losses and the US Government remains closed, a shutdown that has run a record 38 days (as of the writing of this note). When politicians succeed at politics, they earn the right to set policy. And given Wall Street’s recent interest in politics, we thought now a good time to revisit Federal fiscal policy – how we are taxing and spending at the national level – and what it might mean for the US economy in 2026.

- From a legislative point of view, one could argue the signature success of this Congress and White House was the passage of the One Big Beautiful Bill Act, which extended tax cuts from 2017’s Tax Cuts & Jobs Act, enacted tax cuts tied to income from Social Security, overtime and tips and incented companies to invest in productive assets. Agree or disagree with the Republican party’s policy path, most pundits see the OBBBA as stimulating the economy through 2026.

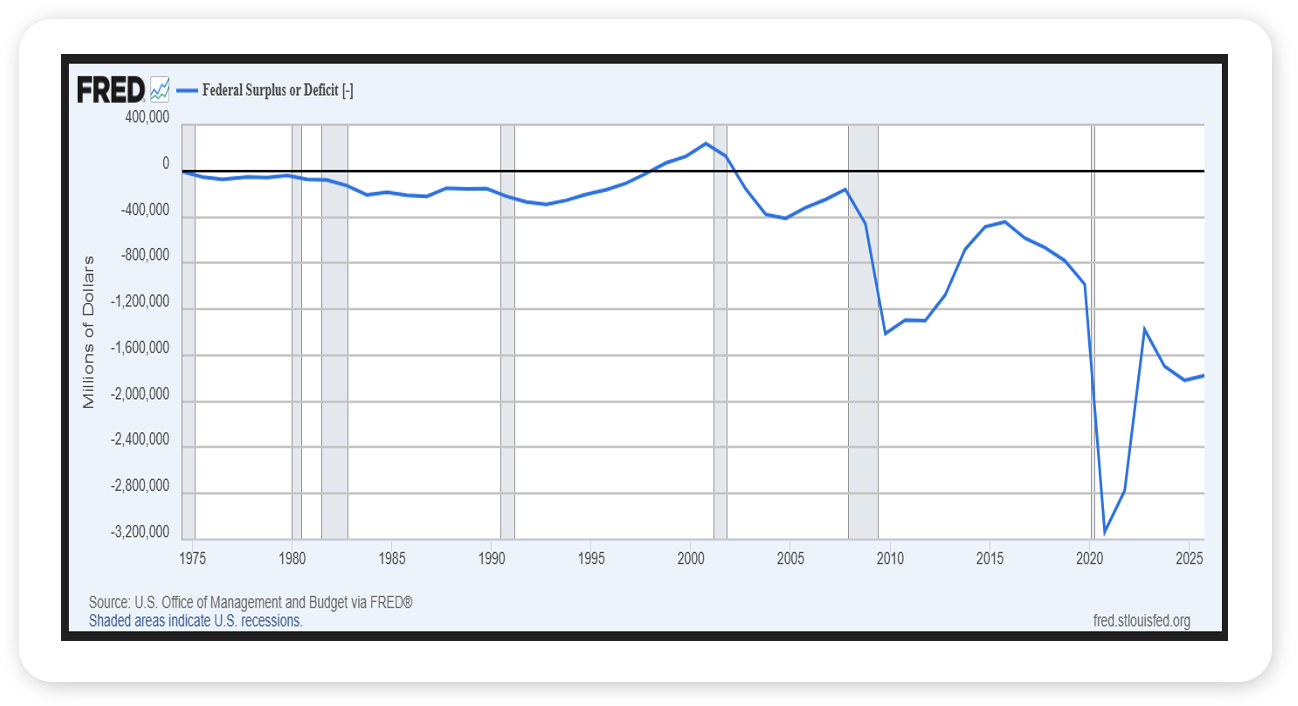

- On the other side of the tax and spending ledger, we continue to spend well beyond our means, running a Federal deficit of approximately $1.8 trillion in the fiscal year ended September 30th, or about 6% of US GDP (see chart). And while the government remains shutdown, and Republicans and Democrats have not been able to work through legislation to fund the government through September 2026, most DC watchers expect the US to run a comparable deficit – on an absolute basis and as a percentage of GDP – again this fiscal year. And that matters for the economy as deficit spending, especially on the scale that the US has and is expected to engage in, should be very supportive of growth, as the government puts more money into the hands of consumers and spends heavily on goods and services.

- Fiscal policy, broadly speaking, should prove to be a pretty big tailwind for the US economy in 2026.

Source: Federal Reserve Bank of St, Louis, November 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets struggled as the prolonged government shutdown began to ripple through the economy. Technology and semiconductor stocks led losses, weighed down by stretched valuations and rising short interest. Despite the pullback, year-to-date returns for balanced portfolios remain strong.

The University of Michigan’s consumer sentiment survey dropped to near record lows, with respondents citing the ongoing shutdown as a primary concern. The delayed Nonfarm Payrolls report has left the ADP Private Employment report as the best current gauge of labor trends, which showed moderate job gains in the trades, education, and health sectors, while professional and information jobs contracted. The labor market remains a top-of-mind concern for the Federal Reserve.

Corporate developments continued to highlight the dual nature of the current cycle: resilience in earnings alongside emerging risks. AI-driven capex remains elevated, as mega-cap firms continue to invest heavily in infrastructure and hardware. However, layoffs have recently accelerated, particularly at UPS, Amazon, and Intel, raising concerns of “AI washing,” a new term coined to describe companies attributing workforce reductions to AI rather than slower business performance.

This Week

Last night, the US Senate reached the required 60 votes to reopen the government. Once the measure if officially passed, it will move to the House for a vote and the government is likely to be reopened within the next few days. In the meantime, the U.S. Department of Transportation announced roughly 10% of flights will be canceled this week as air-traffic operations face growing staffing challenges, creating a potential drag on travel and business activity.

It’s another full week for earnings, though without any of the mega-cap tech names. With nearly all S&P 500 companies having reported, third-quarter earnings growth stands at 13.1% year-over-year, the fourth straight quarter of double-digit growth. However, the strength in earnings is being met with recently slowing manufacturing data.

Inflation data is expected later this week, though the release is set to be delayed if the government shutdown continues. The Federal Reserve’s next policy meeting is scheduled for December 10. Market expectations, according to CME FedWatch, currently imply a 67% chance of another 25-basis-point rate cut. The Atlanta Fed’s GDPNow model estimates Q3 GDP growth at 4.0%, slightly higher than last week.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.