Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- One of the things we love about the markets are the maxims…and the ones that are discussed the most exist and persist – we think – because they frame and communicate an historical truth about investing in an easily understood fashion…for example…“Don’t Fight The Fed” reminds us if the Fed is cutting rates that is an historical tailwind for stocks and if the Fed is raising rates that is an historical headwind for stocks. Another maxim, and the subject of this note, is “Sell In May And Go Away” which reminds us there is a seasonal pattern to equity returns, with markets doing better from November through April relative to May through October.

- Now, Don’t Fight The Fed makes sense as lower interest rates should stimulate the economy – and corporate profits – and support a higher price to earnings multiple, all factors that should push stocks higher, while higher rates should slow the economy and weigh on corporate profits and support a lower price to earnings multiple, all factors that should pull stocks lower. What drives the seasonal nature of US equity returns and underpins Sell In May And Go Away is, in our opinion, less clear. We could call out that new money often goes into stocks early in a new year – as 401K plans and IRAs are funded – a positive for January, February and March, while on the negative side of the return ledger September is the only month, on average, to see the S&P 500 trade lower, and Wall Street portfolio managers leaving their desks for the beach could amplify market volatility, and with it, down days over the summer.

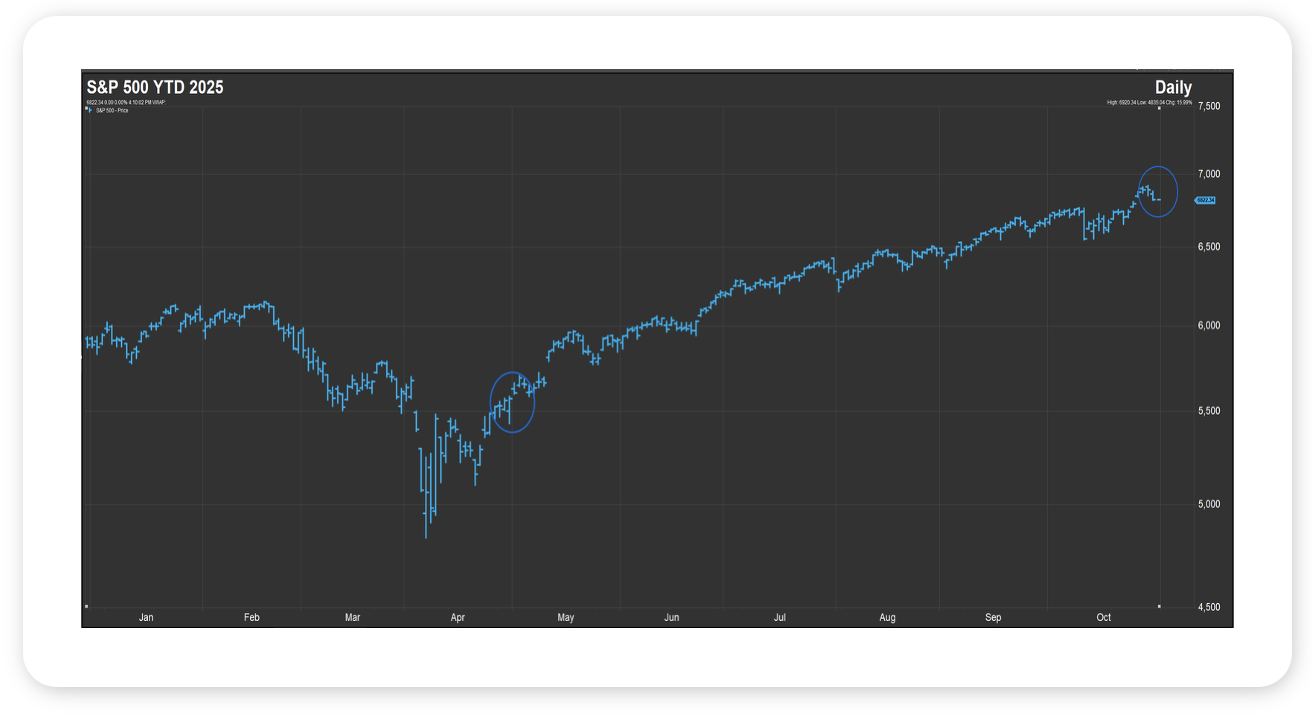

- Either way, adhering to Sell In May And Go Away wasn’t such a good idea this year, as the S&P 500 returned approximately 23% from the end of April through the end of October (see chart, the period between the circles). As to why stocks rallied over those six months, we see several key catalysts, including better than expected S&P 500 Q2 earnings, enthusiasm for the AI cap ex build out, passage of the OBBBA, clarity on US trade policy and the Federal Reserve cutting interest rates twice.

- We were cautiously optimistic on the economy and stocks heading into May, and we are cautiously optimistic on the economy and stocks heading into November.

Source: FactSet, October 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

The Federal Reserve cut its benchmark rate by 25 basis points, as widely expected, to a range of 3.75–4.00%. However, Chair Jerome Powell’s comments struck a more cautious tone. He noted that while inflation remains above target, economic growth and consumer spending are stronger than anticipated, suggesting the Fed may slow the pace of future cuts. Powell also announced that quantitative tightening will end on December 1.

U.S. large caps rose on the week, led by strong technology earnings. All five of the “Mag 7” companies that reported (Microsoft, Meta, Amazon, Alphabet, and Tesla) beat consensus earnings estimates, though MSFT and META sold off modestly afterward. Broader market participation was weak, with Wednesday’s S&P 500 session showing the worst single-day breadth on an up day since 1990: only 104 stocks advanced while 398 declined (Bespoke Investments).

US President Trump and Chinese President Xi met in South Korea and reached several encouraging agreements, including a one-year pause on Chinese export controls, commitments for China to purchase U.S. soybeans, oil, and gas, and a reduction in U.S. tariff rates on Chinese goods. The summit also produced cooperative discussions around semiconductor production and military transparency.

By week’s end, the S&P 500 gained modestly, driven by mega-cap tech. Small caps and value stocks declined, while bond yields rose as the yield curve steepened after the rate cut. Over the full month of October, all major asset classes were positive except U.S. mid caps. Tech and emerging markets continue to lead 2025 equity performance.

This Week

The government shutdown enters its 33rd day, with expectations for its duration now at roughly 46 days (Kalshi). If accurate, that would surpass the record 34-day shutdown from 2018–2019. Nonfarm payrolls are scheduled for release this week, but data may be limited due to the shutdown, leaving ADP private payrolls as the main labor market indicator.

The Fed’s next meeting is on December 10. Markets currently assign a 69% chance of another 25 bp cut at that meeting, down from 92% the week prior. The Atlanta Fed’s GDPNow model continues to project Q3 GDP growth of 3.9%, though the official release remains delayed.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.