Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- Last week was was one of those weeks where several big datapoints landed on Wall Street, but one datapoint mattered more.

- On Sunday, we got news of a US / EU trade deal that puts a 15% tariff on European exports. The US and EU traded $975 billion worth of goods in 2024, so trade certainty between the two is a meaningful positive. And on Wednesday, we learned that the US economy grew 3% in Q2. The positive, and better than expected, report was welcome following a Q1 GDP print of negative 0.50%. Both datapoints mattered and were well received by Wall Street.

- Then on Friday, we got a jobs report that showed the US created just 73,000 jobs last month, well below the 115,000 investors expected, while jobs numbers for June and May were revised lower. The report raised immediate concerns about the health of the US consumer and economy, and saw investors move away from stocks and buy bonds, with the yield on the US 10 Year Note falling 12 basis points on Friday. The July jobs report mattered and mattered more to Wall Street.

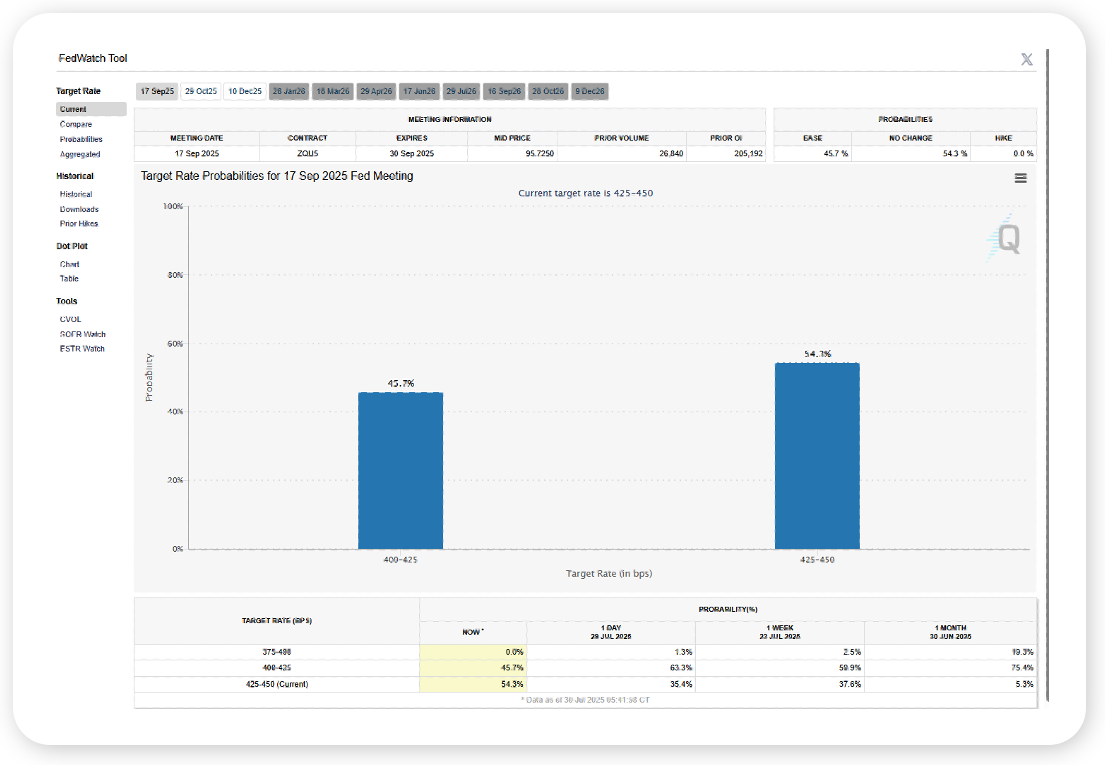

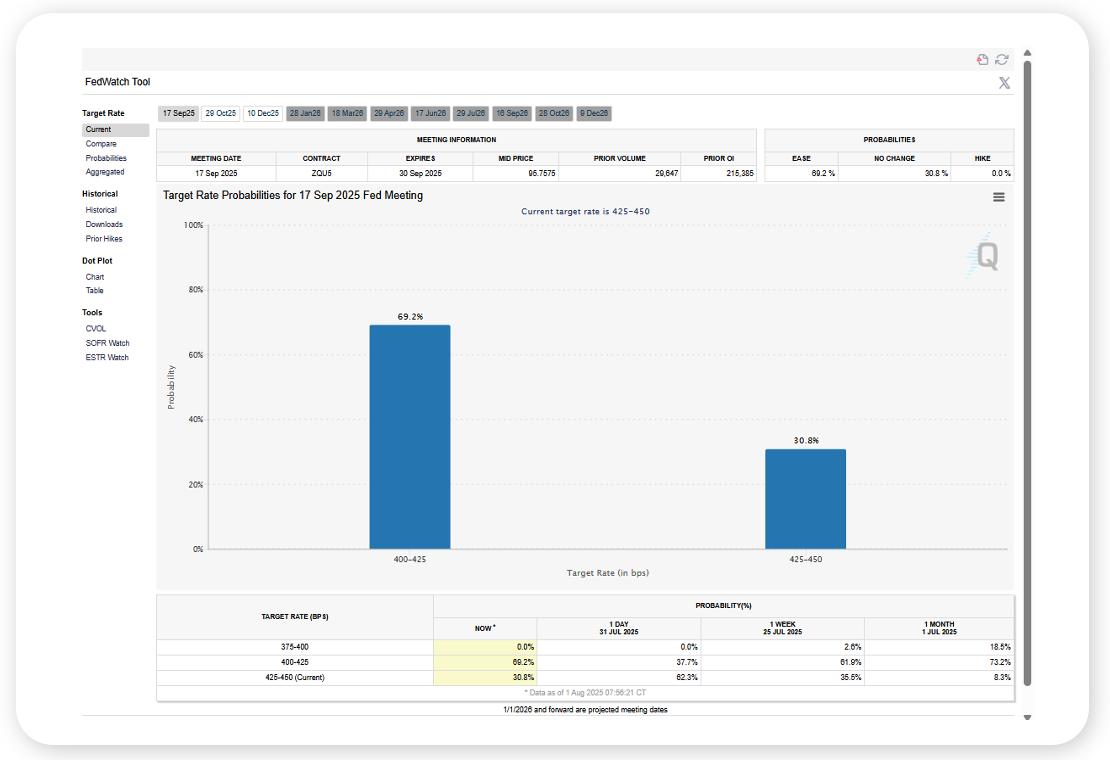

- It also had Wall Street reconsidering the path forward for interest rates. After Fed Chairman Powell declined to tee up a September rate cut following the Fed’s meeting on July 30th, Wall Street’s expectations went from a rate cut to the Fed standing pat next month (see first chart). Following the weak July jobs report, Wall Street reconsidered the path forward for rates once again and is now expecting a quarter point cut in September (see second chart). The August jobs report will be released on September 5th, twelve days ahead of the Fed’s September meeting. It will probably be a datapoint that matters more.

Source: CME Group, July 2025

Source: CME Group, August 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

It was a heavy week for economic data, with GDP, labor, inflation, and the Fed’s interest rate decision all in focus. Results painted a mixed picture of the economy. The S&P 500 declined for four consecutive days, with the sharpest drop coming Friday after a much weaker-than-expected nonfarm payrolls report.

Geopolitical tensions also resurfaced, as the U.S. deployed nuclear submarines in response to “provocative” comments from Russia, adding a layer of caution to already unsettled markets.

On the data front, Q2 GDP came in at 3.0% versus 2.3% expected, boosted primarily by a sharp reversal in net exports. However, most core components, including consumption and business investment, remain below one- and three-year averages. Personal income rose 0.3% in June, while personal consumption matched that pace. PCE inflation, the Fed’s preferred gauge, rose 0.3% in June, with the year-over-year rate ticking up to 2.6% from 2.4% in May, largely reflecting last year’s unusually soft inflation readings rolling out of the data.

Labor data disappointed. Nonfarm payrolls increased by just 73,000 versus 104,000 expected, and prior months were revised down by a combined 258,000, resulting in a net loss of 185,000 jobs including revisions. The unemployment rate edged up to 4.2%. The ISM Manufacturing Index fell to 48.0 in July, its fifth consecutive month in contraction territory, underscoring the drag from trade-related uncertainty.

Q2 earnings remain a bright spot. With 66% of S&P 500 companies reporting, 82% have posted positive EPS surprises and 79% have beaten on revenue. Earnings growth is running at 10.3%, well above the 4.9% estimate from June 30, with strength in communication services, financials, and consumer discretionary.

This Week

The coming week is quieter for economic data. The U.S. trade balance is expected to show a second straight month of surplus, while markets will closely watch for any reaction as broad U.S. tariffs on roughly 67 countries are set to resume Thursday, August 7.

On the policy front, rate cut expectations have shifted sharply. Following the weak labor report, futures now imply an 80% probability of a September cut, up from under 40% earlier last week. Markets are now pricing in two to three cuts by year-end.

Earnings season continues, but the heaviest reporting period is now behind us.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.