Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- As the word peg features importantly in this week’s note, we went looking for an entertaining (well, hopefully entertaining) way to introduce it…we didn’t find much to work with…there don’t seem to be many famous folks named, Peg (the late singer Peggy Lee likely tops the list); there are well known sayings built around the word including “a square peg in a round hole” but connecting those dots was a stretch; and the Steely Dan song “Peg,” seemed too niche…so, panicked, we pivoted where we have so many times before: 1980’s movies, specifically “Vision Quest,” where high school wrestler Louden Swain (played by Matthew Modine – Dr. Martin Brenner for you “Stranger Things” fans) scales the gym’s peg board while John Waite’s classic song “Change” blares (the movie soundtrack is stellar).

- Most of us are familiar with the Price To Earnings Ratio or P/E Ratio, which measures a company’s share price relative to its annual earnings (if a stock is priced at $10 and is producing $1.00 in earnings per share, its P/E Ratio is 10x). The P/E Ratio is an easy way to determine if a company represents good value (a low P/E should indicate an attractively priced stock while a high P/E should indicate an expensively priced stock). The problem with the P/E Ratio as a valuation tool is it provides no context – a low P/E stock could have dismal growth prospects while a high P/E stock could have phenomenal growth prospects. Enter the “PEG Ratio” which looks at a company’s Price To Earnings Ratio relative to its Earnings Growth Rate (the math is P/E Ratio divided by Annual EPS Growth). Popularized by legendary portfolio manager Peter Lynch, the PEG Ratio can help determine if a stock’s price is justified by its earnings growth – a fairly valued company should have a PEG Ratio of 1; an overvalued company a PEG Ratio above 1 and an undervalued company a PEG Ratio under 1. The same math holds for stock indices.

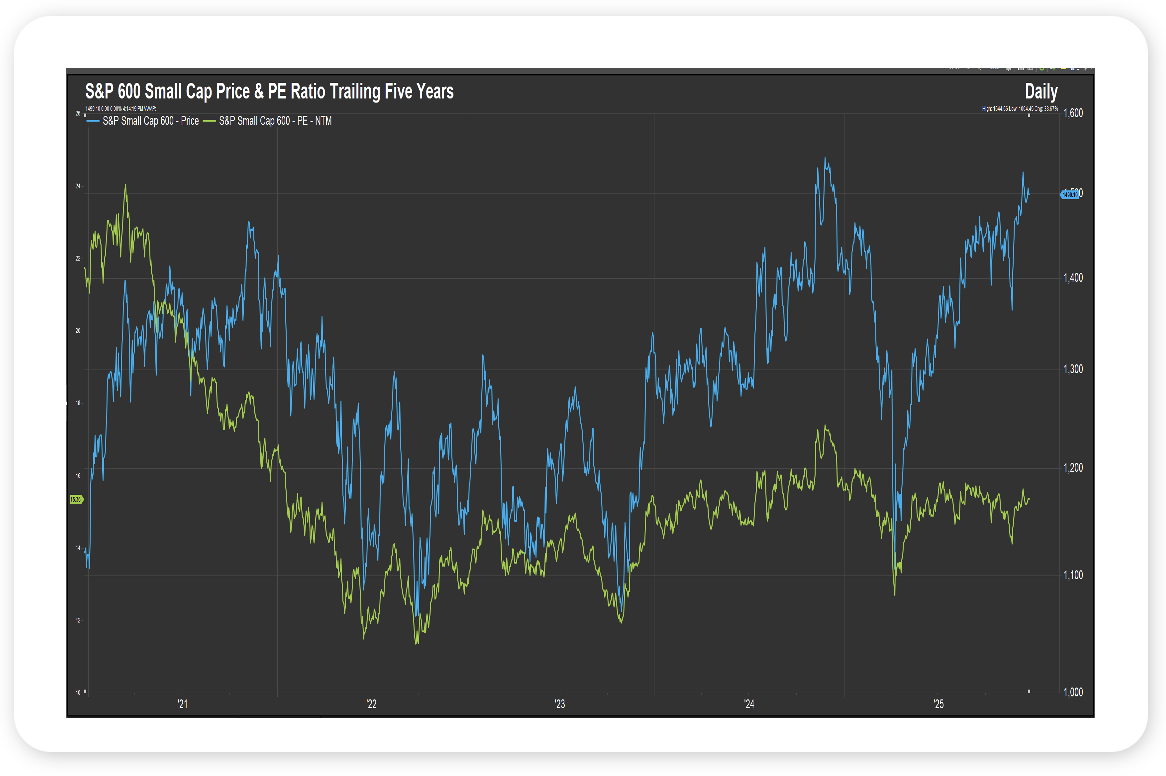

- We have written often of late of the attractiveness of US small cap stocks. To make that case once again, consider that the S&P 600 Small Cap Index is trading at approximately 15x its expected next twelve-month earnings (see chart, yellow line) while Wall Street sees the index’s earnings growing 16% through 2027, giving the index a PEG Ratio of approximately 0.9, indicating the S&P 600 Small Cap Index is attractively priced relative to its expected earnings growth.

- And as we say goodbye to 2025, we would like to wish you and your loved ones a Happy, Healthy & Prosperous New Year!!!

Source: FactSet, December 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets closed out the holiday shortened week with solid gains despite being shut for 1.5 days around Christmas. Broad asset classes finished higher, including stocks, bonds, real assets, and alternatives, reflecting constructive year end momentum.

Economic data surprised to the upside. Q3 GDP was finally released and came in well above expectations at 4.3% versus 3.2% expected. Growth was driven primarily by strong personal consumption and net exports. Core Real GDP, which strips out more volatile components, grew at a still healthy 3.0% annualized pace.

Performance leadership remained global. Commodities, emerging markets, and U.S. large caps led gains on the week. For the year, international equities continue to dominate.

Emerging markets are up 34% YTD, developed markets are up 33%, while the NASDAQ 100 has gained about 23%. Globally diversified portfolios are on track to finish 2025 on a strong note despite elevated volatility throughout the year.

Precious metals stayed in focus. Silver surged over the weekend and now represents more than $4.6 trillion in global value, surpassing NVIDIA as the second most valuable asset behind gold. Silver, platinum, and gold have all outperformed U.S. equity benchmarks by wide margins during the current bull market.

This Week

It is another shortened holiday week. Markets will be closed Thursday for New Year’s Day, while New Year’s Eve will be a full trading session. With a light economic and earnings calendar, volatility is expected to remain muted.

The main event will be the release of minutes from the December FOMC meeting on Tuesday, which may offer additional insight into the Fed’s thinking following its recent rate cut. Markets currently assign an 82% probability that the Fed holds rates steady at its January 28 meeting.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.