Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- On November 8, 2021, the S&P 500 changed hands at 4,701; today it trades at 6,605.

- On November 8, 2021, the Nasdaq Composite changed hands at 15,982; today it trades at 22,385.

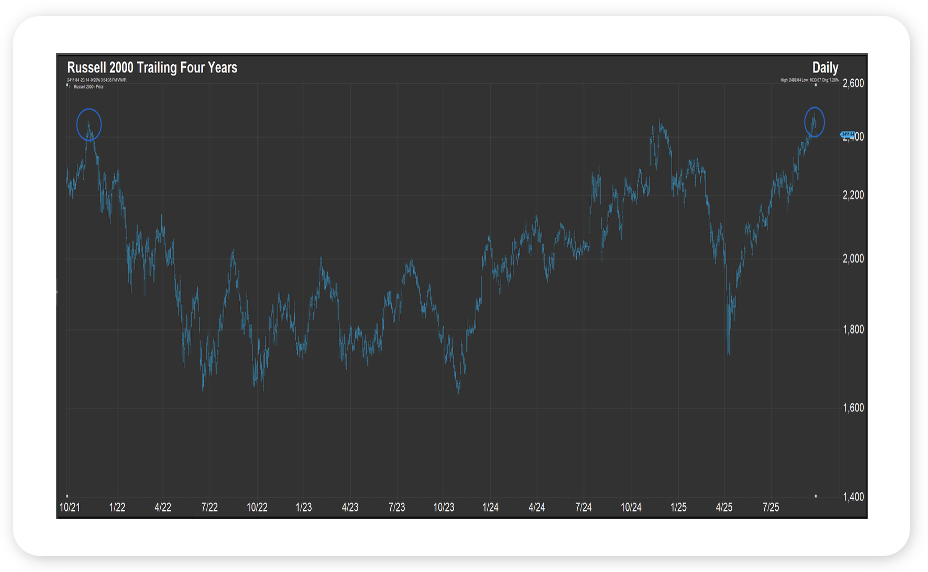

- On November 8, 2021, the Russell 2000, the benchmark for US small cap stocks, changed hands at 2,458; today it trades at 2,411 (all data as of 9/25/2025).

- Where are we headed with this week’s note? As you know, on September 18th the Russell 2000 hit 2,470, registering its first all-time high since trading at 2,458 in 2021. So, in In the span of nearly four calendar years, the S&P 500 and the Nasdaq gave investors gains of 40%+, while the Russell 2000 cost you a few points.. Why? Most see economic uncertainty – due to the pandemic and US trade policy – and higher borrowing costs as the reasons for small cap underperformance. Consider that in November of 2021, the Fed Funds Rate was essentially 0% and the yield on the US 10 Year Note was 1.5%; then, as inflation took hold and the Federal Reserve began rapidly raising rates to break the back of said inflation, the former rose to 5.3% and the latter to 5%, as we moved through 2023.

- That written, we don’t come to condemn small cap stocks, but to praise them. Outside of the strong gains the Russell 2000 has produced of late – up 13% over the prior three months even with last week’s stumble – one could argue, and we would be in that camp, that the index hitting an all-time high (see chart, far right) is a bullish sign for the market, as more stocks are biased higher, helping push major US stock indices – including the S&P 500, the Nasdaq and the Russell, to new records.

Source: FactSet, September 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets took a modest step back, with the S&P 500 down 0.3%. That said, the index is still up about 2.5% for September, defying the month’s reputation as seasonally weak. International equities slipped on a stronger dollar but remain up roughly 25% year-to-date. Bonds fell as longer-term rates rose, while commodities gained more than 2% on the week and are now up 10% this year. All in all, balanced portfolios continue to show solid performance in September, the third quarter and year-to-date.

On the economy, second-quarter GDP was revised 0.5% higher to 3.8%, a strong rebound from the -0.5% contraction in Q1. Core GDP, which excludes government spending, inventories, and trade, grew at a 2.9% annual rate, up from the prior 1.9% estimate. Other data also surprised to the upside. New home sales jumped 20.5% in August to an 800,000 annual pace, breaking above pre-pandemic levels, while durable goods orders came in much stronger than expected. Inflation, measured by the Fed’s preferred PCE index, rose 0.3% in August and is up 2.7% year-over-year, with the core measure running at 2.9%.

This Week

Markets will be watching Washington closely, as the odds of a government shutdown are climbing, with betting markets assigning about a 70% chance that it begins on Wednesday morning. Later in the week, labor market data will be in focus after recent downward revisions. Consensus expectations are for just 45,000 jobs added in September, with the unemployment rate holding at 4.3%.

The Fed’s next meeting is scheduled for October 29. As of September 26, market pricing shows an 88% chance of another 25-basis point cut. The Atlanta Fed’s GDPNow model projects Q3 growth at 3.9%, up from 3.3% the prior week, with the official release due in late October.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.