Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- We caught up with some clients last week and the debasement trade was top of mind (my poor attempt at humor was that when I used to worry about debasement it was over what my teenage son and his buddies were doing in the basement, as opposed to the outlook for fiat currencies and inflation).

- Here is how I think about the debasement trade…several nations – including the US – are heavily indebted and generating only modest economic growth while burdened by aging populations and social programs that are unsustainable but untouchable politically. So, instead of cutting spending or raising taxes to deal with their deficits and debt, these countries will continue to live beyond their means and issue more bills, notes and bonds, and print more Pounds, Yen and Dollars, which will drive down the value of – or debase – their currencies and drive-up inflation, which will leave their citizens poorer on an inflation adjusted basis but lower their countries respective debt-to-GDP ratios and make their debt burdens more manageable.

- If an investor thinks we are entering or are in a period of currency debasement they should seek out hard assets that have historically held their value during periods of rising inflation, a group that has included real estate and gold. And we think gold, which has had a remarkable 2025 – up 60%, taking out its all-time inflation adjusted 1980 high of $3,600, and trading at $4,300 – is the asset most often talked about when talking about the debasement trade.

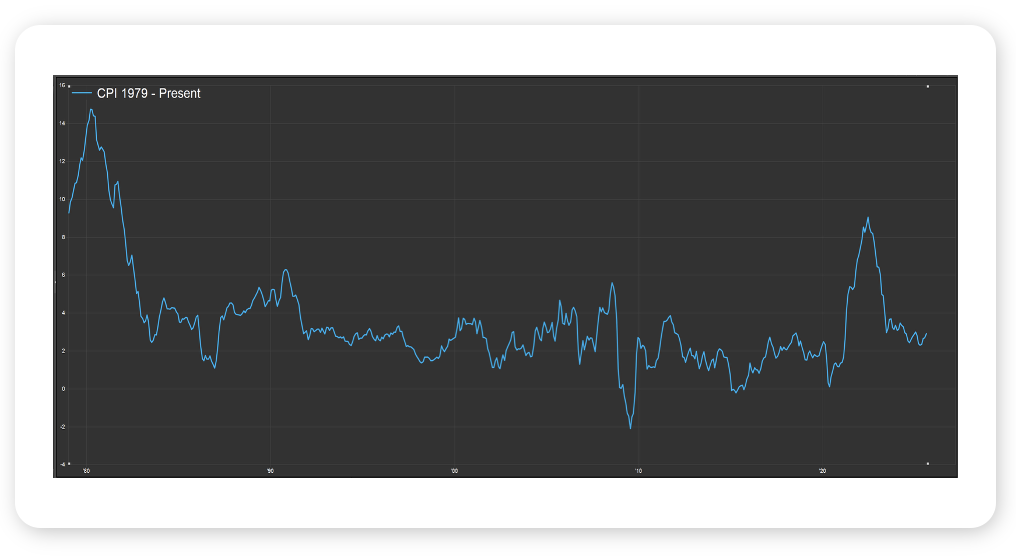

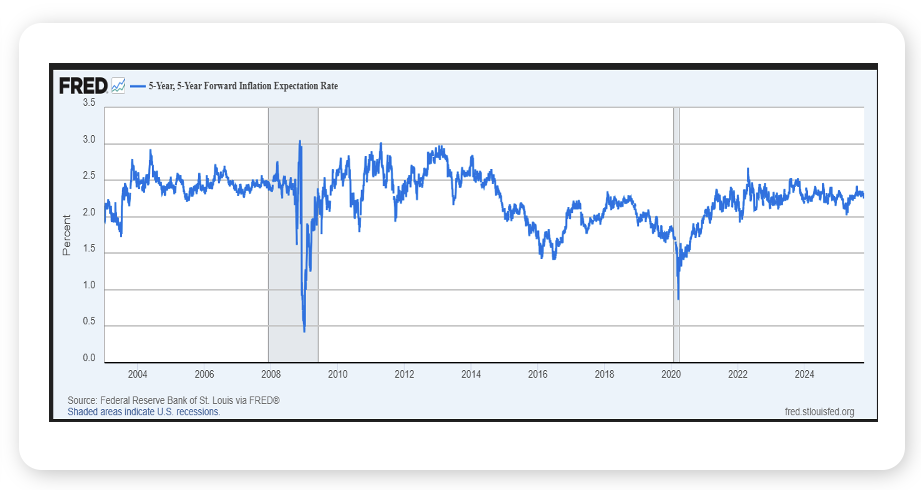

- We recognize the US and other countries are heavily indebted and unwilling, it seems, to put their respective fiscal houses in order, and that the dollar has dropped 10% this year, but we are not willing to plant the debasement trade flag just yet…consider the last time gold was at an all-time inflation adjusted high the Consumer Price Index was at 14% compared to 2.9% today (see first chart), while five-year inflation expectations five years on from today sit at 2.25%, essentially in line with the Fed’s long-term target for inflation (see second chart). So, inflation doesn’t seem to be an issue today or a concern down the road (a sub 4% yield on the US 10 Year Note is another datapoint that the bond market isn’t worried about inflation). The debasement trade is a fascinating macro topic, but not necessarily one that is in place today. As it concerns the rally in gold, a falling dollar and falling rates, geo-political risk and price momentum are likely near-term catalysts for the metal.

Source: FactSet, October 2025

Source: Federal Reserve Bank of St. Louis, October 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets rebounded as investors looked past continued government gridlock. Falling yields supported risk assets, while private credit stress and trade uncertainty added fresh volatility.

Markets rebounded following the prior week’s selloff, with the S&P 500 gaining nearly 2% after falling more than 2% the week before. Year-to-date, the index is up over 14%. Gains were led by tech and small caps, while fixed income benefited from falling yields. Overseas performance was mixed, with emerging markets giving up modest ground despite a weaker U.S. dollar, though they remain the leading equity group in 2025. Commodities had another strong week, driven by a 5% surge in gold, which is now up 58% year-to-date.

Concerns over private credit markets took center stage. Reports of sour loans and potential fraud sent regional bank stocks lower and raised questions about the rapid growth of the asset class. The private credit market has expanded significantly over the past decade, with limited transparency compared to public credit markets. Should defaults and bankruptcies continue to rise, investor confidence may remain strained.

The U.S. dollar experienced its steepest decline since June, as renewed trade uncertainty weighed on global sentiment. Meanwhile, Treasury yields fell, with the 10-year briefly dipping below 4% for the first time since April. Lower yields supported bond prices.

Investor sentiment softened after turning bullish the prior week. Optimism faded as concerns over the extended government shutdown and rising credit market risks came back into focus.

This Week

The government shutdown continues with little visible progress. Betting markets now expect the closure to last around 43 days, which would mark the longest in U.S. history. The Bureau of Labor Statistics confirmed that the Consumer Price Index will still be released on Friday even if the shutdown continues. Economists expect the report to show the hottest inflation reading since May 2024.

The Federal Reserve’s next meeting is on October 29. According to the CME FedWatch Tool, there is a 100% chance of at least a 25 bp rate cut, with a small 1% probability of a 50 bp cut. Markets are also fully pricing in one additional cut before year-end. The Atlanta Fed’s GDPNow model currently estimates Q3 GDP growth at 3.9%, up from 3.8% the week prior.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.