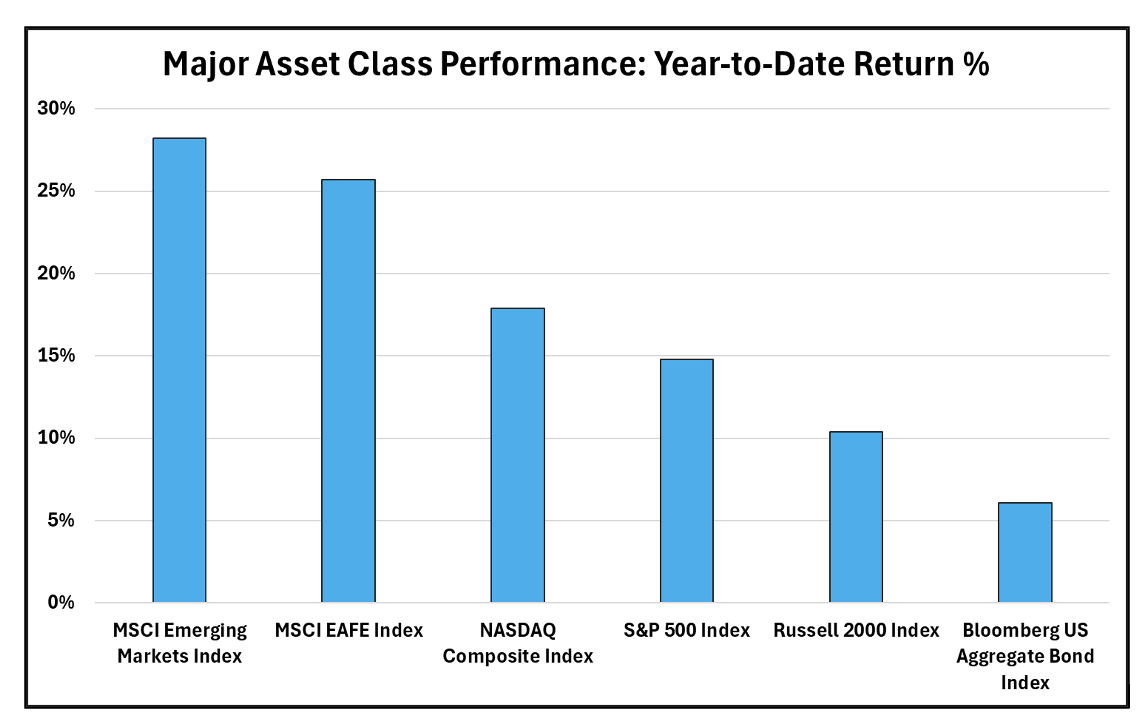

2025 has been an interesting year for investors, to say the least. US stocks notched double digit returns through the first nine months, which seemed like a far-fetched outcome back in the Spring. Volatility around trade uncertainty sent equity prices lower by approximately -20%, but resilient economic data, strong corporate earnings, easing monetary policy expectations, and a dismissal of worst-case tariff scenarios ignited a comeback for stocks. Through 9/30, the S&P 500 is ahead 14.8%.

While most investors would be pleased with positive domestic performance, many may be surprised to see emerging markets outperforming by 13%, represented by the MSCI Emerging Markets Index up 28.2% year-to-date. With geopolitical tensions high, import duties that haven’t been seen in 100+ years – including last week’s escalation threat with China - and the world’s top tech companies domiciled here at home, what should we make of the EM outperforming every major asset class in 2025?

Returns shown are year-to-date, through 9/30/2025. Measured in US dollars on a total return basis.

Source: FactSet

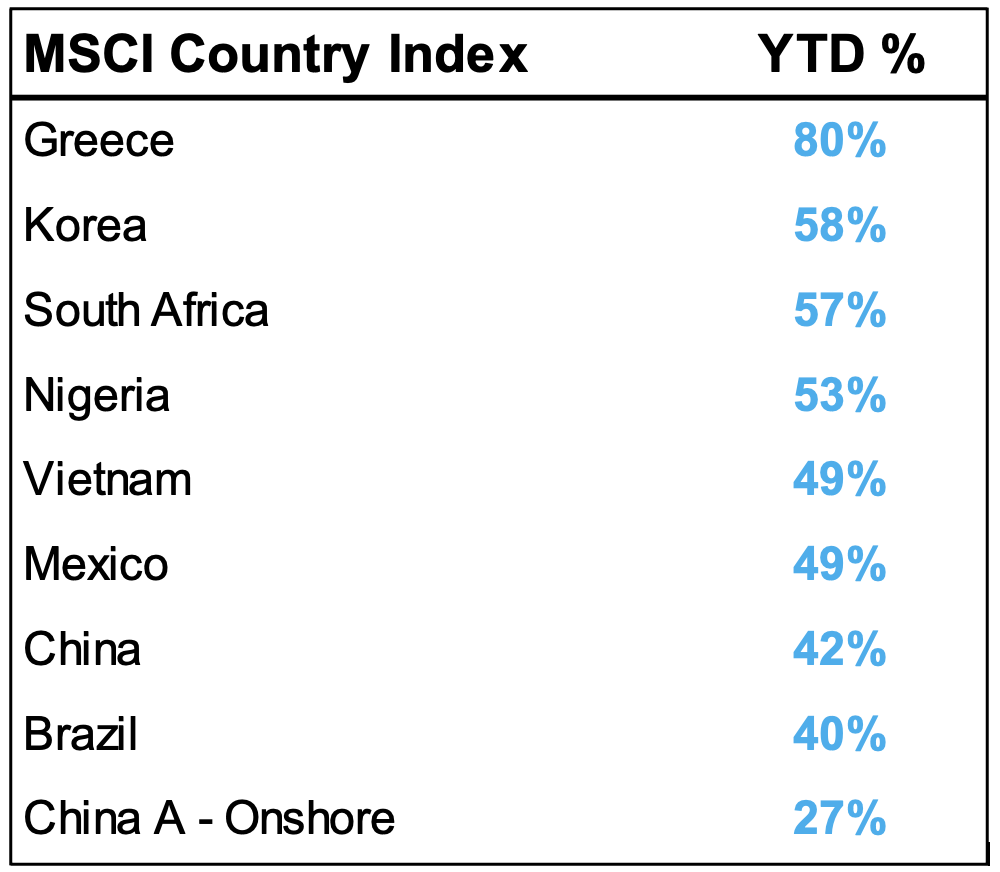

A Look at Select Top Emerging Markets in 2025:

Returns shown are year-to-date, through 9/30/2025. Measured in US dollars on a total return basis.

Source: FactSet.

What’s Driving Emerging Markets Higher?

As the largest market in the MSCI Emerging Markets Index (30.4% weight), China played a major role, with a 19.1% gain in Q3 and 42% year-to-date. The global AI race was a major factor behind the rally, as competition amongst semi-conductor manufacturers led to a 57% spike for the Chinese sector. Tech stocks in Taiwan and Korea were also major contributors, with the latter market up 58% year-to-date. While the AI theme has spread beyond hardware in the US, Chinese software and service providers have been left on the sidelines, falling -9% in the third quarter.

Developments on trade have also influenced markets, as regions and countries agree to new tariff agreements with the Trump Administration. Select countries garnered manufacturing attention, as US import duties and price pressures force CEOs to re-think their supply chains. Exporters of industrial metals, precious metals, and commodities have been prime beneficiaries, exemplified by South Africa’s 57% gain in 2025.

The price of gold in particular stands out, as global investors have signaled caution around sovereign debt loads, geopolitical tensions, and uncertainty around trade. Gold has appreciated close to 50% on the year, fetching more than $4,000 per ounce. These factors have also pushed the US dollar lower, down about -10% on the year. A weaker dollar is a tailwind for multinationals and foreign markets, as international companies often borrow capital in dollars and generate revenues in local currency. Cheaper borrowing costs translate to higher profit margins for those businesses.

Finally, attractive valuation levels have been a major driver of returns for emerging markets. With a price multiple of approximately 14x forward looking earnings estimates, EM trades at a significant discount compared to 23 times forward earnings for the S&P 500 and 25x for the NASDAQ composite.

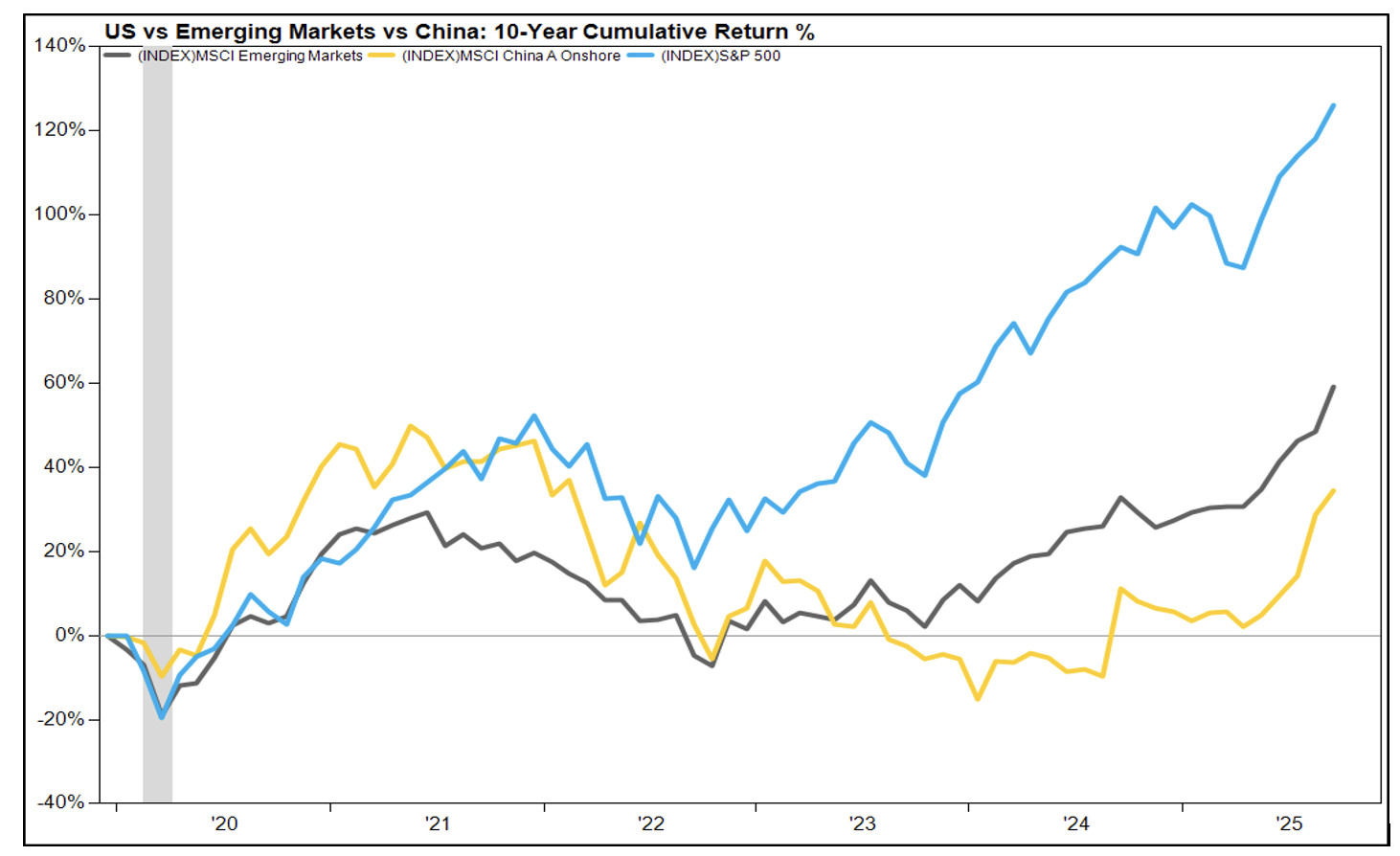

The Post-Covid Lull

The valuation gap becomes more rationalized if we take a step back and look at the divergence between US equities and EM markets over the past 5 years. Since the COVID-19 pandemic, emerging market equities—particularly in China—have lagged significantly behind U.S. markets. This divergence is driven by a mix of macroeconomic headwinds, investor sentiment shifts, and structural challenges.

Grey Line = periods of U.S. recession

Source: FactSet

China's equity markets have faced a unique set of pressures, including extended COVID lockdowns that outlasted those in most other countries, which suppressed domestic demand and industrial output. Investor confidence has been shaken by regulatory crackdowns, geopolitical tensions, and a broader flight from Chinese assets due to concerns over intellectual property theft, government overreach, and broad transparency with the west. Additionally, the country’s property sector remains under stress, with high leverage and credit risks among developers posing systemic threats. These factors have contributed to persistent underperformance and capital outflows.

Beyond China, emerging markets have contended with global supply chain disruptions, a restrictive Federal Reserve, and a strong dollar (2025 notwithstanding), which has tightened financial conditions and made dollar-denominated debt more burdensome.

What’s Next for EM?

Trade tensions came back to the surface last week as China “delivered” a letter to key trading partners outlining an export restriction on rare earth minerals. China is a key region in the excavation of these minerals globally, and export restrictions will be a headwind to manufacturing and research and development, notably within the AI space. In retaliation to the announcement, US President Donald Trump announced a renewed 100% tariff on imports from China, set to start on November 1st. Equities sold off sharply on Friday, pushing the S&P 500 down roughly 2.5% for the week, marking the first 2%+ decline since April. Trade uncertainty had generally dissipated relative to earlier in 2025, so this renewed shock sent renewed trade fears throughout global markets.

President Trump walked back these threats over the weekend, however, it serves as an important reminder about the market’s sensitivity to trade announcements, the dollar, and the evolving AI tech race.

For now, we are optimistic on both US and international equities, as corporate earnings and economic data continue to exceed Wall Street’s expectations. With the Fed set to potentially cut interest rates further in 4Q, global inflation cooling, lower energy costs of late, and an uptick in sovereign self-sufficiency, we think there’s room for both asset classes to move higher in 2026.